Bitfarms Calls Riot’s Takeover Offer ‘Significantly’ Undervalued

Canada-based Bitfarms has responded to the takeover offer from its bitcoin mining rival Riot Platforms, saying it “significantly undervalues” Bitfarms and its growth prospects.

Riot revealed the proposal on Tuesday, intending to purchase 100% of the common shares of Bitfarms for $2.30 per share after becoming Bitfarms’ largest shareholder with a 10% stake. Bitfarms responded on Wednesday that it first received the “unsolicited” proposal from Riot on April 22 with the same price offer but decided that was a significant undervaluation.

“A Special Committee of the Board comprised solely of independent directors carefully considered the [April 22] proposal and determined it significantly undervalues the Company and its growth prospects,” Bitfarms said in the response on Wednesday.

The firm added that it requested customary confidentiality and non-solicitation protections to engage with Riot in “a meaningful manner” but did not receive a response. Such requests would create an exclusive and confidential negotiating environment.

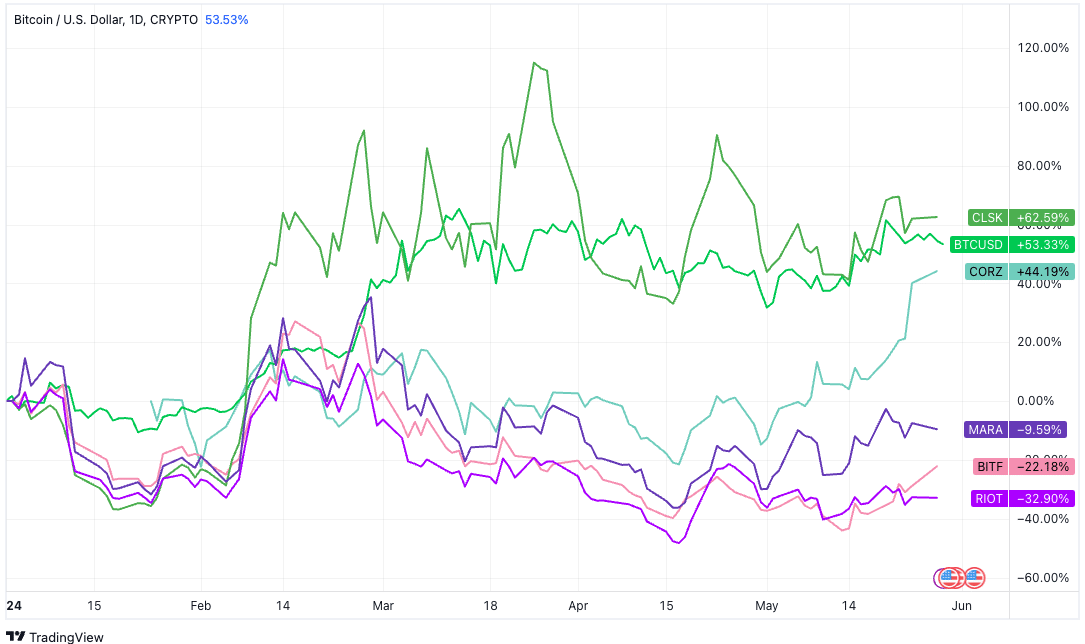

The stock price of Bitfarms (BITF) closed at $2.05 on April 22 before declining to $1.60 in early May. It has since bounced back to over $2.00 on May 24. Following the publication of Riot’s takeover plan, BITF jumped 9.41% on Tuesday and closed at $2.21. Yet still, it is down 22% year-to-date, underperforming bitcoin and other major competitors.

Bitfarms said the special committee is evaluating strategic alternatives such as continuing to execute its business plan, a strategic business combination, or a sale of the company.

The company previously announced hardware and infrastructure expansion plans to reach 21 EH/s by the end of 2024 at a fleet efficiency of 21 J/TH. Bitfarms said in the response that it “strongly believes” that the continued execution of the growth plan maximizes shareholder value.