Bitcoin Miner Phoenix Buys WhatsMiners in $136 Million Contract

UAE-based bitcoin miner distributor, colocation and mining operator Phoenix Group is doubling down on its investment in mining equipment.

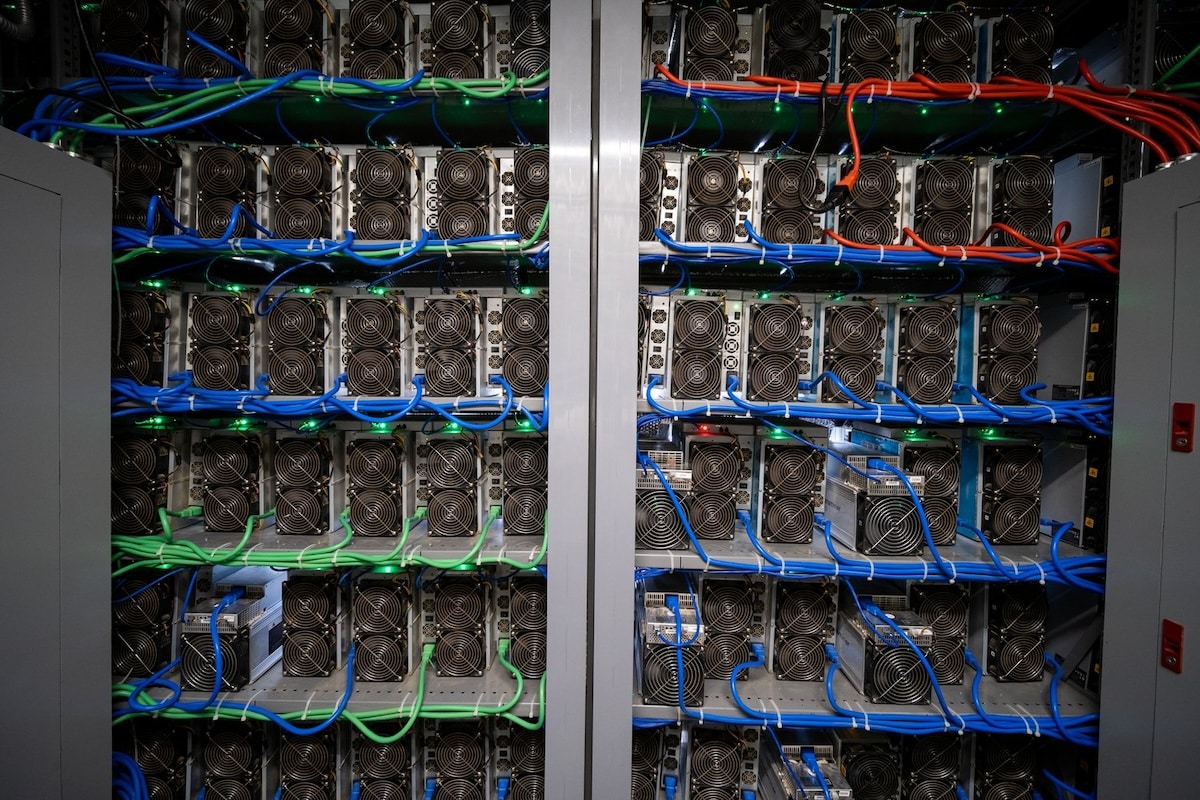

In an announcement on Thursday, the company said that it signed a purchase contract with MicroBT to buy $136 million worth of its hydro-cooling WhatsMiners for immediate delivery, with an option to invest an additional $246 million.

Phoenix did not disclose the model and total hashrate of the purchase. The contract comes weeks after Phoenix closed its $370 million initial public offering (IPO) in the Middle East, boosting its market capitalization to over $3 billion.

According to its IPO prospectus, Phoenix’s business includes mining and wallet hardware sales, proprietary mining and miner hosting, but it appears that miner hardware sales have been its main driver.

Phoenix made a revenue of $755 million and $230 million in 2022 and the first nine months of 2023, respectively. About 95% of its revenue last year came from hardware sales thanks to its distribution rights of Antminers and WhatsMiners.

Phoenix’s purchase follows closely after Riot’s bulk preorder of 18 EH/s of MicroBT’s WhatsMiner M60 series, valued at $290 million.

Based on public announcements, MicroBT has signed miner sales contracts over the past three months with Northern Data, Bitfarms, Riot, and Phoenix totaling $666 million, not including future options.