Large-scale public bitcoin mining firms with ambitious growth plans in North America have raised more funds from stock offerings in Q1 alone than they did during the second half of 2023.

According to recent production updates and SEC filings, CleanSpark, Iris Energy, Marathon and Riot are estimated to have raised $1.6 billion in Q1 ahead of bitcoin’s halving event, dwarfing the $1.25 billion they raised in Q3 and Q4 last year.

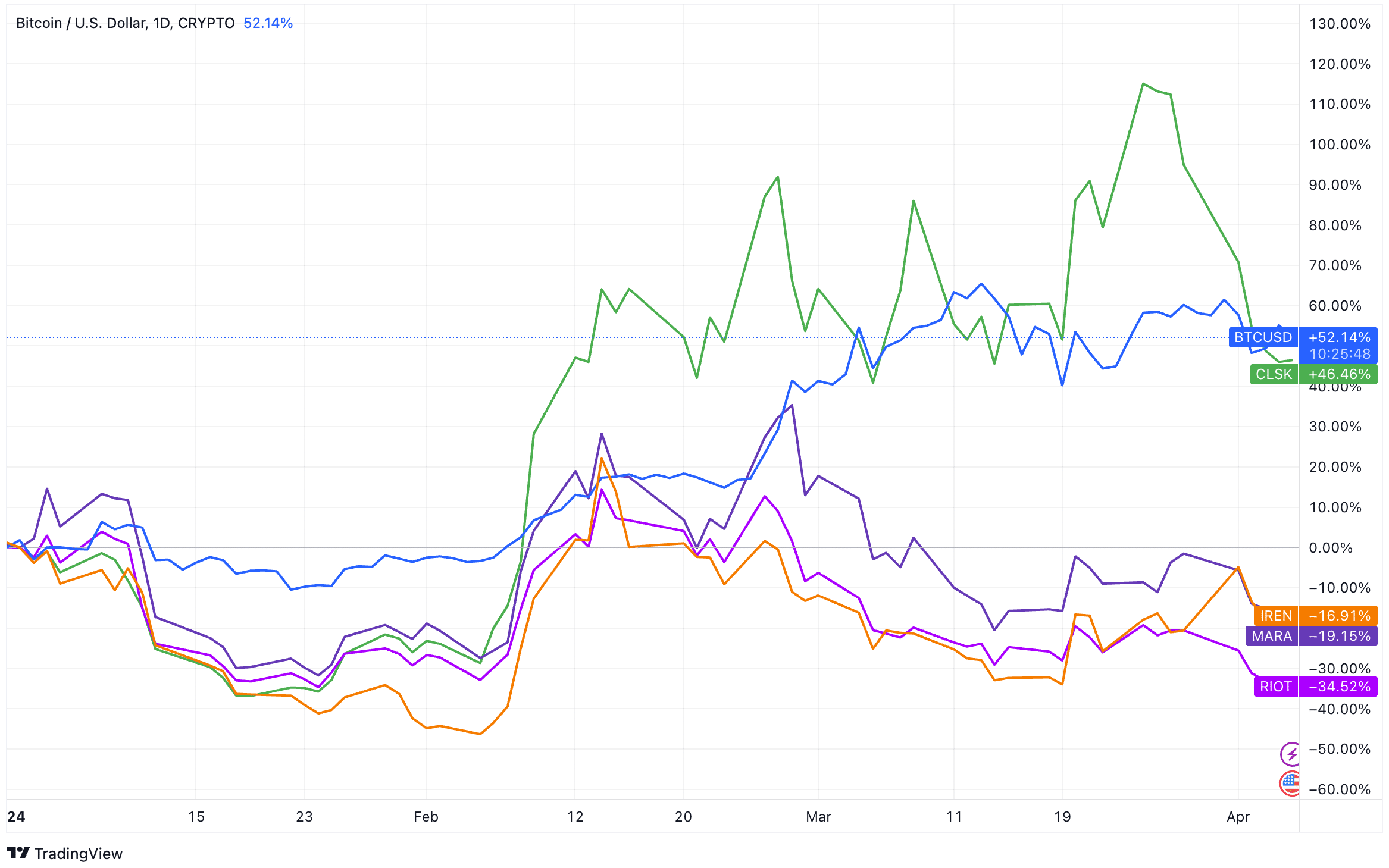

Meanwhile, their stock prices so far this year are all underperforming bitcoin amid the share dilution. CLSK was the only one among the four companies that recorded a gain YTD, but it declined sharply over the past week after insider transactions while announcing a new at-the-market (ATM) plan.

In a March production update on Thursday, Iris Energy said it had received $72 million from its latest ATM offerings between Mar. 16 and 29, in addition to the $213 million it raised in Q1 as of Mar. 15. The remaining capacity of the $500 million ATM is $166 million, the firm added.

Riot said in a filing on Feb. 20 that it had received $114.9 million through ATM offerings since the New Year and its outstanding shares as of then was around 253 million. The company said on Thursday that its outstanding shares increased to 268 million, which implies that it raised an additional estimated amount of $190 million based on its average stock prices since Feb. 20.

Last week, CleanSpark said it had raised the full $500 million through its Jan. 8 ATM offering as of March 27, and began another ATM offering with a maximum limit of $800 million.

Marathon, on the other hand, raised $500 million as of Feb. 21 already and started another ATM offering for up to $1.5 billion. It appears not to have significantly utilized the new ATM offering yet, based on the cash it was holding as of Feb. 29 ($426 million) and March 31 ($324 million), respectively.

All four companies are boasting a significant hashrate scale-up by the end of 2024, betting on a bull run after bitcoin’s halving event. While they all said they have obtained enough capital to fund the capital expenditure on mining equipment, it remains to be seen how they will execute infrastructure expansion to power the hashrate growth.

Share This Post: