Bitcoin Miners Eye $1.4 Billion in December Revenue

Bitcoin miners have collectively earned 4,055 BTC in transaction fees this month so far, which are worth $170 million as of writing and making up 20% of the total block rewards.

This percentage is higher compared to the 13% recorded in May driven by the resurgence of inscription activities on the network. At the current rate of on-chain activities, bitcoin miners could potentially earn 6,800 BTC in rewards solely from transaction fees this month.

This could result in an estimated total mining revenue of $1.42 billion at bitcoin’s average price of $42,100 so far. This figure closely matches the mining revenue recorded in December 2021 during the peak of the previous bull market.

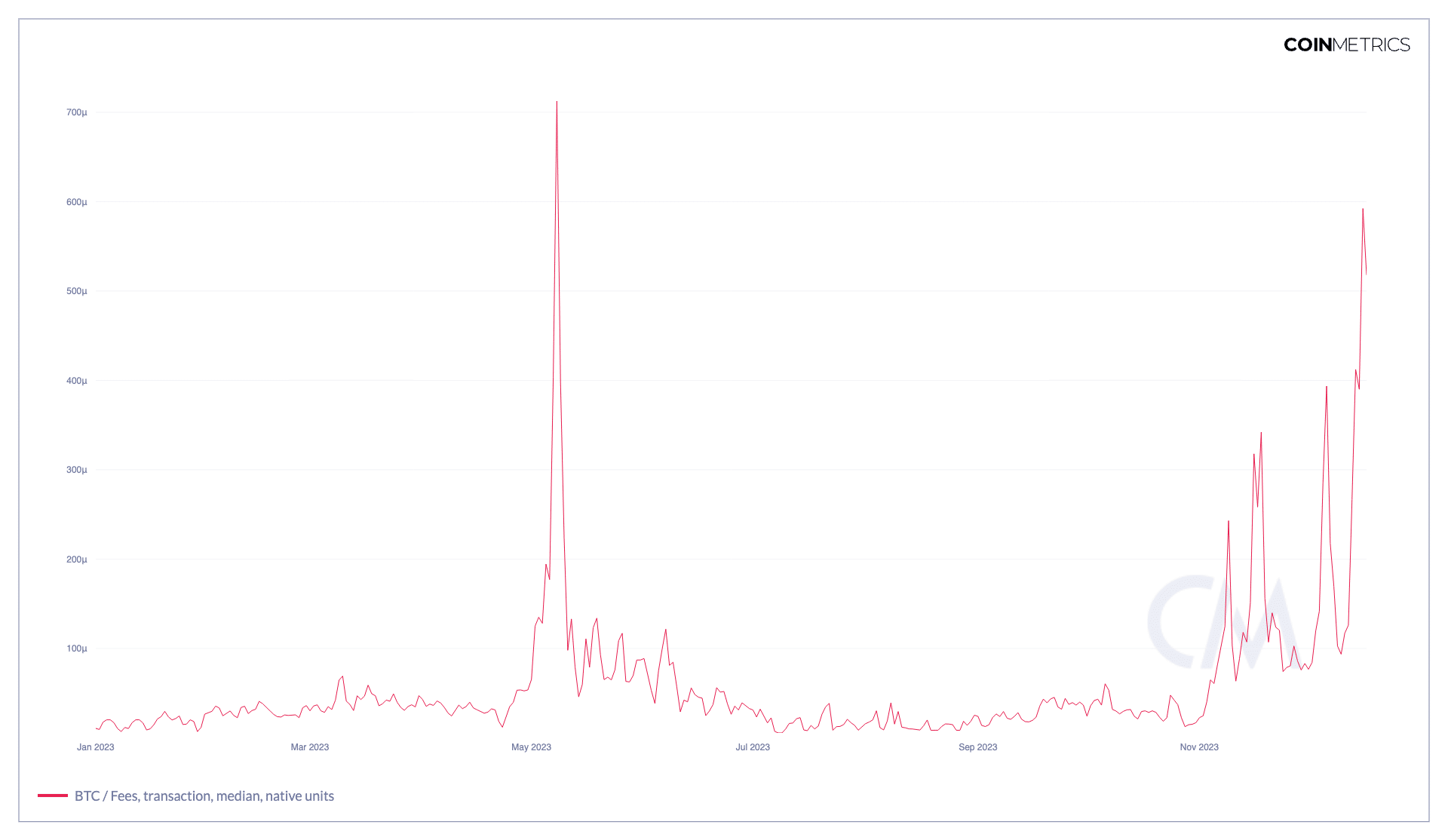

According to data from CoinMetrics, the median bitcoin-denominated fee spiked to 592 sats over the weekend following fluctuations since late November. The increased fees have led to a rise in bitcoin transactions waiting in the mempool.

Consequently, bitcoin’s hashprice surged to a new yearly high of over $130/PH/s before dropping to below $120/PH/s on Monday. Bitcoin’s seven-day moving average hashrate has also risen to over 510 EH/s again.

Meanwhile, public mining companies are set to report positive results in their December production updates early next month.

Marathon, the largest public mining company by realized hashrate, has mined about 1,070 BTC as the time of writing through its proprietary MaraPool, 22% of which came from transaction fees.

Based on the current daily production rate of 57 BTC, Marathon could potentially mine more than 1,700 BTC in December, which would be the highest monthly bitcoin production ever reported by a mining company.