Miner Weekly: Bitcoin Mining Hashcost, Explained

This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

Bitcoin’s hashprice set new yearly highs above $130/PH/s over the past week as mining companies are reaping an increasing amount of block rewards from transaction fees. As of writing, hashprice stands at $113/PH/s.

If we assume hashprice remains constant at $110/PH/s through April, it will be reduced to $55/PH/s right after the halving, which is now estimated to happen around April 23. What would that mean for bitcoin mining companies?

TheMinerMag has published a new hashcost metric to evaluate the competitiveness of mining companies. It is similar to the cost of bitcoin production metric but comes from a different perspective.

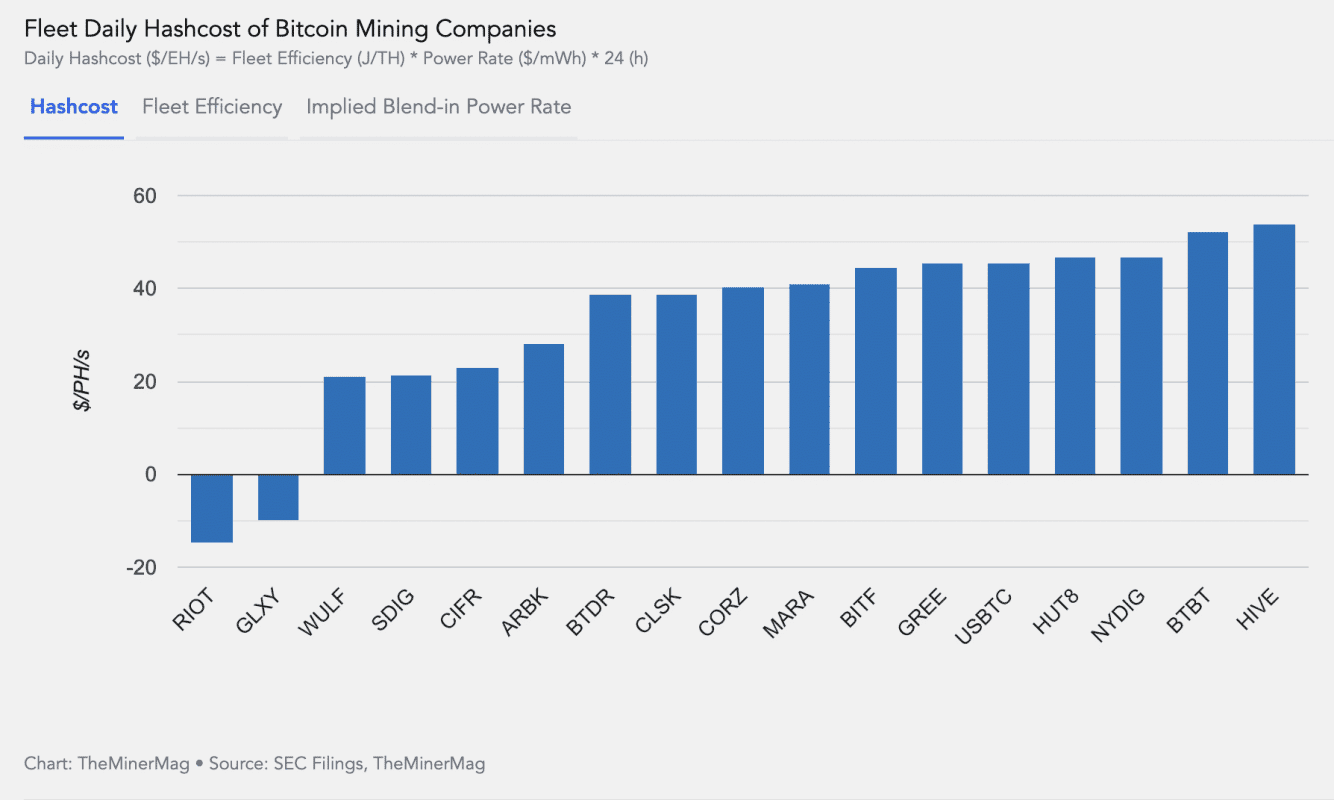

Just as the Luxor team’s hashprice chart captures bitcoin’s daily mining revenue in dollars per PH/s of hashrate, this hashcost metric shows how much money on average a mining company pays every day to operate each EH/s or PH/s of hashrate. Below is a quick formula:

Fleet Daily Hashcost ($/EH/s) = Fleet Efficiency (J/TH) * Power Rate ($/mWh) * 24 (Hours) = Cost of Bitcoin Production ($/BTC) * Daily Block Rewards (BTC) / Network Hashate (EH/s)

The chart above maps out the estimated average daily hashcost of mining companies in Q3. Bitcoin’s average hashprice in Q3 was around $70/PH/s, so most companies were fine. But those on the higher end of the scale will face much more uncertainty post-halving if they don’t reduce their hashcost.

So why do we need the hashcost metric? It takes the cost of bitcoin production metric a step further, extracting the value of a company’s fleet efficiency or its blend-in power rate when either of the two is known.

For instance, HIVE’s average daily hashcost was estimated to be $54/PH/s in Q3 and it reported a fleet efficiency to be 38 J/TH, which implies a blend-in power rate of $59.2/mWh. Similarly, Greenidge reported a Q3 hosting revenue to be $65/mWh. That was essentially the all-in power cost for NYDIG’s miners hosted with Greenidge, which implies the firm’s fleet efficiency to be 30 J/TH.

Reducing the hashcost by improving fleet efficiency and/or securing lower energy rates is hence paramount as the halving looms. That explains why we’re in the middle of an arms race among mining companies for the next generation of miners.

Hardware and Infrastructure News

- Marathon Buys 390 MW Bitcoin Mining Sites for $178 Million – TheMinerMag

- TSMC Chair Steps Down in Power Shift at Global Chip Linchpin – Bloomberg

- Cipher Buys 7.1 EH/s for New Texas Bitcoin Mining Site – TheMinerMag

- Iris Energy Preorders Enough Bitcoin Miners to Fulfill 10 EH/s Goal – TheMinerMag

- HIVE Digital Buys 96 Nvidia H100 GPUs as Part of its AI and HPC Strategy – Link

Corporate News

- Core Scientific Delays Final Hearing on Bankruptcy Exit to January – TheMinerMag

Financial News

- Bitcoin Miners Eye $1.4 Billion in December Revenue – TheMinerMag

- Bitcoin Miner Raised $15M to Use Energy from Argentina’s Vaca Muerta Oil Field – The Defiant

Feature

- The Largest Immersion Mine In North America W/ Austin Storms – The Mining Pod

- Ledger Exploit, Inscription Censorship and Ocean Pool W/ Thomas Pacchia & Drew Armstrong – The Mining Pod