Miner Weekly: The Next Wave of Energy Hunt

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

After flocking to preorder the next-generation mining machines since Q4, public mining companies have slowed down their buying spree. Instead, they are now focusing on acquiring greater power capacities, having raised over $1 billion through equity during Q1.

In the two months following Bitcoin’s halving, we’ve seen power and site expansion plans from Iris Energy in Texas, Mawson in Pennsylvania, and Bitfarms in Paraguay, which total a nameplate capacity of 270 MW. Additionally, CleanSpark, Northern Data, and Cipher announced the acquisition of sites in Wyoming and Texas, collectively adding up to a power capacity of 445 MW.

Although not all these capacities will be operational immediately, this trend underscores the growing importance of infrastructure as a key element in the next phase of competition among bitcoin mining companies.

In the last week alone, Bitfarms said it was expanding to Pennsylvania, developing an existing site from 12 MW to a full capacity of 120 MW for proprietary mining. Days later, CleanSpark announced it has signed definitive agreements to acquire five turnkey facilities in Georgia, adding another 60 MW to its portfolio.

According to local media, Bitfarms is leasing the property from Vertua in Sharon, Pennsylvania. Notably, this is the same entity from which Mawson had been leasing since 2023 to develop a 12 MW site in Sharon, with plans to scale up to 120 MW. However, Mawson exited the lease in February of this year.

An interesting side note: one of the major stockholders of Vertua was James Manning, the former president and CEO of Mawson. Following Manning’s departure last year, Mawson’s Audit Committee began an internal investigation into Manning’s compliance with disclosure regulations regarding related party transactions.

And as if bitcoin mining wasn’t already power-hungry enough, the electricity demand from AI and HPC is pushing some bitcoin mining companies to think twice about how they utilize their power capacities. Whether this is a distraction remains to be seen, but so far, the market has reacted positively.

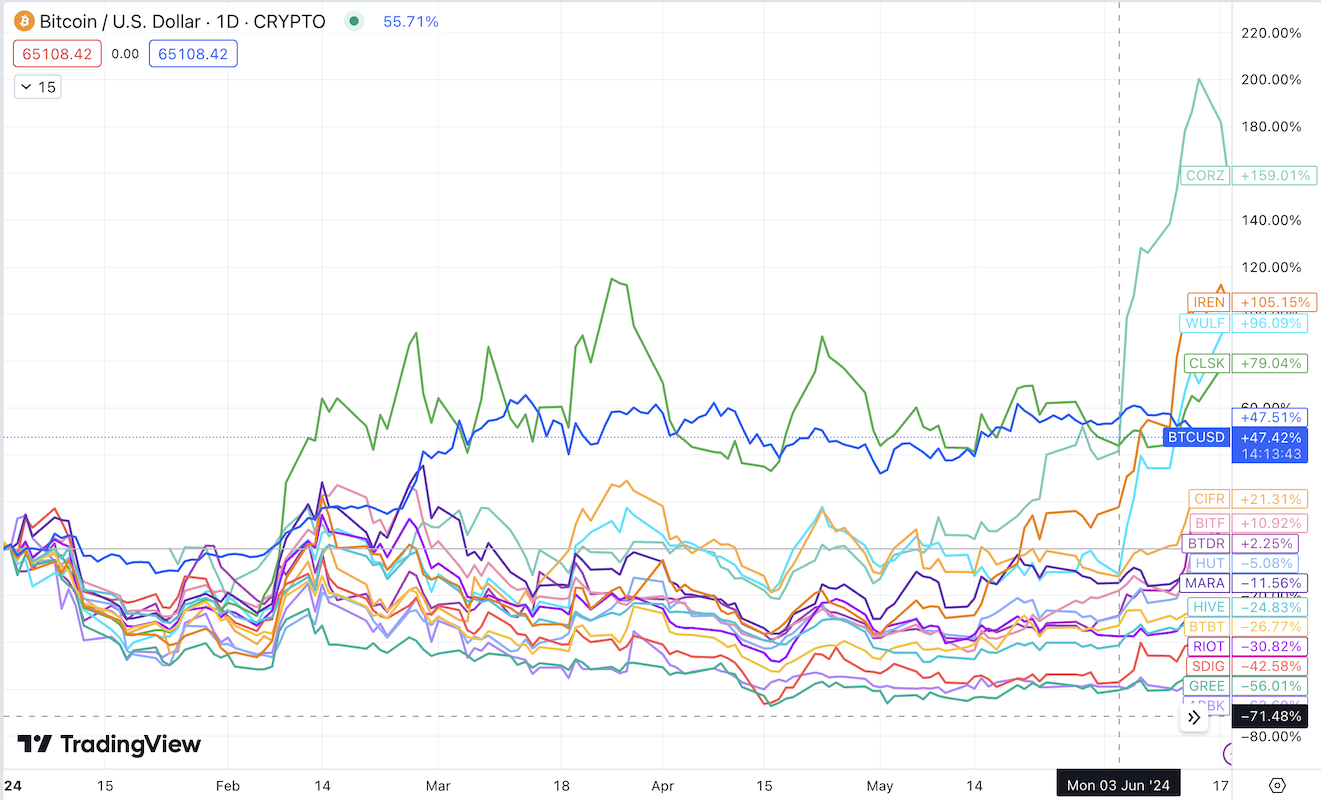

Some relevant context: for a long period in the first half of 2024, CleanSpark was the only mining stock that was outperforming bitcoin. But that trend has shifted – at least for now. The top three mining stocks outperforming bitcoin year-to-date are Core Scientific, Iris Energy, and Terawulf.

All three companies boast not only sizable bitcoin mining fleets but also active AI initiatives. Since the beginning of June, these stocks have experienced a sharp rally, propelled by Core’s announcement of a 200 MW hosting agreement for CoreWeave’s AI computing capacity.

Hardware and Infrastructure News

- Bitmain Launches S21XP with 13.5 J/TH in Bitcoin Mining Efficiency – TheMinerMag

- At-home Miner Capitulates? $2.4M Texas Bitcoin Mining House for Sale – TheMinerMag

- CleanSpark Acquires 60MW Bitcoin Mining Sites for $26M – TheMinerMag

- MARA Pool Earns 0.85 BTC for Inscribing Video on Bitcoin – TheMinerMag

Corporate News

- T-Mobile owner Deutsche Telekom will soon mine Bitcoin in addition to running nodes – The Block

- Bitcoin Mining Hosting Vendor Can’t Dodge $6.4M Suit – Law360

- Cathedra Bitcoin Expects to List in US by Year End – TheMinerMag

Financial News

- Riot Platforms raises Bitfarms stake to 14%, buys another $3.87 million worth of shares – The Block

- Chinese Penny Stock Invests $53M in BTC, Bitcoin Miners – TheMinerMag

Feature

- Bitcoin Miners Pivot to Southeast Asia After China Crackdown – Bloomberg

- INTERVIEW: Flare Gas Bitcoin Mining In 2024 – The Mining Pod

- Bitcoin Hashrate May Finally Slow as Miners Face Scorching Summer Heatwaves – CoinDesk