This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

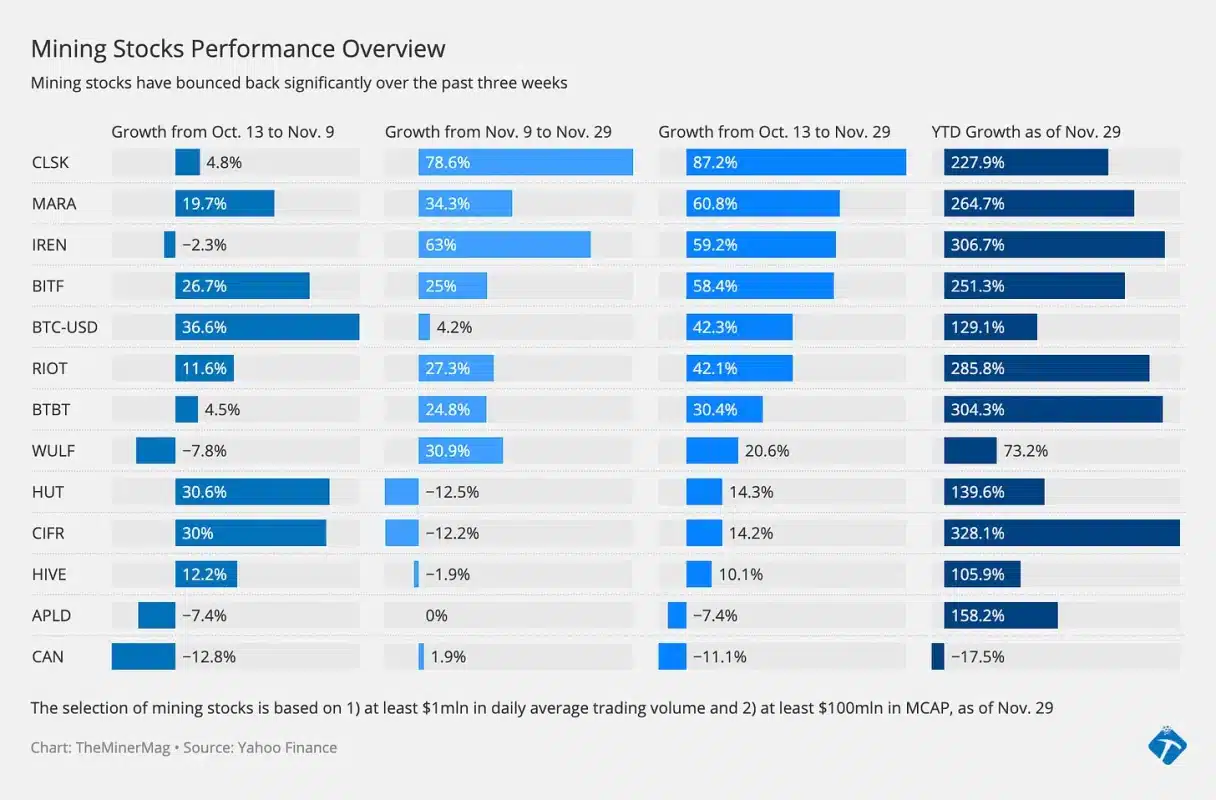

Over the past three weeks, major bitcoin mining stocks have shown strong performance in catching up with bitcoin’s rally since mid-October, with CleanSpark and Iris Energy leading the run.

Up until July, many bitcoin mining stocks had outperformed bitcoin itself by large margins. But as bitcoin’s price retreated to $25,000 in Q3 from north of $30,000, mining stocks went into disarray with many shedding more than 50%, as described in a previous Miner Weekly issue.

Bitcoin’s price started to rally again on Oct. 13 and quickly set a new YTD high above $32,000 on Oct. 24 before reaching 18-month highs of over $37,000 on Nov. 9. During this time, mining stocks mostly had sluggish performance compared to bitcoin, especially the ones with the largest market capitalization, such as Marathon and Riot.

However, mining stocks bounced back significantly over the past three weeks when bitcoin’s price only went up by 4.2%. During this time, CleanSpark jumped by 78.6% from $3.69 to $6.59, followed by Iris Energy, which also saw a sharp increase of 63%. With that growth, CleanSpark’s market capitalization crossed the $1 billion threshold for the first time as of Nov. 29.

Overall, CleanSpark, Marathon, Iris Energy and Bitfarms outperformed bitcoin since bitcoin’s mid-October rally. Interestingly, CleanSpark, Iris Energy and Bitfarms have been consistently on the lower end of TheMinerMag’s price-to-hash ratio below, a metric that measures a company’s enterprise value per each realized bitcoin hashrate.

Also notable is that Bitfarms’ daily trading volume surged sharply over the past few days, likely a result of its hashrate expansion plan announced on Monday after markets closed. The trading volume of BITF on the Nasdaq was about $40 million on Thursday, which was four times that on Monday.

Regulation News

- Waynesville bans cryptocurrency mining operations – Northwest Georgia News

Hardware and Infrastructure News

- Self-Claimed Victim Says Hackers Paid the 83.6 BTC Fees – TheMinerMag

- Bitcoin Miner HIVE Set to Acquire Another Site in Sweden – TheMinerMag

- Bitfarms Buys 6.8 EH/s of T21 Bitcoin Miners for $95 Million – TheMinerMag

Corporate News

- Ex-CBOE Digital Head Joins Bitcoin Miner Argo as CEO – TheMinerMag

- Merge between Hut 8, USBTC expected to close this week – Blockworks

- Northern Data Buys Another 8,200 NVIDIA GPUs with $360 Million – TheMinerMag

Financial News

- Bitcoin Miner Bitfarms Raises $44 Million in Private Placement – TheMinerMag

- Canaan Reports 48% Decline in Q3 Bitcoin Miner Sales – TheMinerMag

- Jack Dorsey Leads $6.2M Seed Round in Luke Dashjr’s Mining Pool Startup – TheMinerMag

Feature

- Bitcoin’s Hashrate War Between Antpool and Foundry Intensifies as BTC ETF Nears – CoinDesk

- Inside two mining operations turning Texas power into crypto profits – The Dalls Morning News

- Antpool’s $3M Transaction, F2Pool Censoring and Mining Stocks W/ Anthony Power – The Mining Pod

- The First Stratum V2 Pool W/ Alejandro De La Torre – The Mining Pod

- Launching Ocean Pool W/ Bob Burnett – The Mining Pod