Chinese bitcoin miner manufacturer Canaan has raised $25 million via equity financing to double down on product research and development.

Canaan said in a filing on Wednesday that it closed the first tranche of a transaction entered on Nov. 27, under which it would raise up to $125 million by issuing Series A convertible preferred shares to an unnamed institutional buyer.

Canaan indicated in a previous filing that it plans to use the net proceeds for R&D, scaling product sales, and covering corporate overhead.

In addition to the issuance of preferred shares, Canaan has entered into an at-the-market agreement with B. Riley, which will act as a sales agent to help Canaan raise up to $68 million via stock offerings.

Canaan initially intended to raise up to $148 million via the ATM, according to its prospectus on Nov. 10, but later revised the upper limit to $68 million.

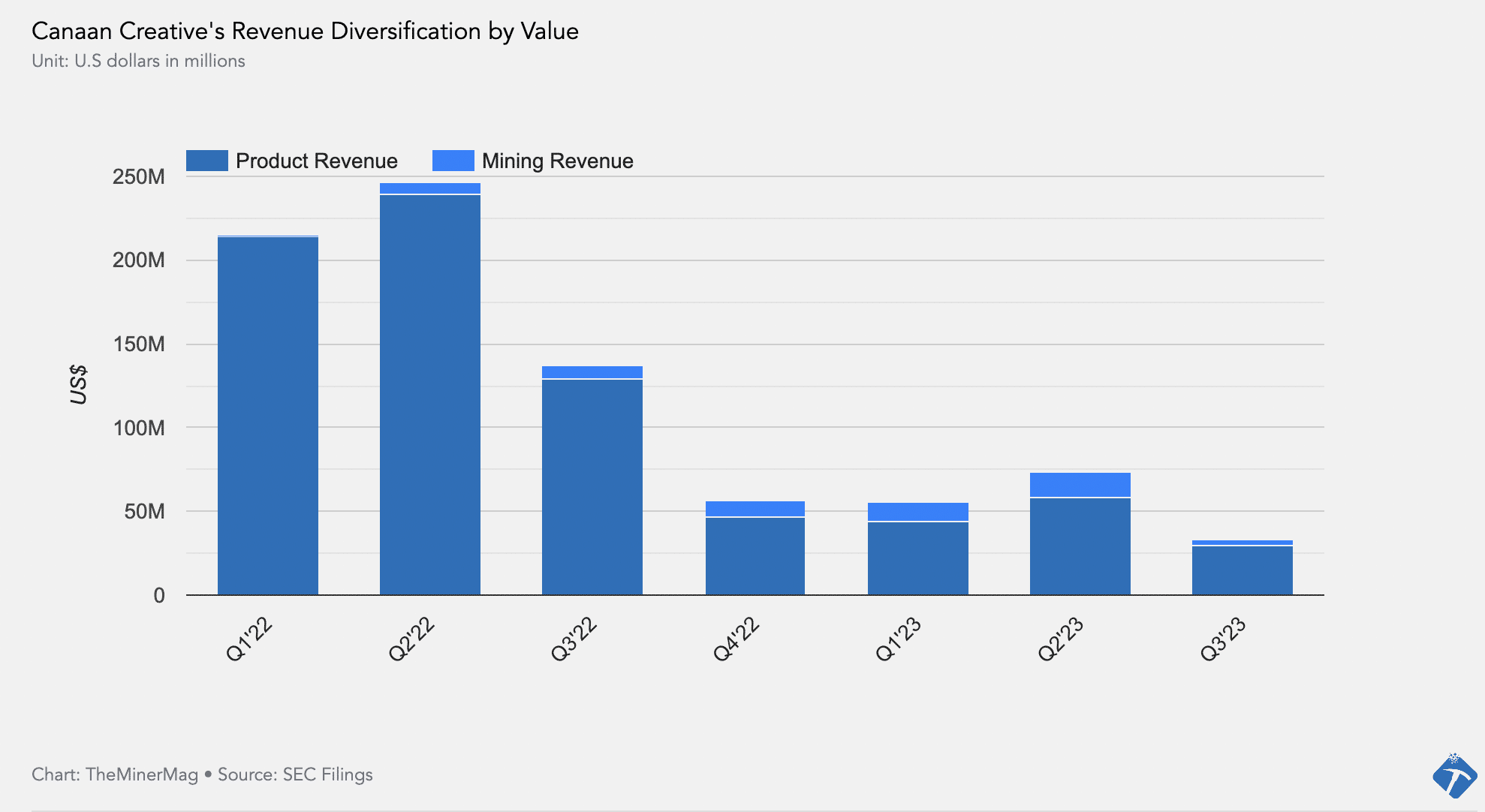

As previously reported, Canaan’s product revenue dropped by 48% in Q3 on a quarter-over-quarter basis, citing “increased pricing competition and a noticeable softening in purchasing power on the demand front.”

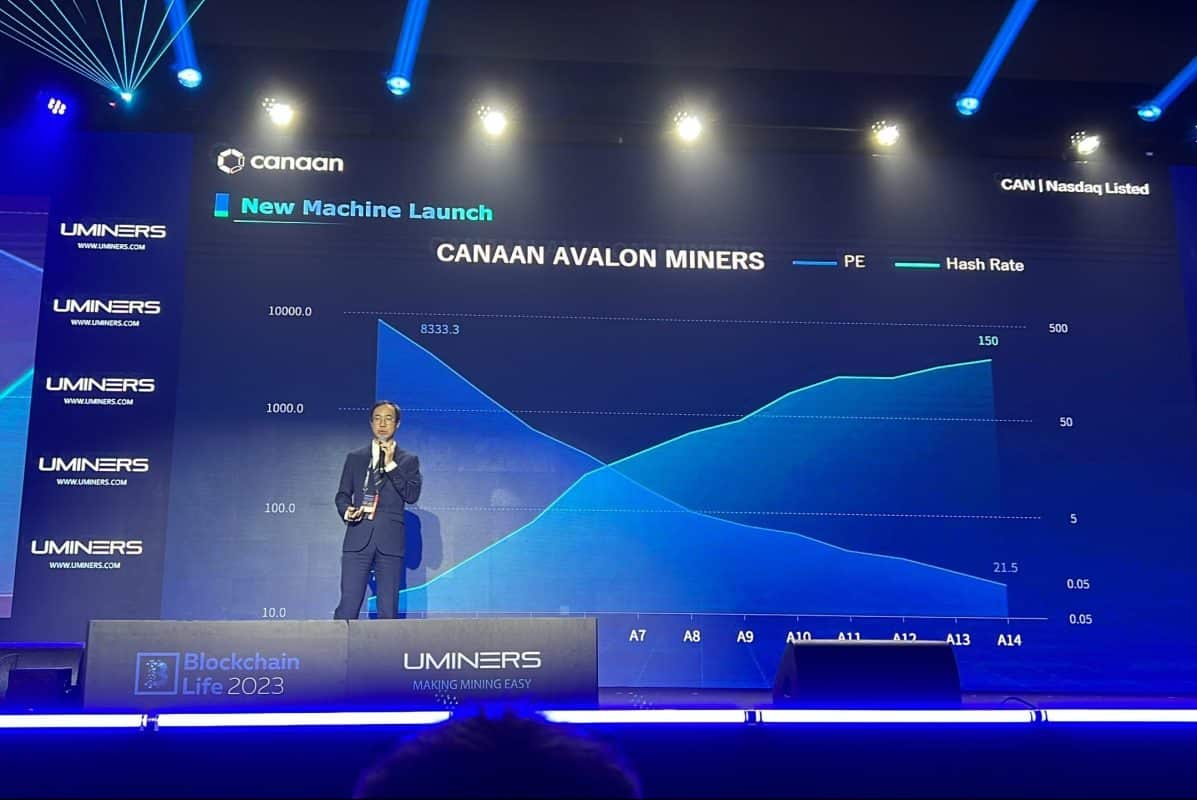

Although top mining companies in North America have committed over $1.2 billion in miner equipment year-to-date, less than 5% of the purchases identified by TheMinerMag were for Canaan’s Avalon miners.

Despite being the company that shipped the first-ever bitcoin ASIC in 2013, the market share of Canaan hardware products has been significantly eroded by Bitmain and MicroBT over the past eight years.

Share This Post: