Canaan Reports 48% Decline in Q3 Bitcoin Miner Sales

China-based bitcoin miner manufacturer and mining operator Canaan has reported a sharp revenue decline in the latest quarter.

The company said in its third-quarter earnings report on Tuesday that the total revenues dropped to $33.3 million. That represented a 54% decline on a quarter-over-quarter basis, which was the worst among over 12 publicly traded bitcoin mining companies tracked by TheMinerMag.

Canaan said the sales of its Avalon bitcoin miners contributed $29.9 million, which declined by 48% compared to the previous quarter. It appears that Canaan’s strategy of cutting miner prices did not help bring in customer demands.

According to its earnings report, Canaan sold 3.8 EH/s of computing power in Q3 at a price of $7.8/TH/s. For context, it sold 6.1 EH/s in Q2 at a price of $9.5/TH/s. Meanwhile, Canaan’s contract liabilities declined to $5.6 million as of Sept. 30 from $8.3 million as of June 30.

“Overall, we faced increased pricing competition and a noticeable softening in purchasing power on the demand front, which has posed severe challenges to our sales,” said Nangeng Zhang, Canaan’s chairman and CEO.

Apart from the sales headwind, Canaan’s proprietary mining segment also declined by 79% to $3.3 million in Q3, due to the “temporary shutdown of approximately 2.0 EH/s computing power in Kazakhstan to ensure legal compliance.”

Canaan added that it has been involved in a legal dispute since August with an unnamed colocation partner in the U.S. regarding their joint-mining agreement. It has taken back 26,000 miners previously deployed in the project and reallocated about half of them for customer orders.

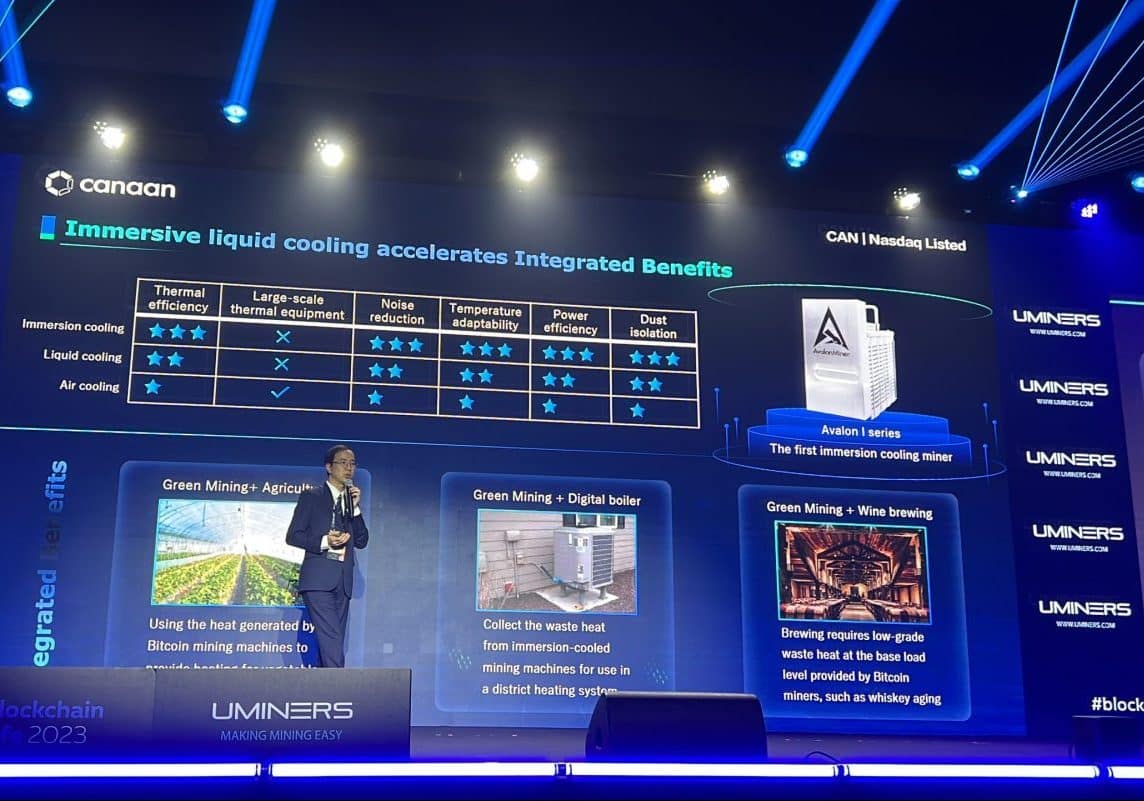

Image via Canaan on X