Hut 8 Set to Acquire 310 MW Power Plants with ‘Successful’ Bid

Hut8 is poised to become a vertically integrated bitcoin mining operation with a successful bid to acquire four gas power plants in Canada totaling 310 megawatts (MW).

The company announced on Tuesday that its stalking horse bid for four natural gas plants in Ontario, Canada, has been declared successful by KSV Restructuring, which carried out the sale and investment soliciting process for the power assets.

As previously reported, Hut 8’s former Canadian power provider Validus Power Corporation went bankrupt in August, which resulted in Hut 8 working with Validus’ creditor Macquarie Equipment Finance in a stalk horse bid to acquire the four plants owned by Validus.

Hut 8 said the completion of the bid is pending final approval from the Ontario Superior Court of Justice. Upon approval, a new entity will be established to take ownership of the four power plants in Kapuskasing (40 MW), Kingston (110 MW), Iroquois Falls (120 MW), and North Bay (40 MW).

Macquarie will own 20% of the new entity and Hut 8 will hold the majority share at 80%. The company expects to complete the bid in January.

The vertical integration move aligns with Hut 8’s business combination with USBTC to become one of the most diversified bitcoin mining operations in North America with proprietary mining, high-performance computing, colocation, and managed services.

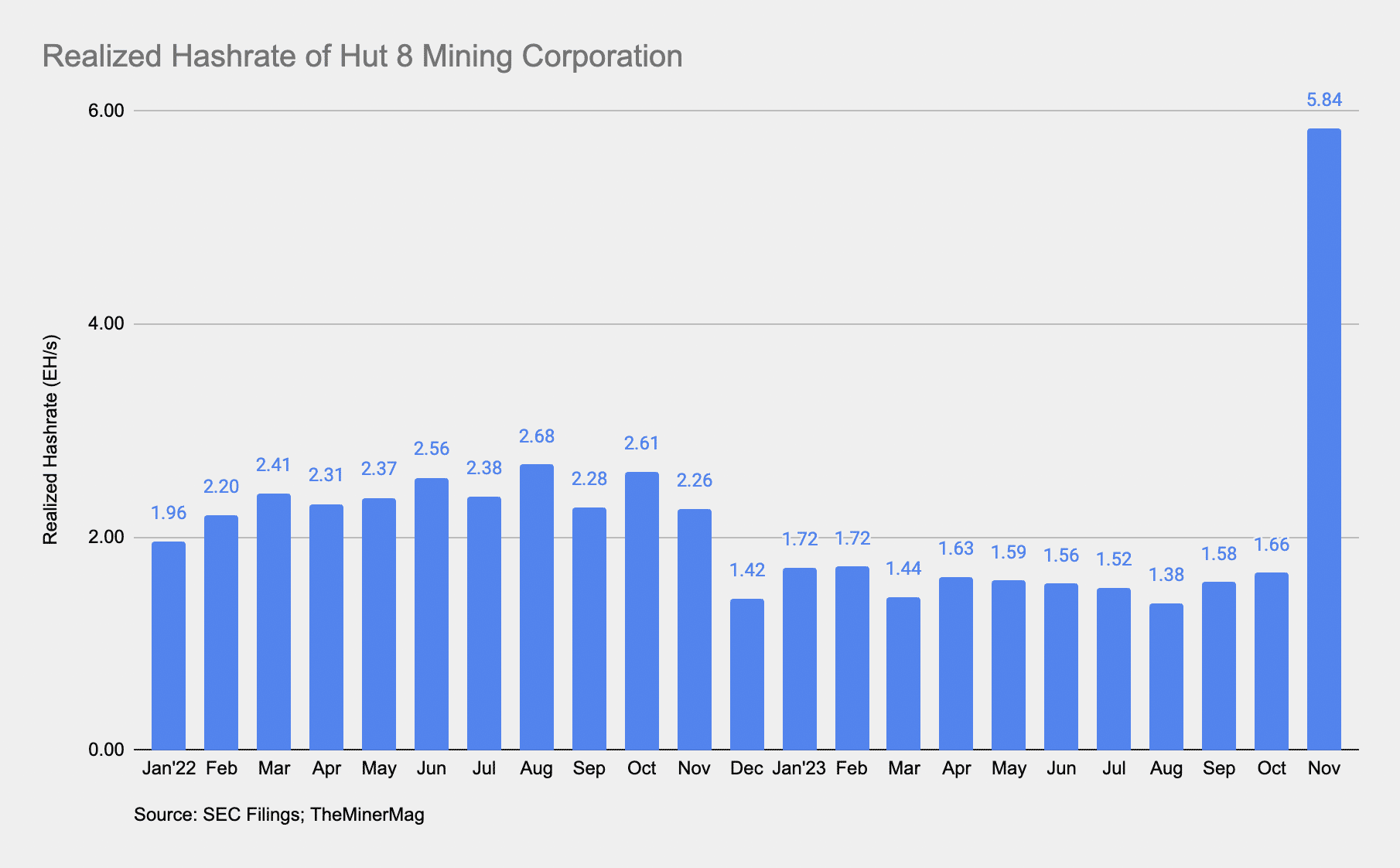

Hut 8’s November production update reflected an increase in realized hashrate, soaring to 5.84 EH/s following the expansion of proprietary mining capacity post the merger with USBTC.