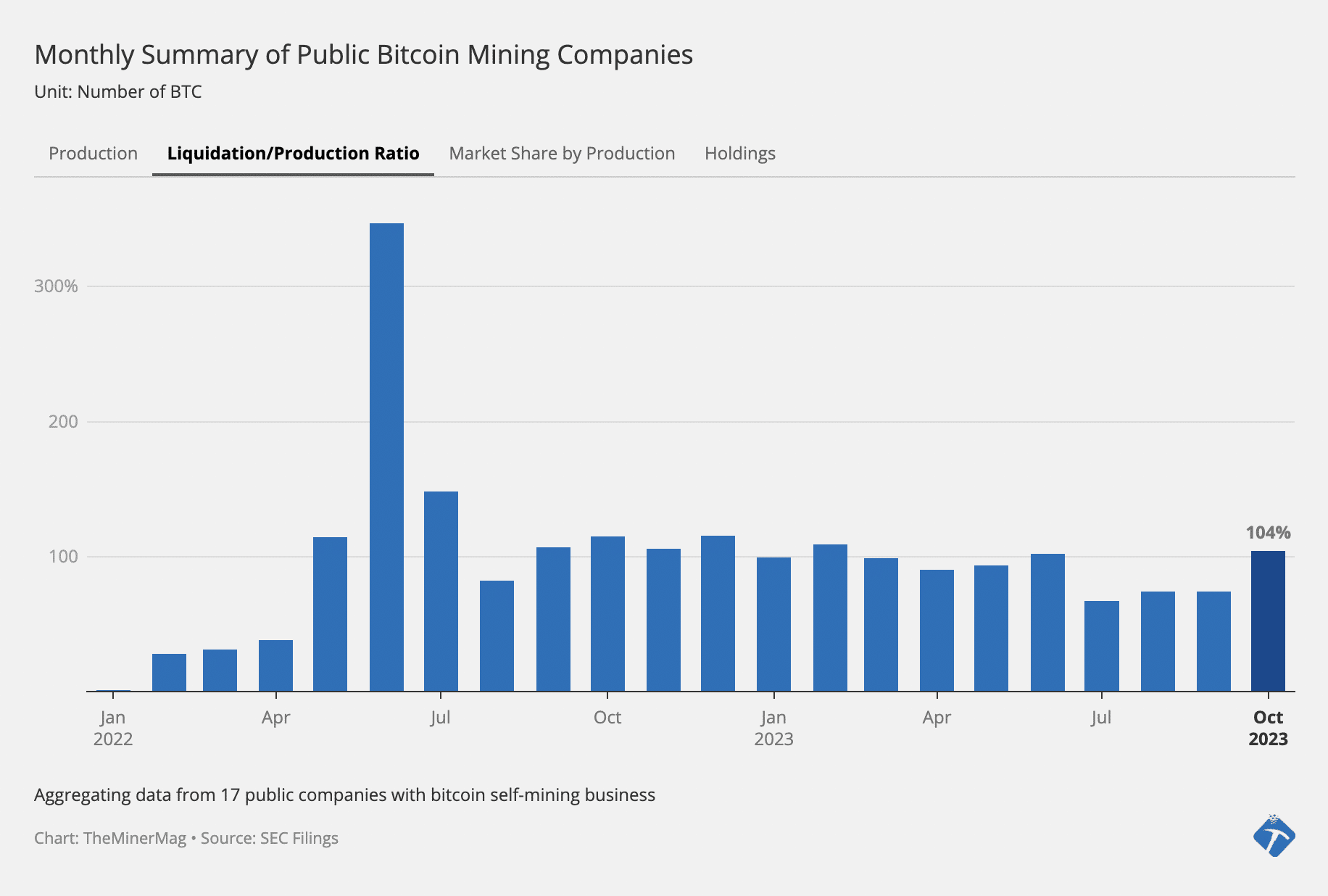

Publicly traded bitcoin mining companies have taken advantage of bitcoin’s market rally in October by selling a higher portion of their mined digital assets.

Based on monthly production disclosures for October, 13 public mining companies liquidated 5,492 BTC with a total estimated value of $164 million, tapping into bitcoin’s 30% monthly gain.

The amount of liquidation accounted for 100% of their combined bitcoin production last month. In comparison, the aggregated bitcoin liquidation-to-production ratio among public mining companies dropped to 70% during the summer.

The 13 companies that have disclosed their bitcoin liquidation and holdings for October are Argo, Bitfarms, Bit Digital, Bitdeer Cipher, CleanSpark, Core Scientific, Digihost, DMG, Hut 8, Iris Energy, Marathon, and Terawulf. Other notable operations such as Riot, HIVE, Northern Data, and Mawson have not yet provided updates on their bitcoin liquidations.

While some of these companies consistently sell all of their mined bitcoin every month, others adopt a hybrid treasury strategy such as Marathon, Hut 8, Cipher, CleanSpark, Bit Digital – and it was them who liquidated more in October than in previous months.

Notably, Hut 8 and Bit Digital sold 365 and 422 BTC last month, respectively, which was more than 300% of their bitcoin monthly productions. As previously reported, Hut 8 received a court’s approval to bid for four natural gas power plants in Canada totaling 310 megawatts.

Share This Post: