Mara and Hut8: A Tale of Two Mining Hodlers

Since earlier 2022, a few mining companies that previously hailed a 100% holding strategy quietly changed the course as bitcoin’s price dipped below $50,000. Others jumped ship in panic mode during the June/July market crash amid the Luna fallout.

But even with the recent FTX collapse, two mining companies are still sticking to the 100% holding strategy as of publishing: Marathon Digital and Hut8 Mining.

Based on their October updates, the two accounted for three percent of the bitcoin network’s market share by production and were holding nearly 20,000 BTC as of the month’s end.

As the bear market extends itself, how are the two sustaining their operations, having sold none of the BTC they have mined and accumulated since 2021? More importantly, will they ever have to sell their BTC reserves?

According to the Q3 earnings of Mara and Hut8, they each incurred about $20 million in cash-based expenses, including the cost of mining revenues, general expenses, and interest payments. Depreciation, share-based compensation, and other non-recurring expenses are excluded.

As of the end of September, Mara and Hut8 had $55 million and $25 million in cash and cash equivalent, respectively. That’s a cash runway of four to six months if we assume their expenses remain steady.

Meanwhile, the equity financing environment is expectedly cold for mining companies. In early November, Mara’s proposal to increase its authorized share of common stocks to 300 million did not get enough votes from shareholders to obtain the requisite threshold.

Hut8, although having established an at-the-market offering program in August, only raised $2 million out of the $200 million upper limit since then.

The two are hence inevitably exploring more debt financing. Mara borrowed $50 million from Silvergate in October, totaling its loan payable to the lender to $100 million while pledging its bitcoin as collateral.

With $55 million in cash and cash equivalent as of Sept 30 and an additional $50 million loan, Mara should be able to cover its cash expenses for another year without having to sell its BTC – if BTC doesn’t plunge any further.

The Silvergate loan requires the value of Mara’s collateral to be at least 155% of the loan value or $155M. Mara will face margin calls if the collateral is worth less than 133% of the loan value.

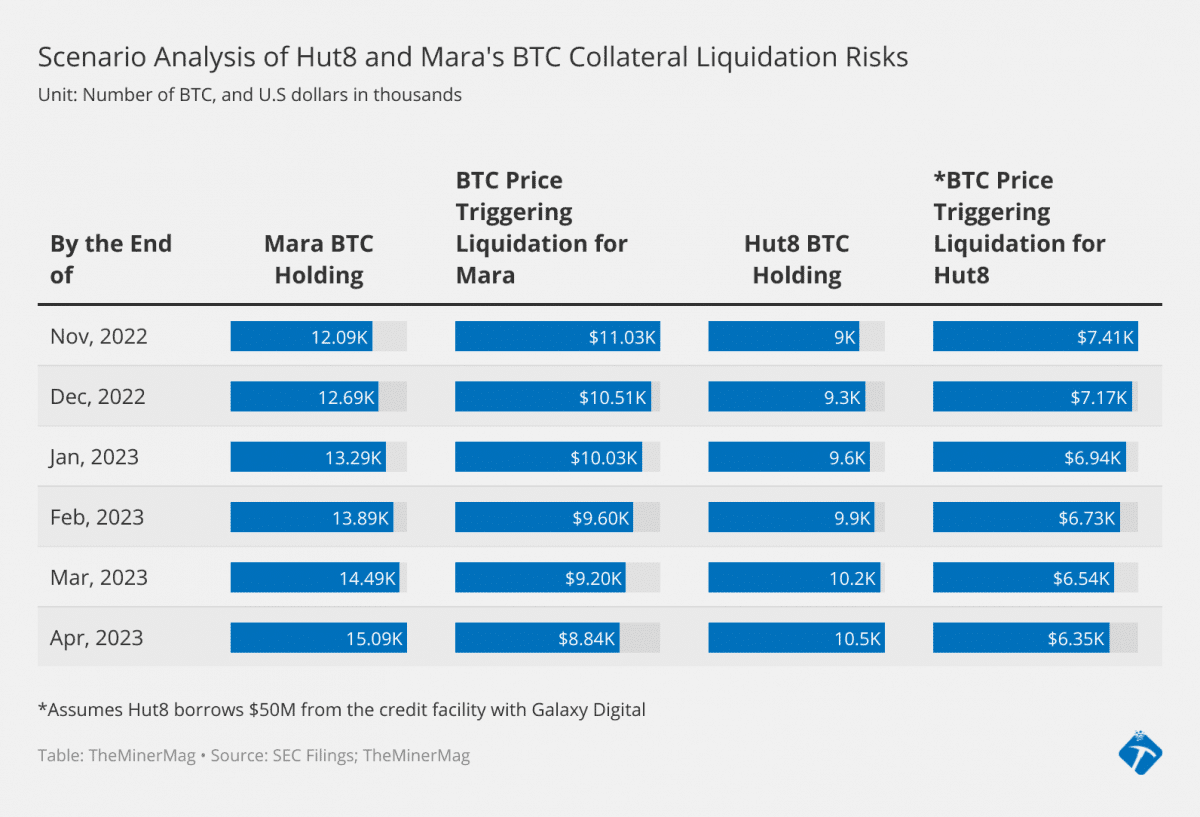

Mara had 11,440 BTC as of Oct. 31. Based on a static estimation that it produces 600 BTC a month, it won’t have any more BTC to meet margin calls by the end of November if BTC tanks to below $11,000.

Hut8 currently has a loan payable of $20 million to Trinity Capital as of the end of Q3. That was an equipment financing deal, which should be secured by Hut8’s mining machines.

But Hut8 has an open-term revolving credit facility with Galaxy Digital for up to $50 million. It hadn’t drawn any of it by the end of Q3’22, but if it does in Q4, the loan will be collateralized with digital assets as well.

We anticipate the terms in the Galaxy facility are similar to what Silvergate offered to Mara, based on the terms of the credit facility that Galaxy offered to Bitfarms previously.

Based on Hut8's production capacity in October, it should be holding nearly 9,000 BTC by the end of November. If it borrows $50 million from Galaxy in Q4, it would also have enough cash to cover its expenses for another year.

In that case, Hut8 will not face any liquidation risk unless bitcoin plunges to below $8K over the next few months.