Iris Energy Co-Founders Sell $10 Million in Bitcoin Miner Shares

UPDATE: Dec. 4 – A previous version of this article incorrectly stated that the two co-founders of Iris Energy retain 67 million shares each. It has been updated with correct information in the third paragraph.

Following the recent market rebound, Daniel and William Roberts, co-founders of Iris Energy (who are related), have collectively sold nearly $10 million worth of shares from their bitcoin mining company.

The brothers individually filed Form 144 documents with the SEC on Friday after the market’s closure. Each filing indicated a proposed sale of 1 million ordinary shares of Iris Energy.

The combined market value of the 2 million shares amounts to $9.87 million. The filings indicated that the approximate date of the sale was Friday, Dec. 1. Despite this liquidation, both co-founders still retain ownership of 5 million ordinary shares each in Iris Energy.

These sales mark the latest significant divestitures among the core executive teams of public mining companies. In a comparable move back in June, senior executives at Riot Platforms sold approximately $16 million worth of Riot’s common stocks.

As described in the latest MinerWeekly newsletter, CleanSpark and Iris Energy have emerged as the top two performers following the mid-October rally in bitcoin prices.

Iris Energy’s stock experienced a notable surge in November, rising 62% from $3.04 to $4.93. It continued its upward trajectory, concluding at $5.57 on Friday, representing an 83% surge since Nov. 1.

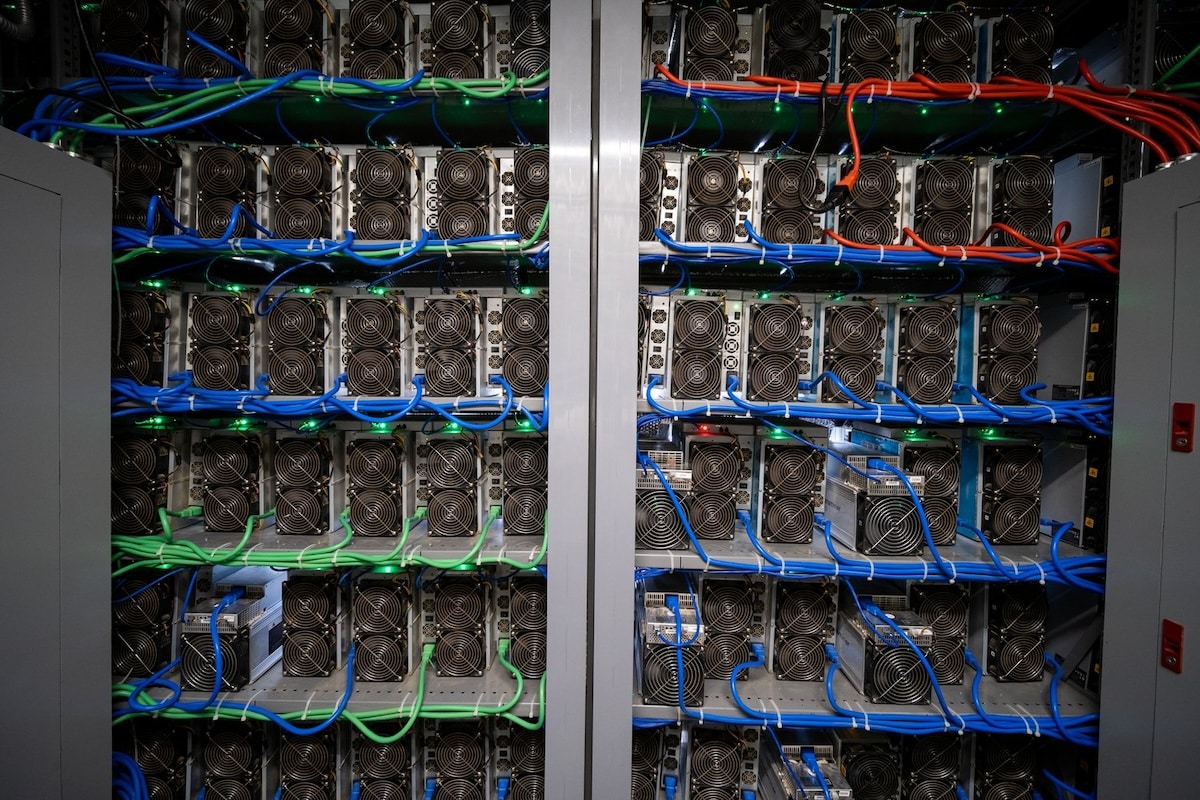

The company recently announced the purchase of 2.7 EH/s in Bitmain’s S21 and T21 bitcoin miners to reach its hashrate expansion goal of 10 EH/s by the first half of 2024.