Miner Weekly: Your Bitcoin Halving Cheatsheet: 2020 vs 2024

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitcoin’s fourth halving is less than two days away. No one knows the exact time it will happen, but there will surely be all kinds of celebrations across the globe.

The latest Miner Weekly issue has summarized some data points to recap the exponential growth of the bitcoin network and the evolution of bitcoin mining over the past four years.

16 Trillion to 87 Trillion

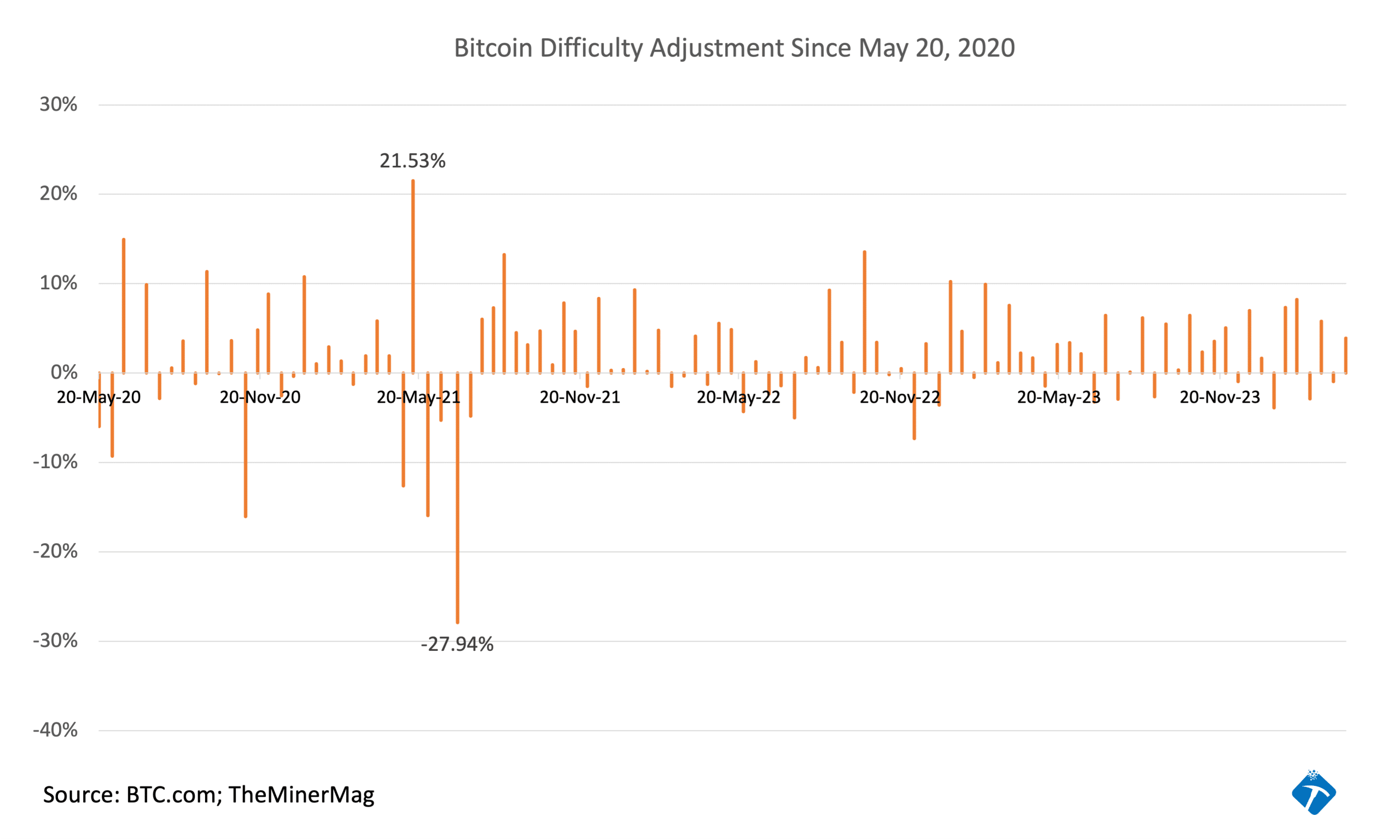

On May 5, 2020, bitcoin’s network difficulty had the last adjustment before the previous halving, reaching 16.1 trillion. On April 11, 2024, in the last adjustment before the upcoming halving, the network difficulty went up to 86.3 trillion.

So over the past four years, mining has become 5.36 times as difficult. That was bolstered by the increase in average hashrate from 115 EH/s to 640 EH/s over the same period. For context, 525 EH/s of computing power is the equivalent of 5.25 million Antminer S19 Pro units (leading equipment over the past cycle) plugged in globally.

However, a more important question is how much will the hashrate decline after the halving, or if at all. Following the May 2020 halving, bitcoin’s hashrate dropped by 15%, causing two consecutive downward difficulty adjustments.

900 BTC to 450 BTC

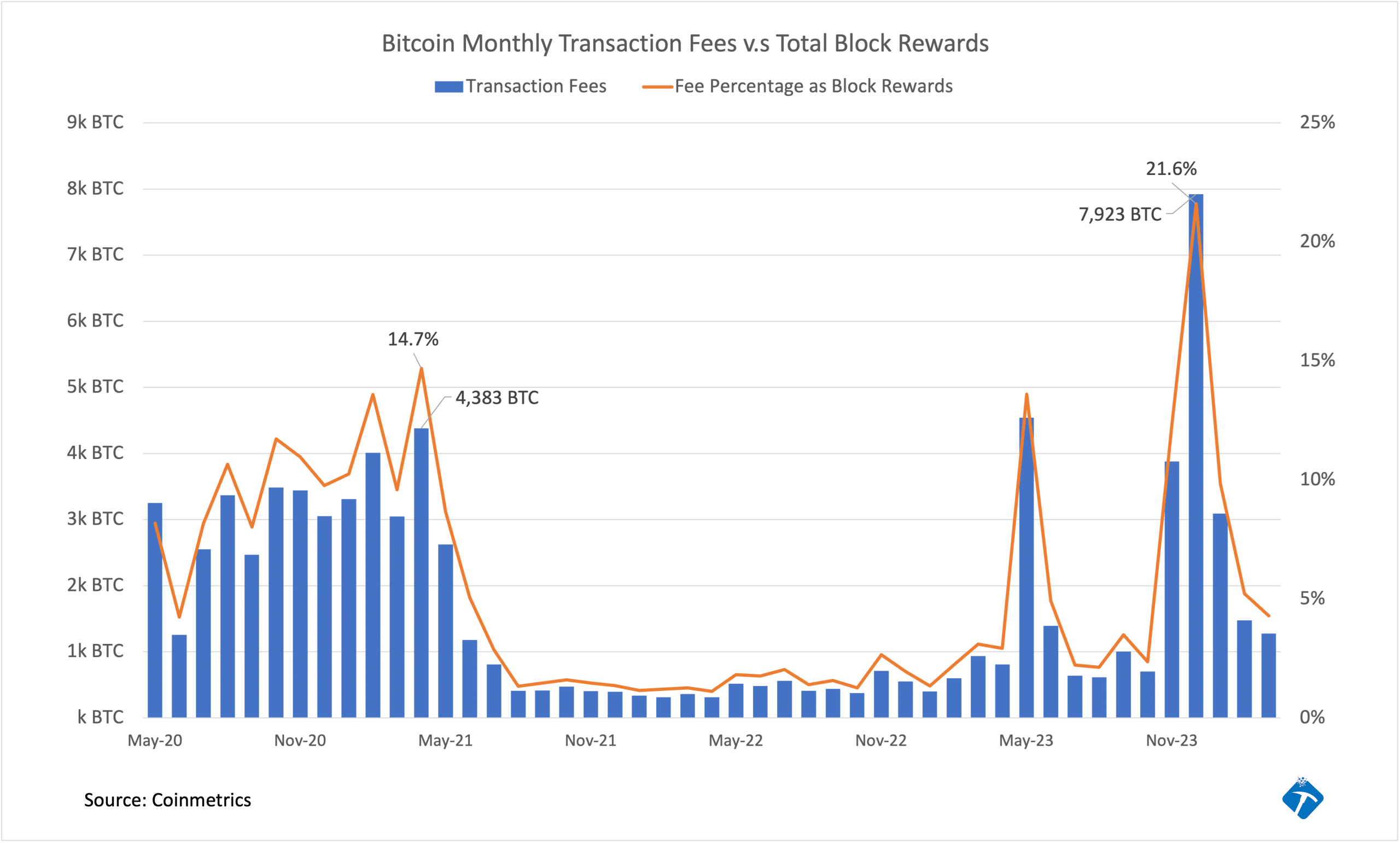

For most of the time since May 11, 2020, bitcoin’s daily block subsidies fluctuated around 900 BTC. That will decline to 450 BTC once we enter the 3.12-BTC-per-block era after April 20. But what about the fees?

In the months after the May 2020 halving, bitcoin’s monthly transaction fees began to rise amid the bull run, reaching a local peak of 14.7% of block rewards in April 2021 before subsiding to an average of 3%. It kept at around 3% until the spike of inscription activities in May and December 2023.

In the most recent month, transaction fees made up 4% of the total block rewards. If we assume that will remain steadily after halving, then nearly 10% of each day’s block rewards could come from fees. And if the bull run continues, the fee market will become more dynamic than ever.

$100 to $50?

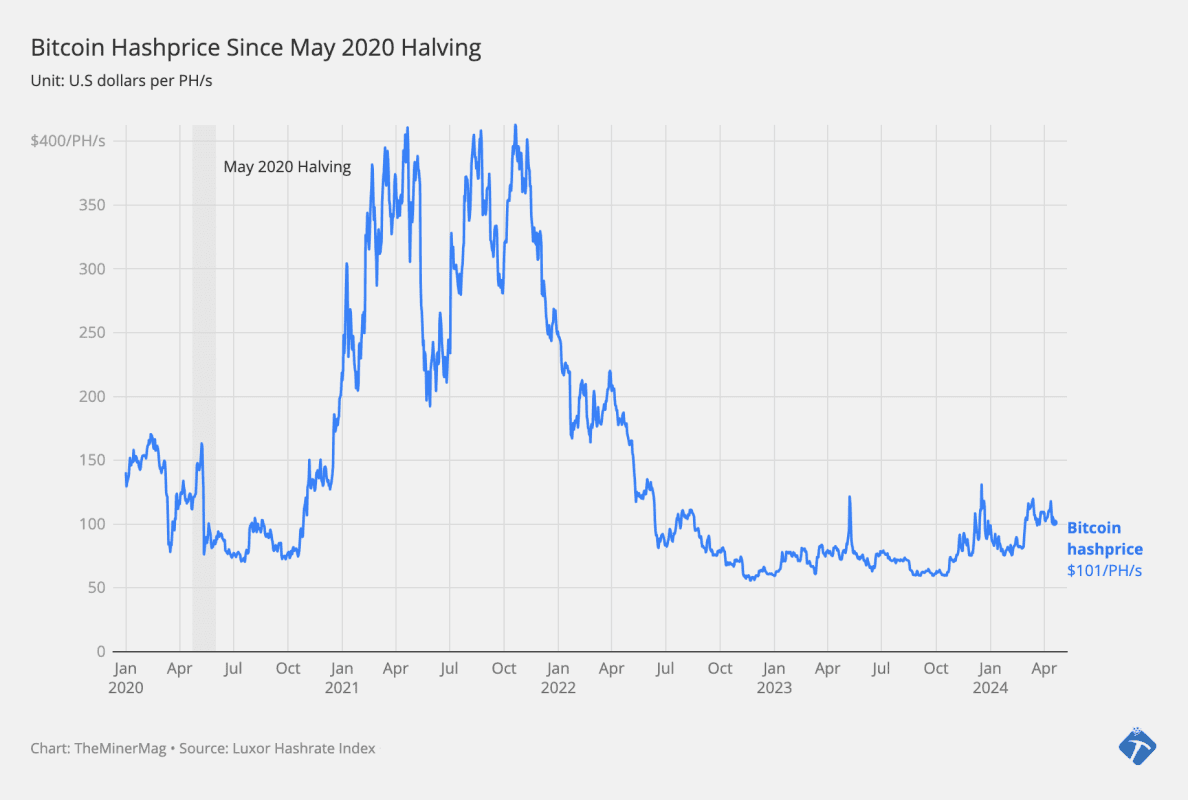

Without checking the historical data, do you remember what bitcoin’s hashprice was before and after the May 2020 halving?

Per Hashrate Index’s data, it dropped from around $140/PH/s to $75/PH/s in May 2020 before rising to $400/PH/s during the 2021 bull market. But the rising hashrate and the bearish market environment throughout 2022 did cause the hashprice to plunge to below $60/PH/s.

With the hashprice hovering above $100/PH/s at the moment, we can expect it to drop to $50/PH/s in a few days, which would cause some operators across the globe to unplug their mining machines due to unprofitability.

50% to 65%

Finally, we feel that nothing can illustrate the most important paradigm shift of bitcoin mining over the past four years better than the reshuffle of bitcoin mining pools.

In the month before the 2020 halving, the top pools were all China-based or affiliated with exchanges that had strong user bases in China. However, the country’s toughest-ever crackdown on bitcoin mining in 2021 led to the rise of North American players. Some of the top 10 pools in March 2024 didn’t make the list in April 2020, while some others didn’t even exist.

In addition, the market share increase of the top pools indirectly shows the consolidation and institutionalization of mining activities as they shifted to North America. In May 2020, there were just a handful of publicly listed mining companies. Now, there are over two dozen public mining operations, with more to come.

Regulation News

- B.C. Seeks to Regulate Electricity for Cryptocurrency Miners, Citing Huge Demands – Toronto Star

- Norway Proposes Data Center Law to Filter Bitcoin Mining – TheMinerMag

- Arkansas Senate Passes Bill to Restrict Crypto Mining – KTHV

Hardware and Infrastructure News

- Bitfarms Reaches 7 EH/s at 31J/TH with Completion of Fleet Upgrade at Garlock, Farnham Sites – Link

- CleanSpark Purchases 23.4 EH/s of Bitcoin Hashrate for $374M – TheMinerMag

- Hut 8 Energizes One-Third of 63MW Site at Salt Creek Ahead of Halving – Link

- Core Scientific Plans 72MW Bitcoin Mining Expansion in Texas – TheMinerMag

Corporate News

- Marathon Appoints Manoj Narender Madnani as Managing Director for EMEA Expansion – Link

- Bitcoin Mining Ceos Remain ‘Upbeat’ Five Days Away From the Halving, Bernstein Says – The Block

- Foundry Plans to Redistribute Halving ‘Epic Sat’ Proceeds – The Block

Financial News

- Bitcoin ‘Halving’ Will Deal a $10 Billion Blow to Crypto Miners – Bloomberg

- Crypto Miners Hoard Bitcoin as Supply Cut Looms – Financial Times

Feature

- Are Mining Pools Political Targets? – The Mining Pod

- US to Award Samsung $6.4B in Grants for Texas Chip Production Complex – Reuters

- Financial Trouble for Bitcoin Miners: A Look Back, and Ahead as the Halving Looms – Blockworks

- Bitcoin Mining’s Q1 Numbers With Parker Merritt – The Mining Pod

- Bitcoin’s Halving Is Coming. Miners Are Looking for New Ways to Make Money. – WSJ

- Buyers and Sellers: How Bitcoin Miners are Thinking about Post-Halving M&A – Blockworks