Bitmain Nets $45M in Q1 Bitcoin Miner Fees from BitFuFu

Bitmain-backed BitFuFu said it made $144 million in Q1 revenues from proprietary bitcoin mining and cloud mining sales while paying the investor $45 million in miner leasing and hosting fees.

BitFuFu went public in February on the Nasdaq exchange after completing a SPAC merger. In the Q1 earnings report released on Monday, BitFuFu said the cloud mining segment contributed $81.5 million in revenue by producing 2,096 BTC for customers. Its proprietary fleet, on the other hand, mined 1,103 BTC, booking a revenue of $60.1 million.

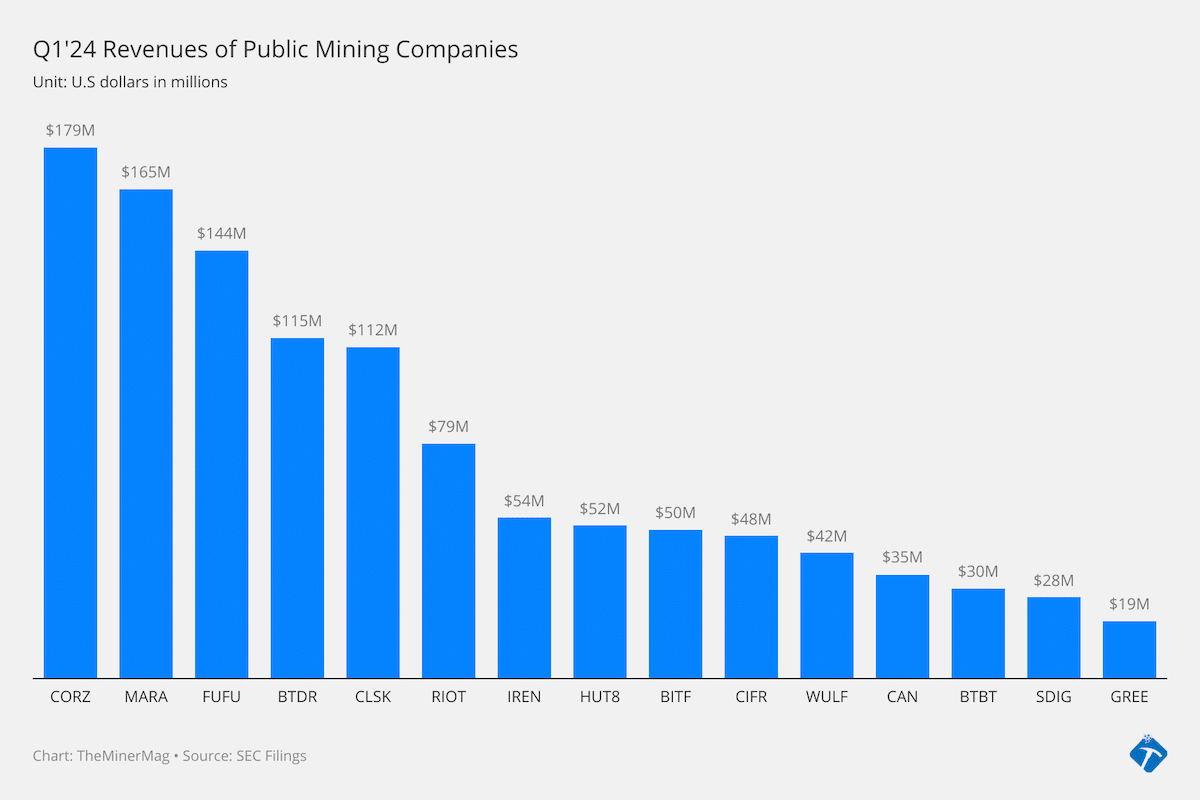

The combined revenue size makes BitFuFu the third-largest public bitcoin mining firm after Core Scientific ($179 million) and Marathon ($165 million) in Q1.

Meanwhile, BitFuFu recorded $45.3 million as a cost of revenue to a related party. As previously reported, BitFuFu rents bitcoin miners from its investor Bitmain. It also hosts equipment on facilities sourced by Bitmain to increase hashrate for cloud mining sales and proprietary mining.

BitFuFu boasted a mining fleet of 28.6 EH/s as of Mar. 31 that was split between the two business segments with a combined power capacity of 644 megawatts.

According to its 2023 annual report, BitFuFu plugged in 22.9 EH/s as of Dec. 31 and 20.3 EH/s of that were from suppliers or leased miners while it self-owned 2.1 EH/s at the time.

The company claimed that the number of cloud mining customers as of Mar. 31 was 321,184, up from 304,270 as of Dec. 31. Existing customers contributed $76 million in Q1 revenue, accounting for 93% of the cloud mining business.

According to BitFuFu’s website, its 180-day bitcoin mining contract using an S19XP is quoted at $0.0572/TH/s per day. This implies that a potential buyer would incur an operating cost of $0.108/kWh based on the 22 J/TH efficiency of Bitmain’s S19XP model.

At an energy rate of $0.1/kWh, S19XPs are close to mining at a loss now that bitcoin’s hashprice has declined to $50/PH/s after the halving.