Miner Weekly: Will Mining Companies be Safe Post-Halving?

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

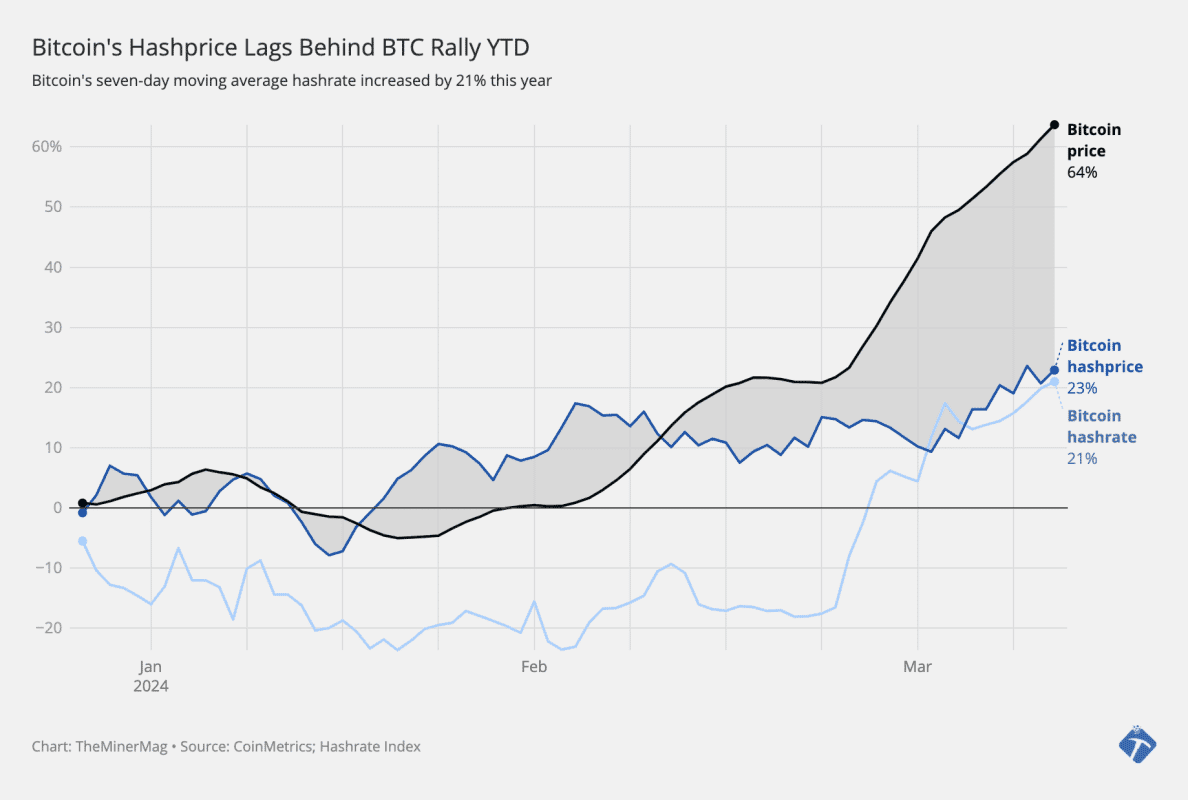

Bitcoin halving is less than 5,500 blocks away, currently estimated to take place on April 20. With the recent bitcoin price rally, the hashprice has climbed to $120/PH/s. However, its appreciation has been slower compared to BTC price action due to the rising network hashrate.

Specifically, the seven-day moving average hashrate set a new ATH above 625 EH/s this week. Consequently, on Thursday, the mining difficulty saw another sharp upward adjustment – this time with a 5.79% jump.

If the network hashrate continues to match up or even outpaces bitcoin’s price appreciation over the next month, we may not see a notable hashprice breakout. In that case, $120/PH/s will be reduced to $60/PH/s immediately after halving.

At that level, an S19Pro miner, the most popular mining model during the 2021 market cycle, will need an electricity price lower than $0.08/kWh to break even. That would result in a significant amount of hashrate being unplugged from the network due to unprofitability. The extent of it will be most interesting to see.

As for public mining companies, it appears that most of them will be able to continue making gross profits after halving if hashprice drops to $60/PH/s.

Major public mining operations have published their Q4 earnings reports. According to the hashcost metric updated by TheMinerMag, most of them managed to keep their respective fleet hashcost under $40/PH/s. However, when factoring in cash corporate overhead, companies on the higher end of the scale are also reaching the $60/PH/s level.

With that being said, various mining operations have been making efforts to upgrade their fleets with the latest generation of equipment from Bitmain, MicroBT, or Canaan, which would help them reduce their fleets’ hashcost in Q1 this year.

In terms of financial hashcost, Bitfarms, and Core Scientific incurred notable interest expenses in the last quarter. However, Bitfarms said it fully paid off the remaining debts in February, hence such hashcost should be significantly lower in Q1.

Regulation News

- Biden’s 30% Tax Would ‘Destroy’ Bitcoin Mining in the US, Industry Says – DL News

Hardware and Infrastructure News

- Bitcoin Hashrate Sets New Highs over 620 EH/s – TheMinerMag

- Bitfarms Buys Additional 10 EH/s Bitcoin Miners for $143M – TheMinerMag

Corporate News

- Cathedra Bitcoin Expands to Mining Hosting in Reverse Takeover – TheMinerMag

- Block Mining Sues Colocation Provider Hosting Source over Breach of Contract Regarding 1,106 Bitcoin Miners – Link

Financial News

- Miners Continue Money-conscious Moves Ahead of the Bitcoin Halving – Blockworks

- Miners Remain Best Equity Proxy as Bitcoin Targets $150,000, Bernstein says – The Block

- Core Scientific Incurred $84M in Q4 Interest Expenses – TheMinerMag

Feature

- Cathedra Bitcoin Merges! With Drew Armstrong, Tom Masiero & Marty Bent – The Mining Pod

- Bitcoin Miners Are Devouring Energy at a Record Pace During the Crypto Runup – Bloomberg

- From Bitcoin Mining To AI Infrastructure With John Belizaire – The Mining Pod