Miner Weekly: Finally, Bitcoin Miners Can Catch a Short Breath

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Nearly 20 days after bitcoin’s fourth halving, the network difficulty is finally dropping.

Minutes before this newsletter went out, bitcoin’s mining difficulty posted a downward adjustment of about 6%. That means miners can finally catch a short breath after two weeks of record network difficulty when bitcoin’s hashprice set new all-time lows around $44/PH/s.

The hashprice all-time low inevitably drove inefficient miners to unplug from the network as the fee market returned to pre-halving levels after April 29. Over the past ten days, bitcoin’s seven-day moving average hashrate dropped from 648 EH/s to less than 580 EH/s. That amount of hashrate decline is the equivalent of more than 700,000 Antminer S19 Pros.

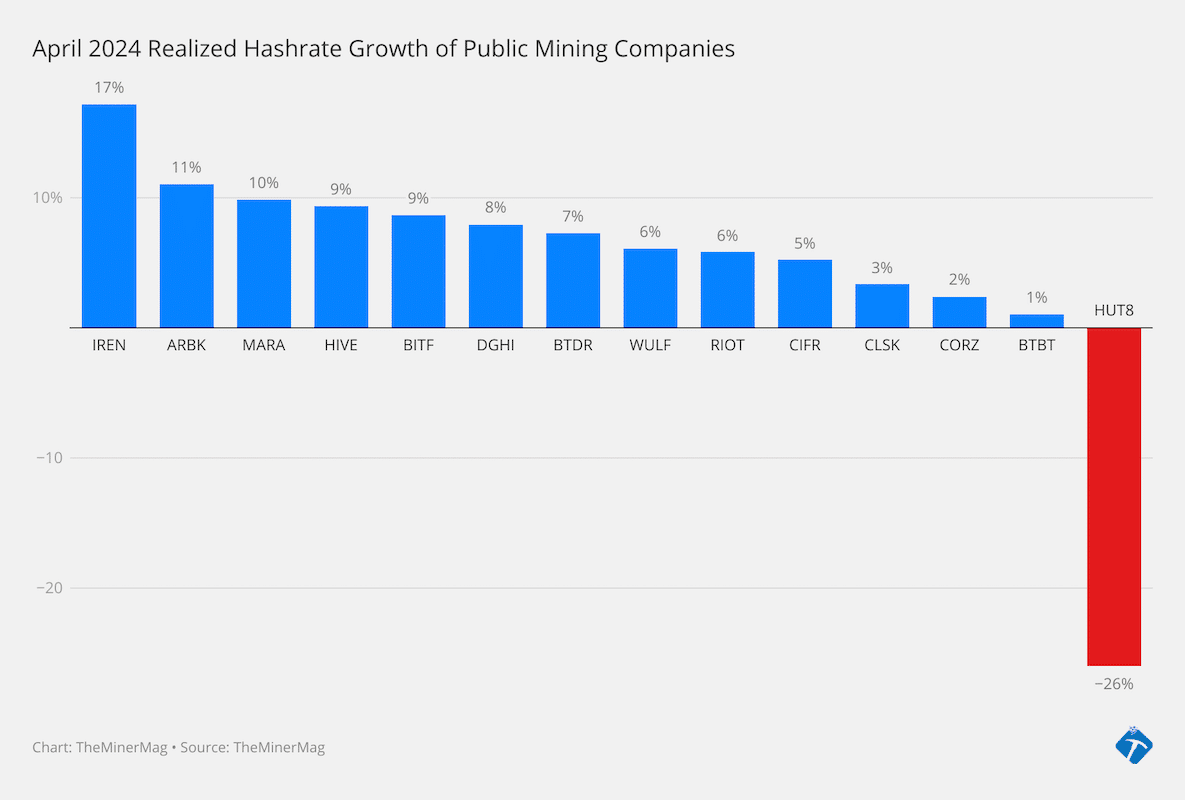

However, the hashrate of public mining companies does not appear to be affected so far. In fact, based on the April updates analyzed by TheMinerMag, most of the major mining firms managed to grow their realized hashrate despite the halving event taking a toll on their total productions.

Among the top public mining companies, only Hut 8 had a decline in realized hashrate—although that was mainly due to the relocation of their miners to a new proprietary site in Texas. Others, including Bitfarms, Cipher, CleanSpark, Core Scientific, HIVE, Iris Energy, Marathon, and Riot reported an increase in their installed hashrate as they keep plugging in newly arrived next gen miners from 2023 preorders.

Indeed, not only public mining companies are expanding proprietary hashrate, but their bitcoin holdings are growing, too. As of the end of April, their combined bitcoin holdings had grown to over 48,000 BTC, according to data from TheMinerMag—the highest level since April 2022.

Following the difficulty adjustment, bitcoin hashprice is expected to recover to the $50/PH/s level, considering that bitcoin’s market price slump to nearly $61k will offset some of the difficulty easing.

That said, the difficulty drop is good news to those who remain plugged in, and it appears that the hashrate will continue declining as the three-day average is down to 520 EH/s.

Regulation News

- U.S. Senate’s Warren Warns National Security Chiefs About Iranian Crypto Mining – CoinDesk

Hardware and Infrastructure News

- Bitcoin Miner Stronghold Mulls Sales After Halving – TheMinerMag

- Bitcoin surpasses one billion transactions processed, eight hundred weeks after launch – The Block

- Bitcoin Hashrate Drops Below 600 EH/s Following Hashprice All-Time Lows – TheMinerMag

Corporate News

- Riot Eyes Selling Power in Texas as Summer Nears – Bloomberg

- Hut 8 Mines 36% Less Bitcoin in April Amid Halving and Miner Relocation – TheMinerMag

- CleanSpark Names Chief Operating Officer and Chief Technology Officer – Link

- Bitcoin Miner Core Converts Data-Center Infrastructure for AI – Bloomberg

Feature

- It’s Name Was OP_CAT – The Mining Pod

- How a Scrappy Cryptominer Transformed Into the Multibillion-Dollar Backbone of the AI Boom – WIRED

- Is Bitcoin Mining Centralized? With Peter Todd – The Mining Pod

- AI-hungry tech giants can’t build fast enough. They’ll need Bitcoin miners to help – DLNews