Miner Weekly: Mining Pubcos Raised $2B in Pre-Halving Quarter

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

A total of 12 public bitcoin mining companies have released their financial earnings for Q1, which was the last pre-halving quarter. Combined, 10 of them raised nearly $2 billion in gross proceeds from equity financing activities in anticipation of the post-halving profitability squeeze. For comparison, the same group of 10 companies raised $1.25 billion combined in Q4.

According to data from TheMinerMag, the three largest public mining companies by market capitalization – Marathon, CleanSpark and Riot – alone accounted for 73% of the funds that all the 10 companies raised in the last quarter. As of Mar. 31, Marathon, CleanSpark and Riot combined were holding $1.33 billion of cash and over 32.2k BTC valued at over $2.2 billion

However, as the chart above shows, the financing activities appear to have cooled down since Q2. As of Wednesday, less than $500 million of investment was poured into subscribing major public mining stocks. That said, the number is already higher than Q3 last year.

While the proceeds from equity financing are generally used to fund hashrate and infrastructure expansion (as shown in the spending on PP&E here), the abundance of cash reserves may also explain why most of the public mining companies chose to hold onto their bitcoin holdings.

Data shows that as of April 30, public mining companies were holding more than 48,000 BTC combined, while Cipher, CleanSpark and Riot barely sold any mined bitcoin to pay for operating expenses in April. Other bitcoin hodlers like Marathon, HIVE and Bit Digital sold 60% to 70% of their April production while accumulating the remaining amounts.

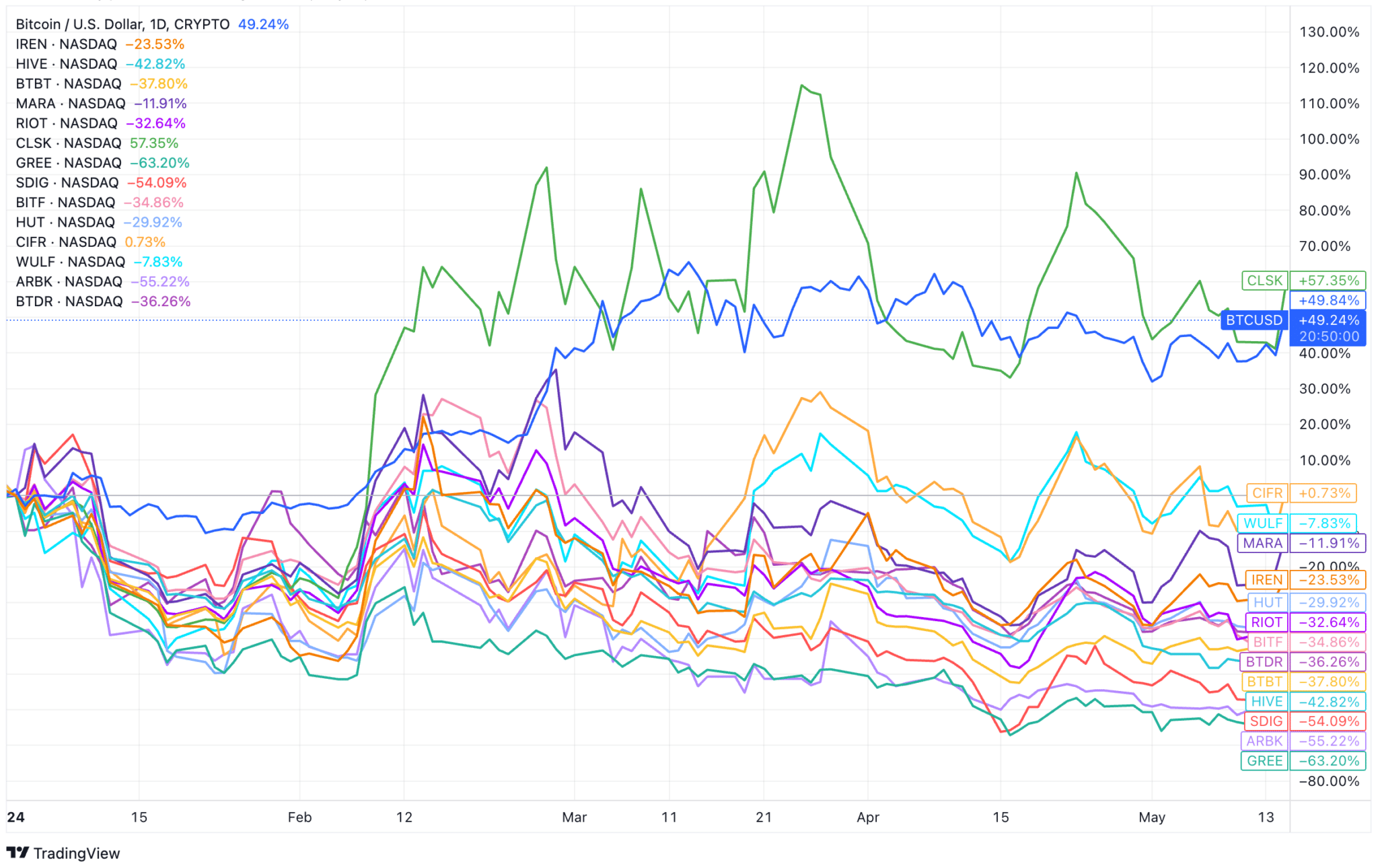

The shareholder dilution, combined with the bitcoin halving and the listing of bitcoin spot ETFs, have likely been affecting mining stocks so far this year. Data from Tradingview shows that nearly all mining stocks have significantly underperformed bitcoin in terms of year-to-date returns.

Regulation News

- Alberta Utilities Commission fines another unlicensed power generator mining bitcoin – Rocky Mountain Outlook

- U.S. Blocks China-Tied Crypto Miners as ‘National Security Risk’ Near Nuke Base – CoinDesk

- Sweeping ‘Bitcoin Rights’ Bill Becomes Law in Oklahoma – CoinDesk

Hardware and Infrastructure News

- Canaan unveils new bitcoin-mining machine after ‘halving’ event – SCMP

- Three weeks after blockbuster launch, Runes faces declining activity – The Block

- ‘Massive’ Solo Miner Wins $200k Bitcoin Rewards with 0.5 EH/s – TheMinerMag

- Bitfarms Secures Another 100 MW of Hydropower Capacity – TheMinerMag

- El Salvador mined 474 BTC, adding to state holding, in last three years – Reuters

Corporate News

- CleanSpark to Acquire 75 MW Wyoming Bitcoin Mining Sites for $18.75M – Link

- Mawson Hires Head of Corporate Strategy and Head of Corporate Development – Link

- Former CEO Sues Bitcoin Miner Bitfarms Demanding $27M – TheMinerMag

- Galaxy Digital revenue, profit grow, buoyed by record mining revenue – The Block

Feature

- Bitcoin Mining Difficulty Is Plummeting—Here’s Why – Decrypt

- Difficulty Drop, Arkansas Mining Bans and AI Mining Pivots – The Mining Pod

- Behind The MEV Mask With Dean Eigenmann – The Mining Pod

- Crypto traders and miners as useful to society as escorts, study finds – DLNews