Miner Weekly: How Big Was Bitcoin’s Mining Profit Squeeze After Halving?

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

As May comes to an end, mining companies are set to report their bitcoin production results next week for the first full month following bitcoin’s fourth halving event.

Although bitcoin’s hashrate declined to around 580 EH/s shortly after the halving, it bounced back in May and mostly remained above 600 EH/s. However, the average hashrate in May was still lower than in April, which helped partially offset the halving’s impact on the daily production benchmark.

According to data from our research arm, TheMinerMag, bitcoin’s daily production benchmark declined to 0.792 BTC/EH/s in May, representing a 45% drop compared to April.

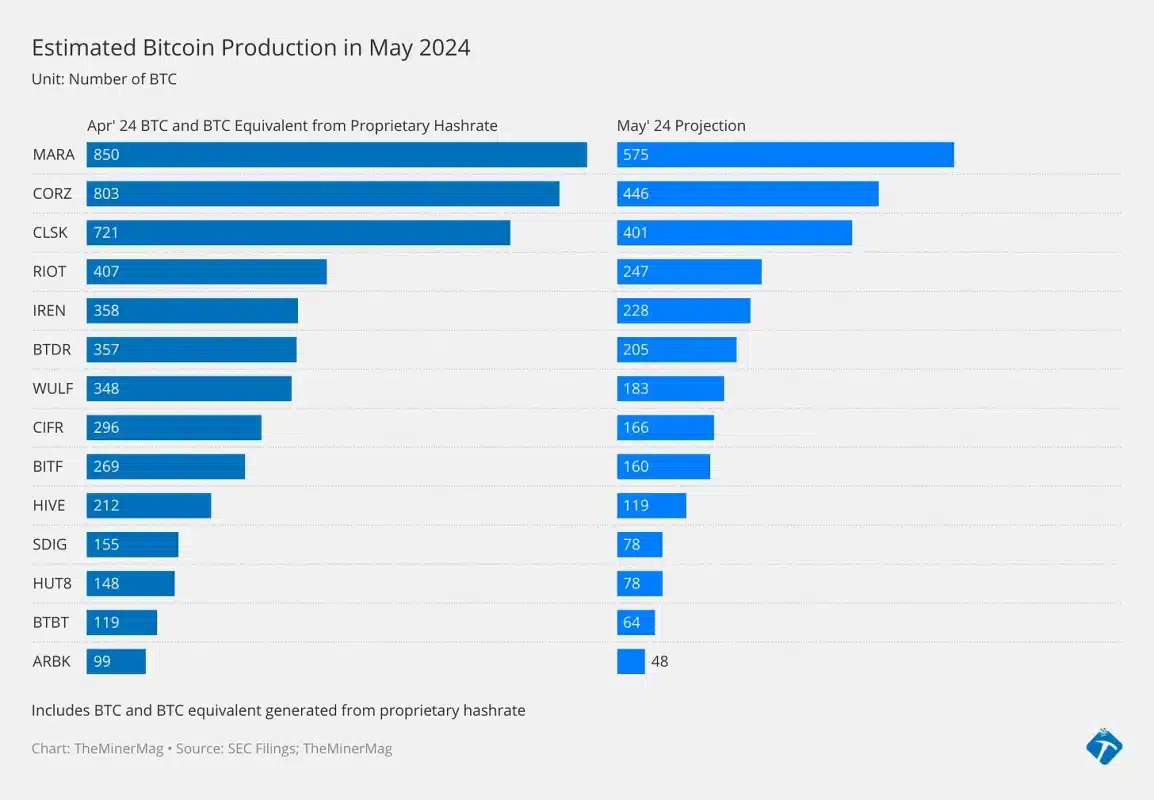

Based on the production benchmark in May, the installed hashrate in April, and the average hashrate realization rate over the past 12 months, TheMinerMag further estimated the May production figures for each major public mining company. Their average production decline is estimated to be 43%.

Notably, one of the biggest news this week is Riot’s plan for a hostile takeover of Bitfarms, which could create another bitcoin mining giant if the plan materializes.

As the chart above shows, Riot and Bitfarms combined mined 676 BTC and BTC equivalent in April, making them the fourth largest producer after Marathon, Core Scientific, and CleanSpark.

According to Riot’s proposal, their offer was to purchase 100% of the outstanding shares of Bitfarms at $2.3, resulting in a total equity value of $950 million. Riot has already taken a 10% stake, making it the largest shareholder. However, Bitfarms responded to the offer later, stating that it “significantly undervalues” their position and growth prospects. As of Wednesday, the share price of Bitfarms closed at $2.18, which is 5% lower than Riot’s offer.

Hardware and Infrastructure News

- Northern Data Buys Second 300MW Texas Bitcoin Mining Site – TheMinerMag

- Bitcoin 7D Hashrate Sets New Record Month After Halving – TheMinerMag

Corporate News

- Kenya Signs MoU with Marathon for Capitalization of Underutilized Renewable Energy Resources – Link

- Riot Platforms Pursues Takeover of Rival Bitcoin Miner Bitfarms – Bloomberg

- Bitfarms Calls Riot’s Takeover Offer ‘Significantly’ Undervalued – TheMinerMag

Financial News

- Bitfarms Jumps 5% Amid Riot’s Bitcoin Mining Takeover Offer – TheMinerMag

- Luxor Bitcoin Hashrate Futures Live On Bitnomial After Regulatory Approval – Link

Feature

- Behind The Great Rune Rush With Mike Hamilton – The Mining Pod