Riot Has Invested $111M to Acquire 13.1% Stake in Rival Bitfarms

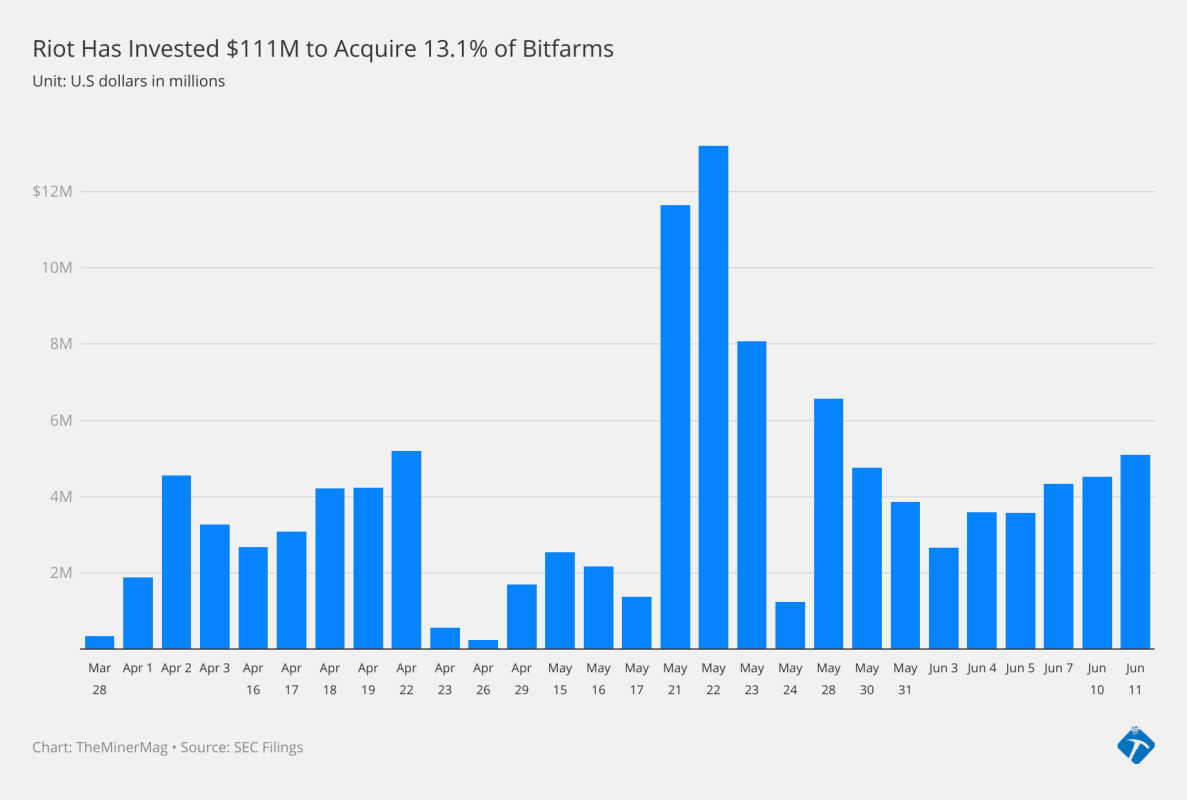

Texas-headquartered bitcoin mining giant Riot Platforms has invested $111 million since March to acquire a 13.1% stake in Canada-based Bitfarms, aiming to take over the rival bitcoin miner.

According to a filing on Wednesday, Riot has made additional purchases of nearly 6 million shares of Bitfarms through the open market over the past week, increasing its stake to 53.8 million shares as of June 11. This represents 13.1% of the Canadian rival.

The filing reveals that Riot’s most recent transaction occurred on Tuesday with the acquisition of 2.3 million Bitfarms shares at a weighted average price of $2.22 per share.

That transaction came a day after Bitfarms announced it had approved a shareholder rights plan, known as a “poison pill” strategy, to fend off Riot’s “hostile takeover” by potentially diluting its shares.

Based on Riot’s filings over the past few months, the company began acquiring shares of Bitfarms in late March. Since then, it has invested a total of $111 million to acquire a 13.1% stake in Bitfarms at an average cost of $2.07 per share. Bitfarms’ share price closed at $2.27 on Tuesday.

In a statement on Wednesday responding to the poison pill approach, Riot’s CEO Jason Les said the action “demonstrates the Bitfarms Board’s entrenchment and disregard for the perspectives of its shareholders.” He also called for the board of Bitfarms to remove its chairman and interim CEO.

“In our most recent letter, we urged the Bitfarms Board to facilitate the resignation and removal of Chairman and interim CEO Nicolas Bonta, who has led the Bitfarms Board since 2018 and bears direct responsibility for its poor corporate governance practices,” Les said in the release.