Core Scientific Rejects CoreWeave’s $1B Acquisition Offer

UPDATE: Core Scientific said on Thursday that it rejected CoreWeave’s unsolicited acquisition offer as the proposed $5.75 per share “significantly undervalues” the company.

UPDATE: Bloomberg reported on Tuesday that CoreWeave has offered to acquire Core Scientific for $5.75 per share. CORZ jumped 30% on Tuesday to $6.34 after the market opened.

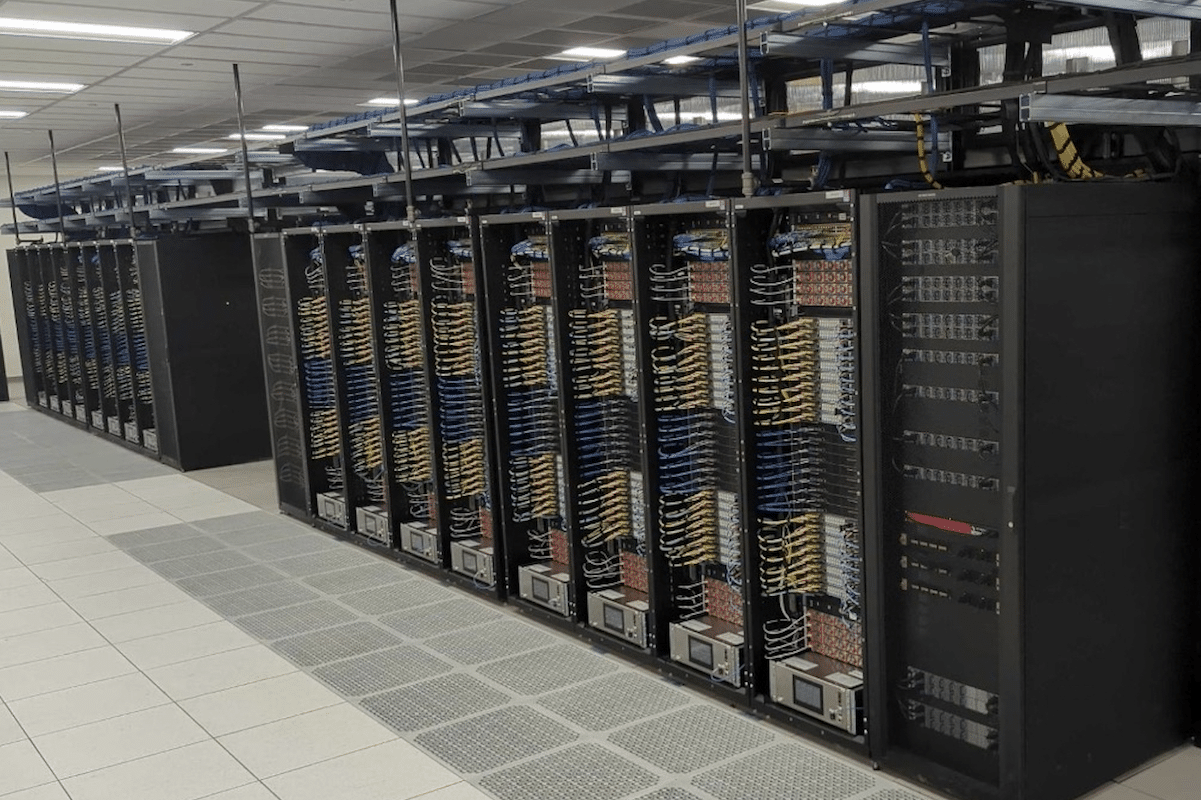

Bitcoin mining and data center hosting provider Core Scientific is set to modify its existing infrastructure to host 200 megawatts (MW) for Nvidia-backed AI cloud computing startup CoreWeave.

The Nasdaq-listed bitcoin mining firm said on Monday that it has signed a series of 12-year agreements with CoreWeave, which was recently valued at nearly $20 billion and is reportedly eyeing an IPO in 2025.

According to Core Scientific, it will modify multiple existing and proprietary sites to host CoreWeave’s Nvidia GPUs. The work will begin in the second half of 2024 and is expected to begin operation in the first half of 2025.

The deal is the latest HPC expansion strategy by publicly traded bitcoin mining companies, riding on the AI computing trend as bitcoin’s fourth halving slashed daily production by 50%.

“In connection with this expansion of Core Scientific’s HPC hosting strategy, Core Scientific intends to redeploy certain of its bitcoin mining capacity from designated HPC sites to other of its dedicated bitcoin mining sites to support business continuity and growth,” Core said in the release but did not specify the amount of hashrate that will be redeployed.

The company self-mined 803 bitcoin in April while its hosting customers produced 263 BTC in the same period. Core’s hosting segment contributed $29.3 million, or about 16.3%, to its total Q1 revenue.

Core Scientific said that CoreWeave will fund the capital expenditure associated with the modification work, which is estimated to be about $300 million. The investment can be used to credit against hosting bills at no less than 50% of monthly payments until fully repaid.

The company claimed that 200 MW of HPC capacity can generate an annualized revenue of $290 million once it is fully operational.