Bitcoin Difficulty Jumps 2.3% Amid Antpool Resurgence

Bitcoin’s mining difficulty set a new record at 62.46 trillion after an upward adjustment of 2.3% early Monday UTC time.

The growth in difficulty comes as more mining operations continue to plug in equipment to maximize rewards ahead of the halving, which is expected in about six months. However, the 2.3% increase indicates that the growth has slowed, at least for now, following jumps of 5.48% and 6.47% in September and mid-October, respectively.

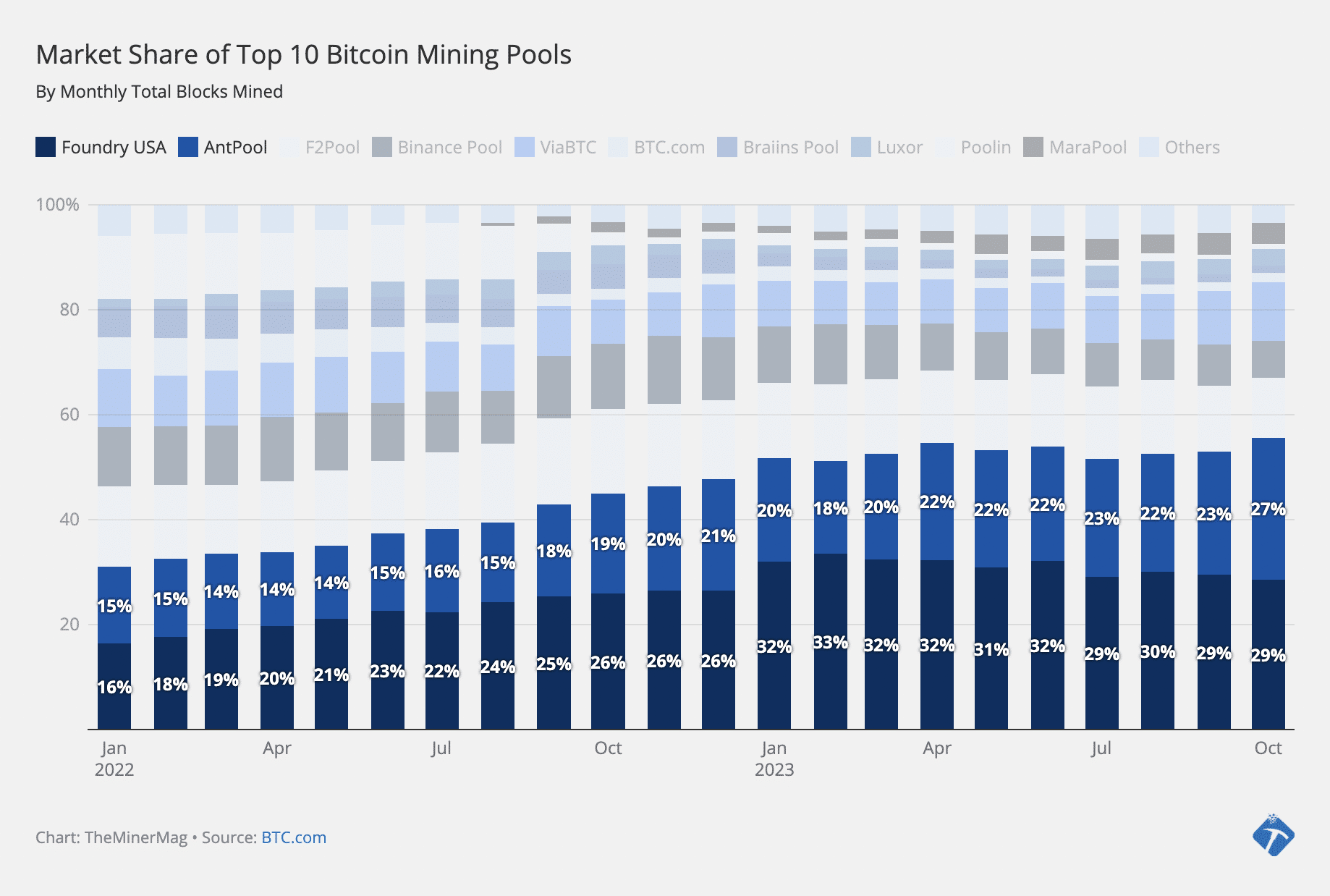

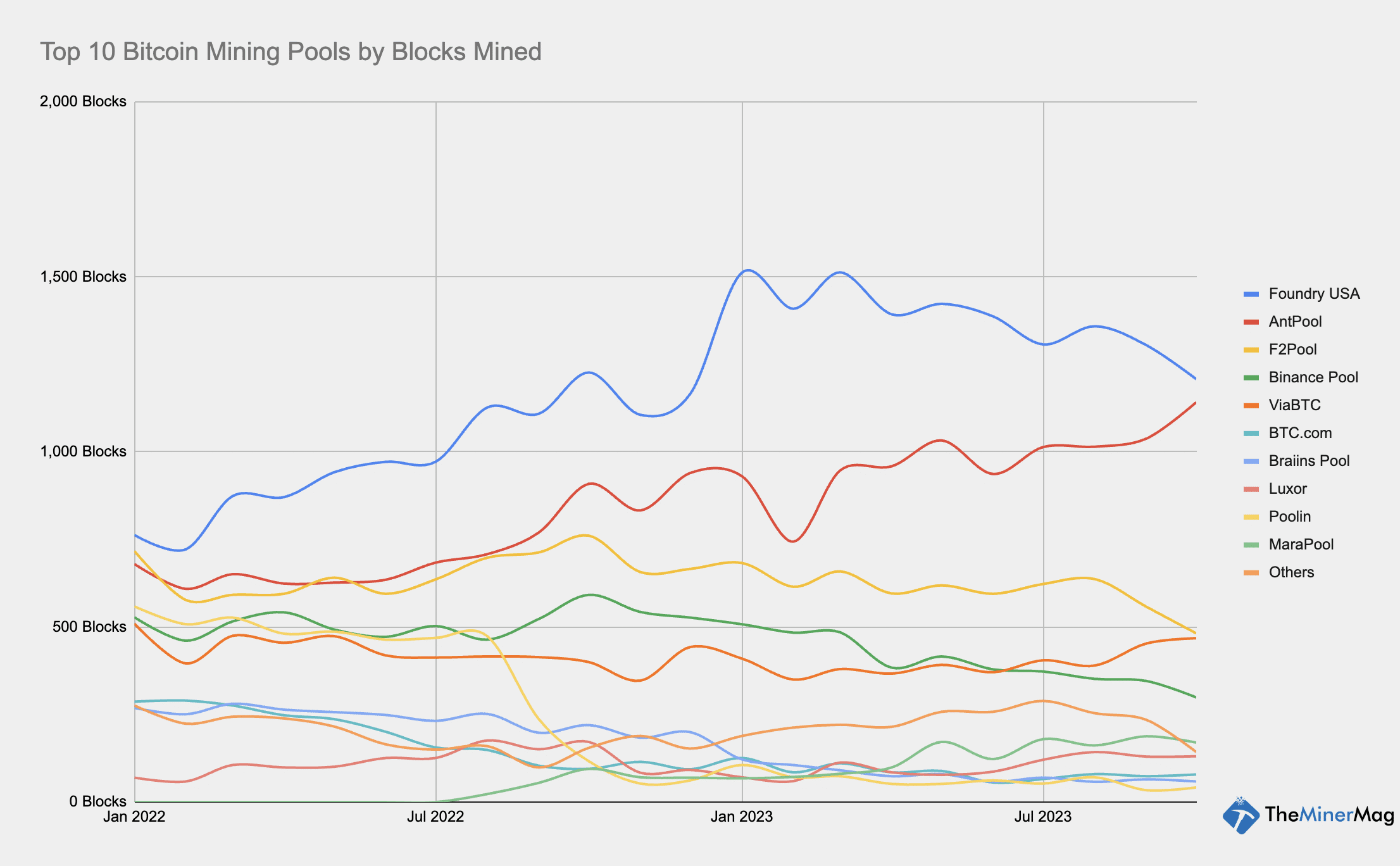

Real-time data from BTC.com reveals that the hashrate on Antpool and Foundry USA Pool experienced the most significant surge over the past two weeks, contributing to the overall network’s increasing competition. However, it appears that Antpool saw a much sharper resurgence which is narrowing the gap with Foundry USA Pool in October, as shown in the chart below.

Based on bitcoin’s blockchain data as of Oct. 29, Antpool has already mined 1,175 blocks this month, marking the highest number in over seven years.

Meanwhile, the widened gap between Antpool and F2pool as well as other smaller pools means that the combined market share of the two largest bitcoin pools has reached a historic high of 55%.

Antpool recently launched cloud mining with contracts based on Bitmain’s S19XPs, suggesting that part of the increased hashrate may have originated from its proprietary miners.

Although Bitmain divested Antpool from its holding group in 2021, the pool remains an integral part of Bitmain’s ecosystem, which includes miner manufacturing, self-mining, and financing.

Based on U.S. miner shipment records identified by TheMinerMag, Bitmain’s U.S. entity imported at least 19 EH/s of S19XPs in Q3 this year, which may have also contributed to the growth of Antpool’s hashrate in the U.S.