Canaan Leads Bitcoin Mining Stocks Rally with 21% Gains

Bitcoin mining stocks are catching up on bitcoin’s price rally since early Thursday Eastern Time with Canaan rising more than 20% and CleanSpark setting new yearly highs.

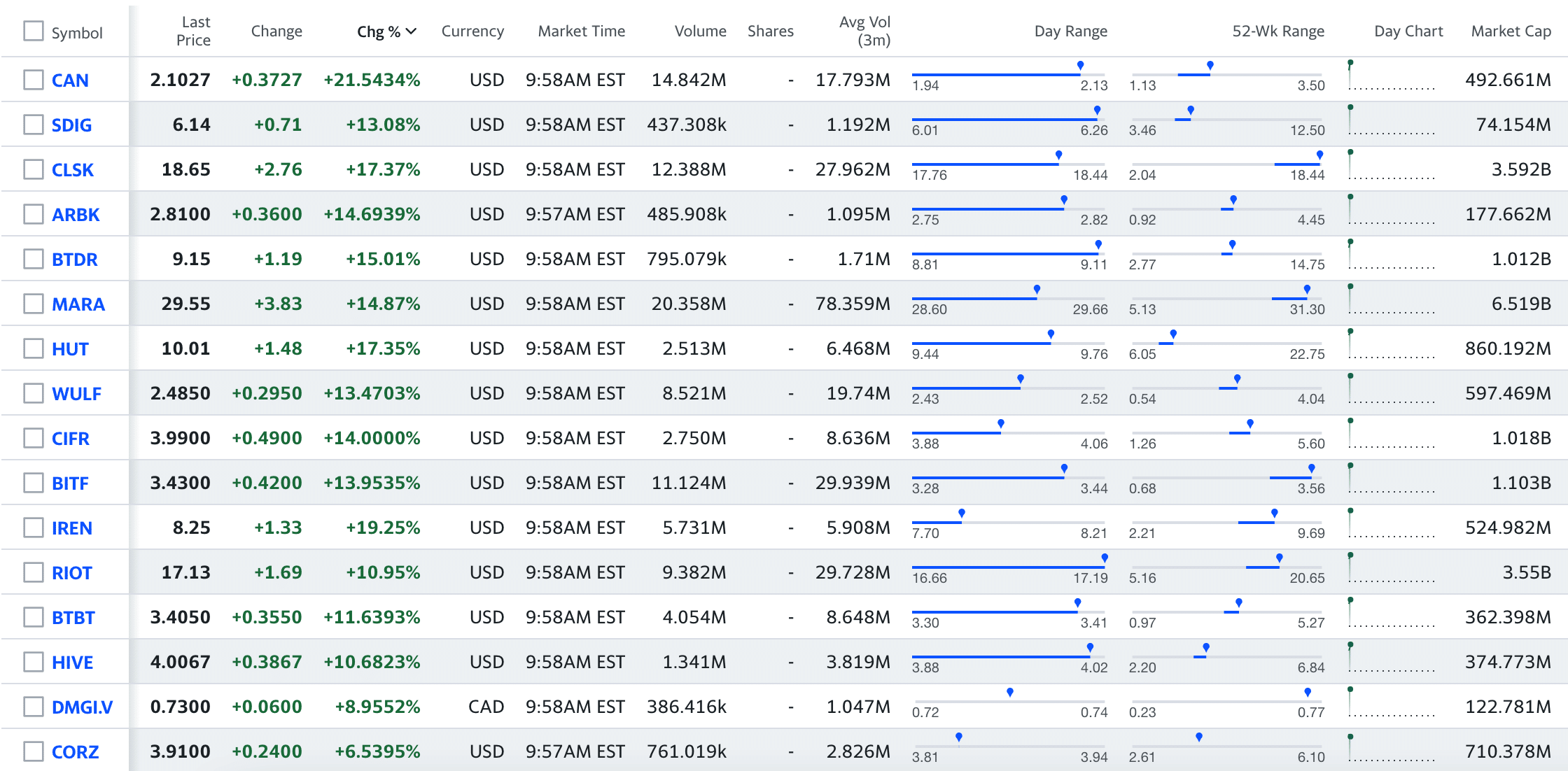

As of writing, 16 North American bitcoin mining stocks with a 3-month average trading volume of at least $1 million are changing hands at gains between 6.5% to 22%.

Canaan is leading the rally with a notable volume, trading at $2.06, though it is still down 40% from its 52-week high. Iris Energy is following up closely each with a 17% gain after announcing on Wednesday an additional purchase of 816 Nvidia H100 GPUs for $22 million to double down on its AI computing capacity.

On the other hand, CleanSpark appears to be the first major mining stocks that surpassed the previous yearly highs set in December while Marathon and Bitfarms are close to set new records. As a result, CleanSpark has taken over Riot as the second largest mining company by market capitalization.

As previously reported, the market capitalization of the 12 most traded bitcoin mining stocks by volume has declined by $6 billion since the New Year after setting yearly highs around the end of December.

They plunged even further since mid-January as bitcoin dipped below $39,000 amid the sell-the-news momentum after several bitcoin spot ETFs began trading.

With the price gains on Wednesday, there are now six public mining companies that have a market capitalization of over $1 billion: Marathon, CleanSpark, Riot, Bitfarms, Cipher and Bitdeer.