Riot Raises $559M in Equity to Fund WhatsMiner Purchases

Texas bitcoin mining and colocation giant Riot has raised nearly $560 million over the past four months through stock offerings to fund its large purchases of MicroBT’s WhatsMiners.

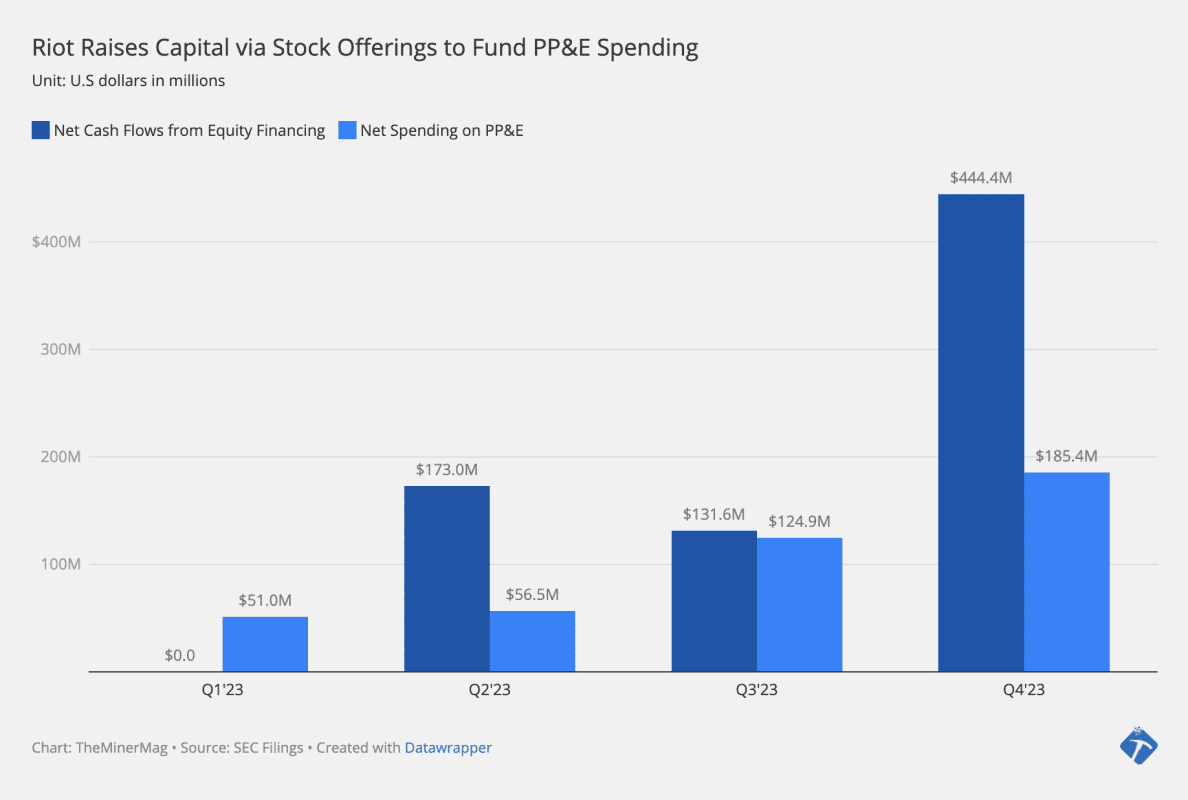

Riot disclosed in its annual report on Friday that it received total net proceeds of $747.7 million from stock offerings in 2023. Notably, 60% of that, or about $444 million, came in the last quarter alone. The company added that since Dec. 31, it has raised an additional $115 million via its at-the-market offerings.

This equity investment flow coincided with the overall price rally of mining stocks and shareholder dilution since mid-2023. As noted in the latest Miner Weekly issue, other public mining companies have been raising capital via stock offerings to fund their preorders for new equipment ahead of the halving.

Riot announced in June and December to purchase MicroBT’s flagship WhatsMiner M56S and M66 series totaling 25.7 EH/s, worth about $453.4 million. Shipments began in the fourth quarter and are expected to be fully delivered and deployed by mid-2025.

Riot’s equity financing signals a confidence boost for both Riot and MicroBT to fulfill the contract. As of Dec. 31, the Chinese bitcoin ASIC chipmaker has received $191.1 million in deposits and payments. Riot stated that the remaining payments of $220.0 million and $50.4 million will be made in 2024 and 2025, respectively.

Also notable in the filing was Riot’s decision to liquidate 2,700 Bitmain S19XP miners for gross proceeds of $6.4 million, despite incurring a loss of $5.3 million in the transaction.

Meanwhile, Riot secured an option with MicroBT to purchase up to 18.75 EH/s of WhatsMiners annually until the end of 2027. If it fully exercises the option, Riot would need to raise at least another $1.2 billion.