Miner Weekly: AI Fueling the Next Mining Stocks Rally?

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

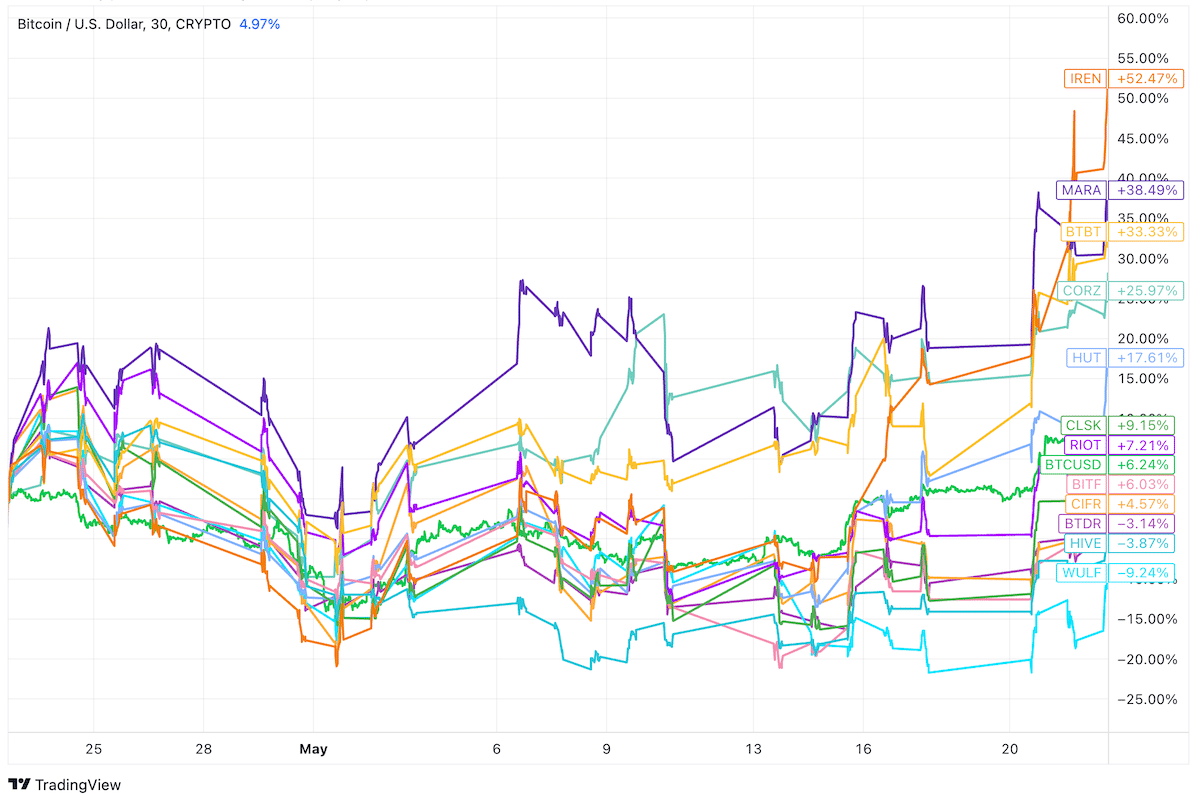

It’s been a month since the halving and bitcoin mining stocks have again shown a wide range of performance relative to bitcoin itself.

Since April 22—the first trading day after bitcoin’s halving—IREN, MARA, BTBT, CORZ, and HUT8 have notably outperformed bitcoin’s 6% return over the past month, as the chart above from TradingView shows.

CLSK, RIOT, BITF, and CIFR matched bitcoin’s performance closely while a few others have declined even though bitcoin’s price remained above $60,000.

Interestingly, there were signs that BTBT, IREN, and HUT8 might be off to a rally as they were on the lower end as of April in our Price-to-Hash (P/H) metric. As described in this article last year introducing the metric last year, the P/H ratio implies the estimated dollar value per TH/s an investor is paying a mining company to mine bitcoin on their behalf. Obviously, the cheaper the better.

The calculation takes into account a company’s enterprise value (market capitalization + net debt) and adjusts it for the proprietary mining segment using a fair-share of revenue approach. It then divides the mining segment’s enterprise value by the company’s realized hashrate.

Another thing that BTBT, IREN, and HUT8 appear to have in common is their expansion into AI/HPC, which lowered their enterprise values of the proprietary mining segment.

For instance, Hut8 ventured into HPC after acquiring the TeraGo data center in 2022, which generated a revenue of $3.3 million in Q1. BTBT reported an $8 million revenue for the HPC segment that it began in Q1, which accounted for 26.6% of its total revenue.

CORZ announced in March that part of its data center hosting capacity will support CoreWeave’s AI and HPC segment. HIVE is another public miner that expanded to HPC after Ethereum’s PoS switch, which generated a revenue of $1.13 million in Q4, although its stock has been lagging behind other peers.

Regulation News

- Power Company Flagging Cryptocurrency Mining in Ohio – NBC4 WCMH-TV

- Venezuela Cracks Down On Bitcoin Miners Amid Grid Concerns – TheMinerMag

Hardware and Infrastructure News

- Biden Order to Halt China-Tied Bitcoin Mine Beside Nuke Base Came as U.S. Firm Just Bought It – Coindesk

- Crypto boom, erratic rain spark outages in Laos, Asia’s clean power export hub – Reuters

- Bitcoin Developers Are Touting ‘Programmability’ as the Catalyst for the Next Rally – Bloomberg

- Bitcoin Mining Difficulty Set for 1% Increase as Hashrate Rebounds – TheMinerMag

Financial News

- Soluna Secures $30M from Spring Lane Capital to Fuel Project Dorothy 2 – Link

- Bitmain Nets $45M in Q1 Bitcoin Miner Fees from BitFuFu – TheMinerMag

Feature

- The Post-Halving Bitcoin Mining Market With Taras Kulyk – The Mining Pod

- From BTC to HPC: Miners signal evolving focus after the halving – Blockworks

- Miners Eye Middle East as Next Region for Growth – CoinDesk

- Oklahoma’s Pro-Bitcoin Legislation – The Mining Pod

- As Chinese Mine Clears Out, Legislators Say Crypto Still Welcome In Wyoming – Cowboy State Daily