Chinese Penny Stock Invests $53M in BTC, Bitcoin Miners

Coolpad Group, a Chinese phone maker listed in Hong Kong with a market cap of $125 million, is doubling down on the acquisition of bitcoin hashrate amid the ongoing stock suspension imposed by the exchange.

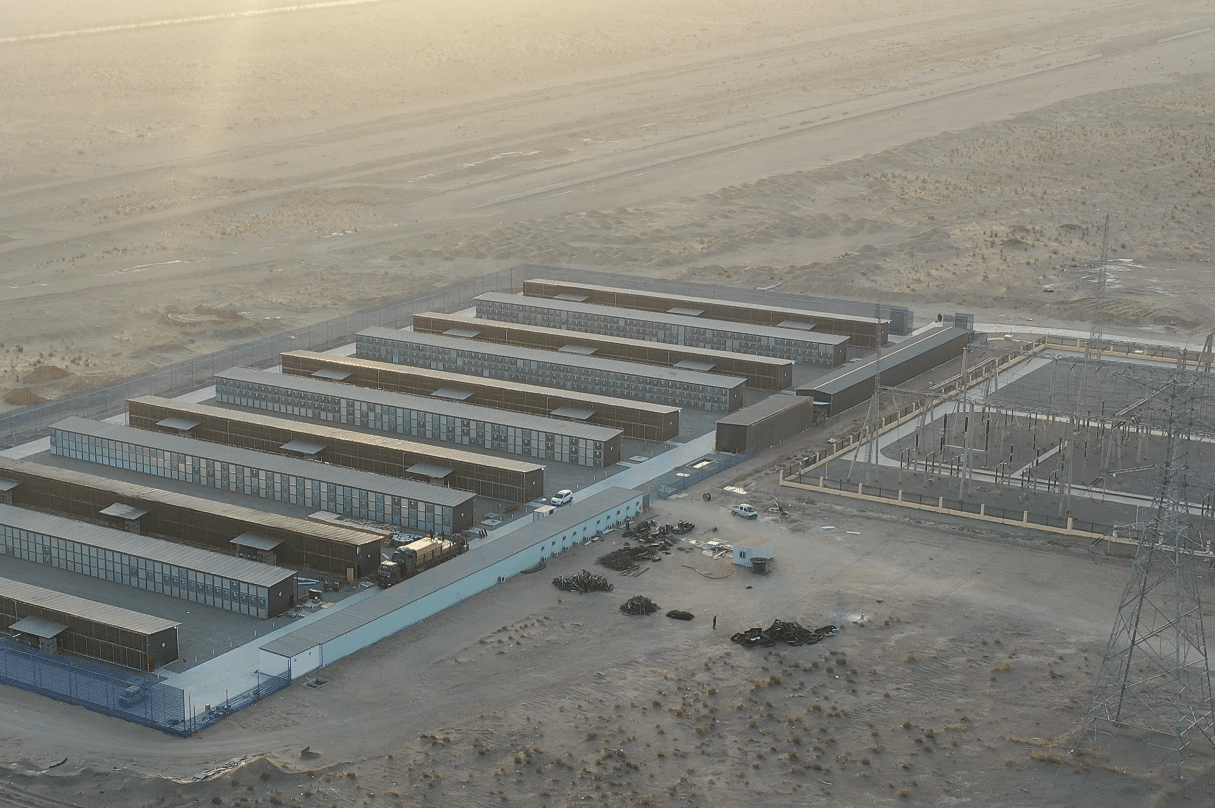

Coolpad disclosed in a statement last week that it entered into an equipment procurement contract worth $13.6 million to scale up its bitcoin mining hashrate from 873 PH/s to 1.5 EH/s. Although the company did not specify the model of the equipment, the transaction implies a cost of about $21/TH/s, which could be the latest generation of miners made by Bitmain or MicroBT.

Coolpad was founded in the 90s initially making pagers and paging systems in China. It pivoted into making mobile phones in the 2000s with a target market of the elderly in the country. Its fully-owned subsidiary Coolbit Technologies began engaging in bitcoin mining last year.

According to a business update in October, Coolpad had about 110 PH/s of effective hashrate hosted in North America as of Oct 25, 2023, accumulating around 11 BTC. In November, it acquired an additional 600 PH/s for about $20/TH/s but does not appear to have provided further bitcoin production updates.

The latest miner acquisition follows Coolpad’s investment in bitcoin spot ETFs and the stock of CleanSpark. Per a May announcement, Coolpad acquired 1.5 million CLSK shares at $15.89 per share between April and May for a total cost of $23.84 million. During the same time, it also acquired BlackRock’s IBIT shares for $4.03 million at $35.64 per share. Coolpad’s investment in CLSK is currently up 11%.

However, the trading of Coolpad’s stock has been suspended since Mar. 28, following the resignation of its auditor Ernst & Young (EY), and the delay of its 2023 annual report.

According to Coolpad’s statement, EY received anonymous allegations in January 2024 of the company’s “misappropriate use of funds in transactions with parties that are suspected to be connected persons of one of the directors who is also the substantial shareholder of the company.” Additionally, EY indicated in its resignation letter that it had not yet “completed all of its planned procedures” over Coolpad’s new bitcoin mining business, including the capital expenditures made.

Coolpad’s stock was trading at HK$0.06 per share before the suspension, which was worth less than 1 cent in USD.

Meanwhile, Coolpad indicated that it plans to spin off Coolbit Technologies to be listed on Nasdaq given most of its miners are hosted in North America.