Miner Weekly: Bitmain US Ramps Up S19XP Imports Ahead of Halving

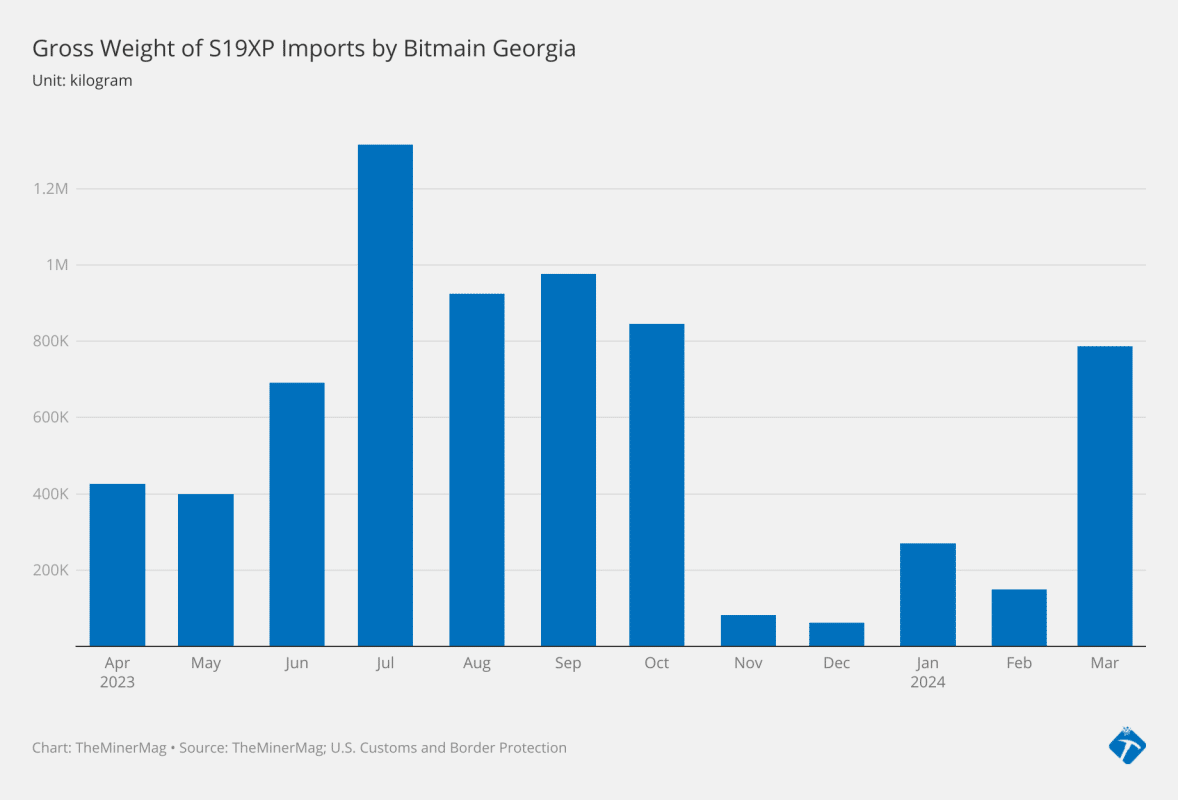

Bitmain had a major push during the summer of 2023 when it shipped more than 40 EH/s of S19XPs to its U.S. subsidiary in Georgia. That subsided for a while since October.

Now, with the halving looming, the world’s largest miner manufacturer is ramping up its imports again. In March alone, it shipped an estimated amount of 50,000 units of its S19XP series, totaling about 8.5 EH/s to its US subsidiary.

According to 15 import records identified by TheMinerMag over the past month, Bitmain Georgia imported a mix of S19XP (134 TH/s), S19j XP (151 TH/s), and S19XP Hydro (257 TH/s) with a gross weight totaling almost 800,000 kilograms, or about 880 U.S. tons.

It is impossible to determine with certainty the extent to which Bitmain’s March imports were intended for its customers or for its own account through its mining proxy, BitFuFu. But recent news suggests that Bitmain/BitFuFu could be planning a further hashrate boost with the S19XP inventories following BitFuFu’s public listing on the Nasdaq exchange.

As previously reported, a majority of the 15.2 EH/s of hashrate that BitFuFu was operating as of June 30 to generate cloud mining and proprietary mining revenues was leased from Bitmain – and a significant amount of those machines were the S19XPs.

BitFuFu was also hosting those miners at Bitmain’s facilities in multiple regions including the U.S. In addition, after BitFuFu completed the public listing on Mar. 1, it raised $74 million from Bitmain and Antpool in a private placement to fund its growth.

Bitmain Georgia, on the other hand, has been importing almost exclusively the S19XP series since June 2023 and signed a contract with Core Scientific in September to host 4.1 EH/s of S19jXPs.

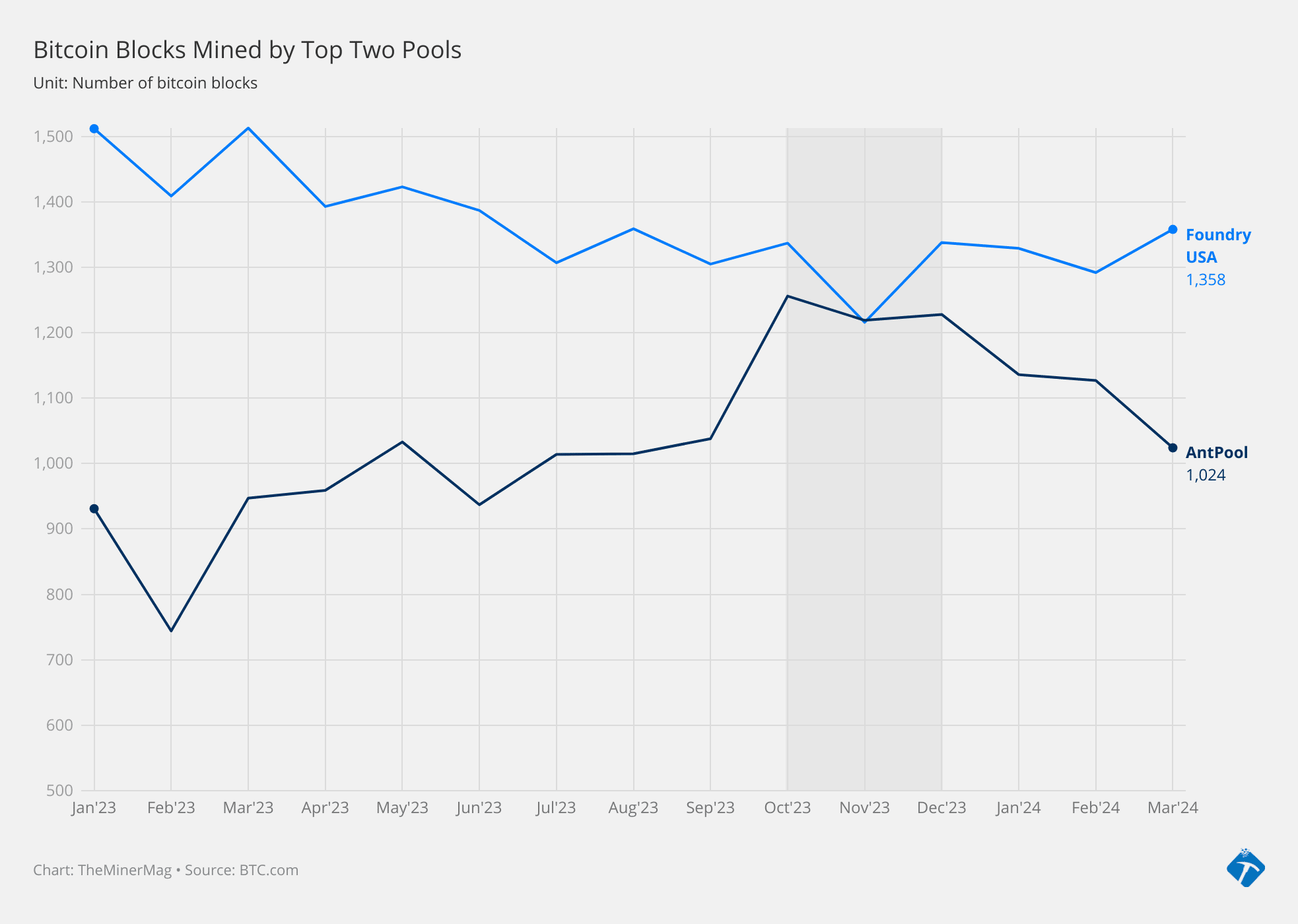

In summary, between July 2023 and March 2024, Bitmain Georgia imported 5.41 million kilograms of the S19XP miner series with an estimated total hashrate of 50 EH/s. The timeframe of the import coincided with the notable hashrate growth on Bitmain-affiliated Antpool, as shown in the graph below.

But it’s also notable that after Antpool momentarily surpassed Foundry as the largest bitcoin mining pool in November, the gap soon widened again, which coincided with the decline of Bitmain’s imports since Q4.

It will be interesting to observe whether Antpool’s hashrate increases again around Halving, considering the recent imports and the forthcoming reports from Nasdaq-listed BitFuFu on its operating hashrate and revenues for the latter half of 2023.

Regulation News

- Massillon City Council votes 8-1 Monday to approve Bitdeer replat – Massillon Independent

Hardware and Infrastructure News

- Zetagig, Backed by GDA Co-founders, Launches Z1 Bitcoin Mining Chip – TheMinerMag

- Bitmain Launches Antminer S21 Pro with an Efficiency of 15J/TH – Link

- GDA Launches 36 MW Data Center Capacity in West Texas – Link

Corporate News

- MARA Pool Mines 773 Bitcoin in March amid Extended Downtime – TheMinerMag

- CleanSpark ‘Fully Funded’ to Exercise 20 EH/s Option, CEO Says – TheMinerMag

- Arkon Energy to Buy 6 EH/s of T21 and S21 Bitcoin Miners – TheMinerMag

- Poolin Founder Sells Texas Bitcoin Mining Sites for $49 Million- TheMinerMag

Financial News

- Bitcoin miner CleanSpark plunges 10% after $800M share offering – Cointelegraph

Feature

- The bitcoin halving is just weeks away — here’s how miners have prepared – Blockworks

- Making Energy Markets Efficient With Alan Schroeder – The Mining Pod

- Hashrate Futures with Matt Williams – The Mining Pod