From its humble beginnings of at-home mining in 2009 to today’s industrial-scale facilities powered by gigawatts of capacities worldwide, Bitcoin mining has transformed into a multi-billion-dollar industry with growing institutional interest.

At the heart of this exponential growth lies the evolution of application-specific integrated circuit (ASIC) chips, purpose-built for Bitcoin’s SHA-256 algorithm. Canaan’s launch of the first-ever Avalon ASIC miner in January 2013 marked the dawn of a new era, revolutionizing Bitcoin mining after the network’s first halving in 2012.

Since then, the Bitcoin ASIC miner market has been largely dominated by Chinese chip design and manufacturing firms, leveraging their proximity to semiconductor foundries and low production costs. While Bitmain retains a dominant market share, its primary competitor, MicroBT, has posed significant challenges since 2019. Moreover, a slowdown in chip processing advancements has allowed new players to enter the market. Since 2022, teams such as Jack Dorsey’s Block, MARA-backed Auradine, and Jihan Wu’s Bitdeer have sought to disrupt Bitmain’s dominance.

As the industry anticipates another cyclical bull run, key questions remain: How much will Bitcoin’s hashrate and hashprice grow, and what opportunities await ASIC manufacturers in a market increasingly defined by compressed margins and rising competition?

This article explores the historical development of the Bitcoin ASIC marketplace and assesses the network’s potential growth leading up to the next halving in 2028.

Bitcoin ASIC Chip History and Current Market Landscape

To forecast future growth, examining the current market landscape and its evolution is essential.

Bitcoin’s ASIC miner advancements are closely tied to its halving mechanism, which cuts block subsidies by 50% every 210,000 blocks. This cyclical process creates a feedback loop: the halving of block rewards drives demand for new generations of ASIC miners, which results in increased network hashrate, reducing revenue per participant and spurring further demand for more efficient chips.

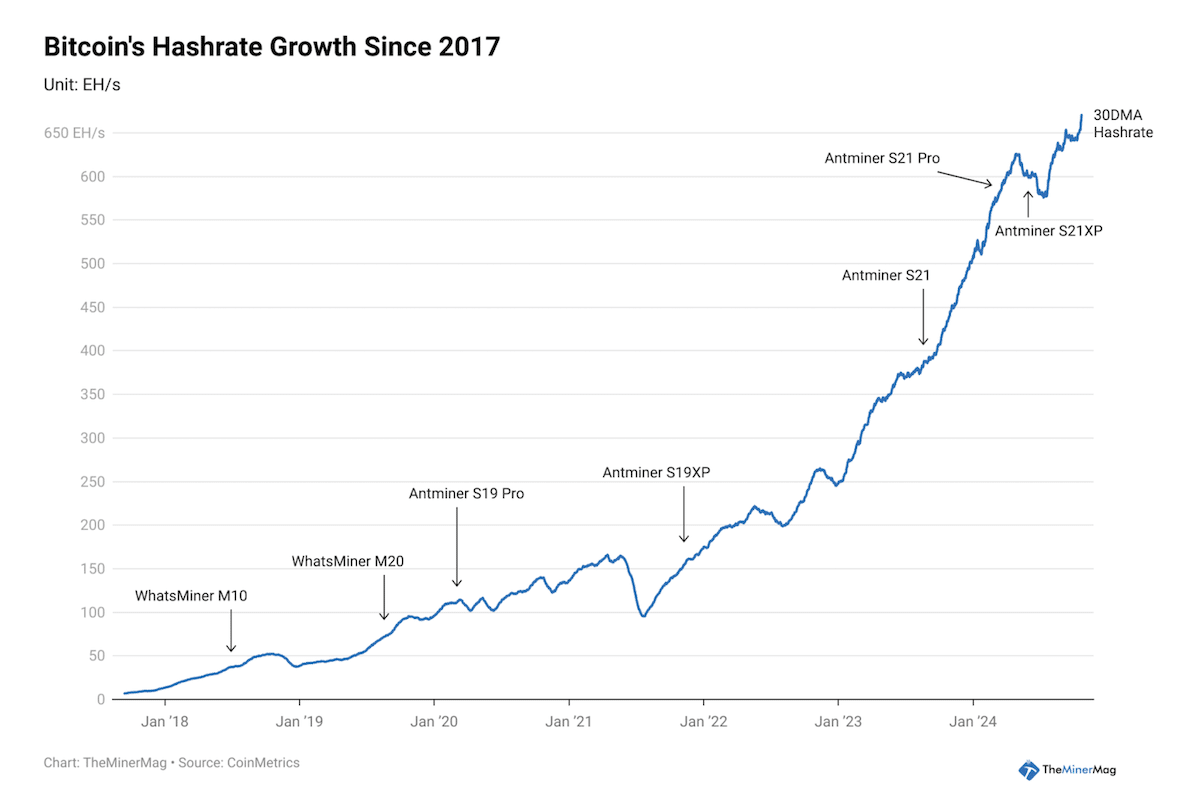

As the data shows, each Bitcoin halving has coincided with the launch of a new generation of ASIC miners that dominate the subsequent epoch. For example, the Antminer S19 Pro was launched before the May 2020 halving, and the Antminer S21 Pro was rolled out in March 2024, just before the April 2024 halving.

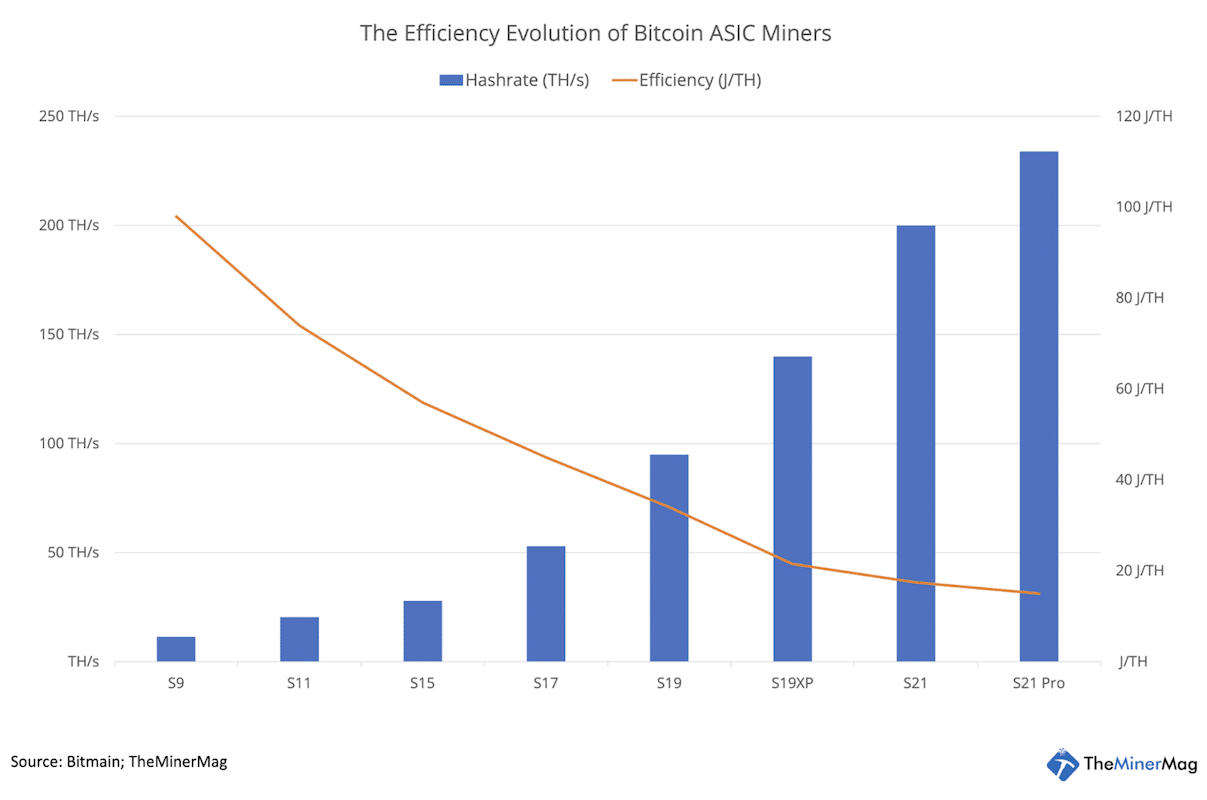

Each generation of ASIC chips represents a significant leap in power efficiency, measured in joules per terahash (J/TH). The first Avalon miner had a power efficiency of 6,000 J/TH in 2013, while the S9 in 2016 boasted 98 J/TH and the S21 Pro in 2024 reached 15 J/TH—an exponential improvement.

In layman’s terms, an S21 Pro would consume 0.015 kilowatt-hours of electricity for running 1 TH/s of hashrate. For comparison, an S9 would consume 0.098 kilowatt-hours for running the same amount of hashrate.

The logic behind this evolution is straightforward: as Bitcoin’s hashrate grows with new ASIC generations, miners face shrinking revenues per terahash, incentivizing cost reductions. This can be achieved by securing cheaper energy sources or upgrading to more efficient miners.

By November 2024, the network’s hashrate had grown to an average of 731 EH/s. This computing power is dominated by equipment from three manufacturers: Bitmain, MicroBT, and Canaan.

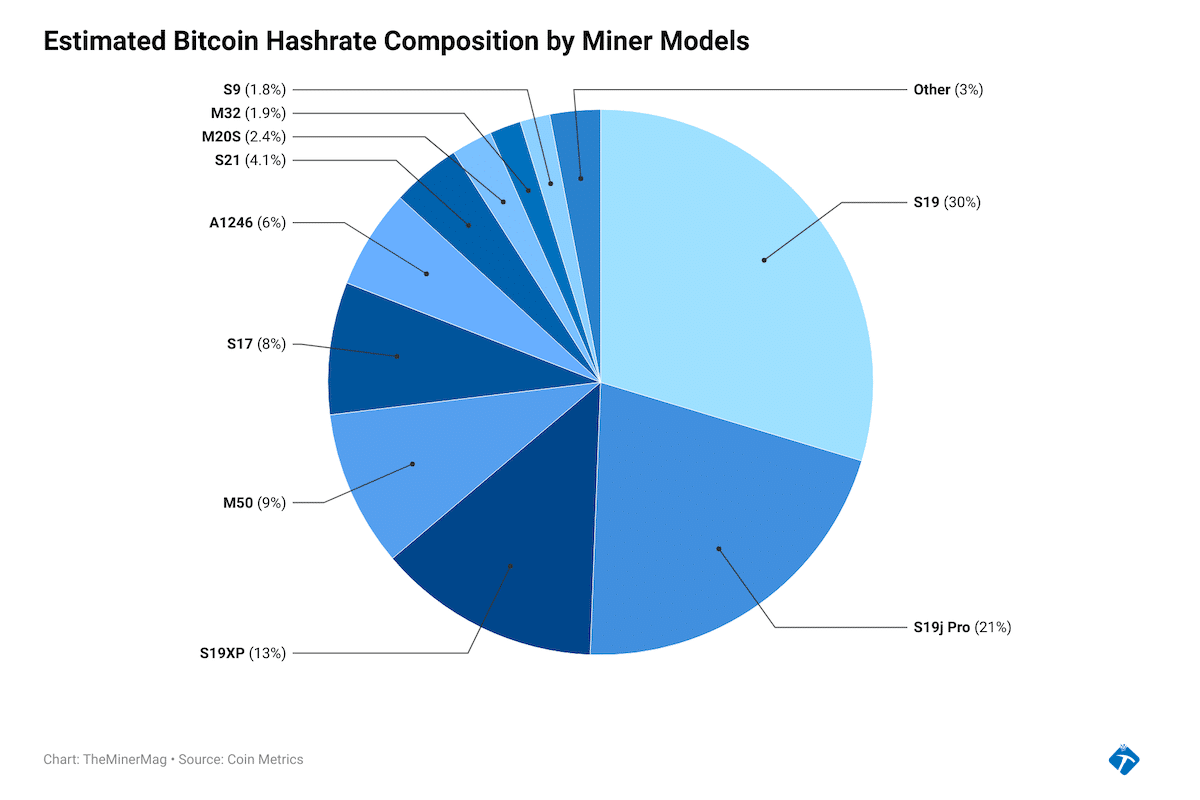

According to Coin Metrics’ data below, Approximately 80% of the network’s hashrate is powered by Bitmain’s S9, S19, S19j Pro, S19XP, and S21 Antminer series as of November. MicroBT and Canaan account for 14% and 6%, respectively. Bitmain, MicroBT, and Canaan each work with specific semiconductor foundries like TSMC, Samsung, and SMIC, respectively.

Coin Metrics’ data further shows that currently, about 82% of the network’s hashrate, or 600 EH/s, is generated by equipment with an efficiency equal to or higher than 30 J/TH. As production ramps up for newer models, the dominant standard is expected to shift to 15 J/TH models like the S21 Pro.

Cyclical Revenue Patterns and Market Projections

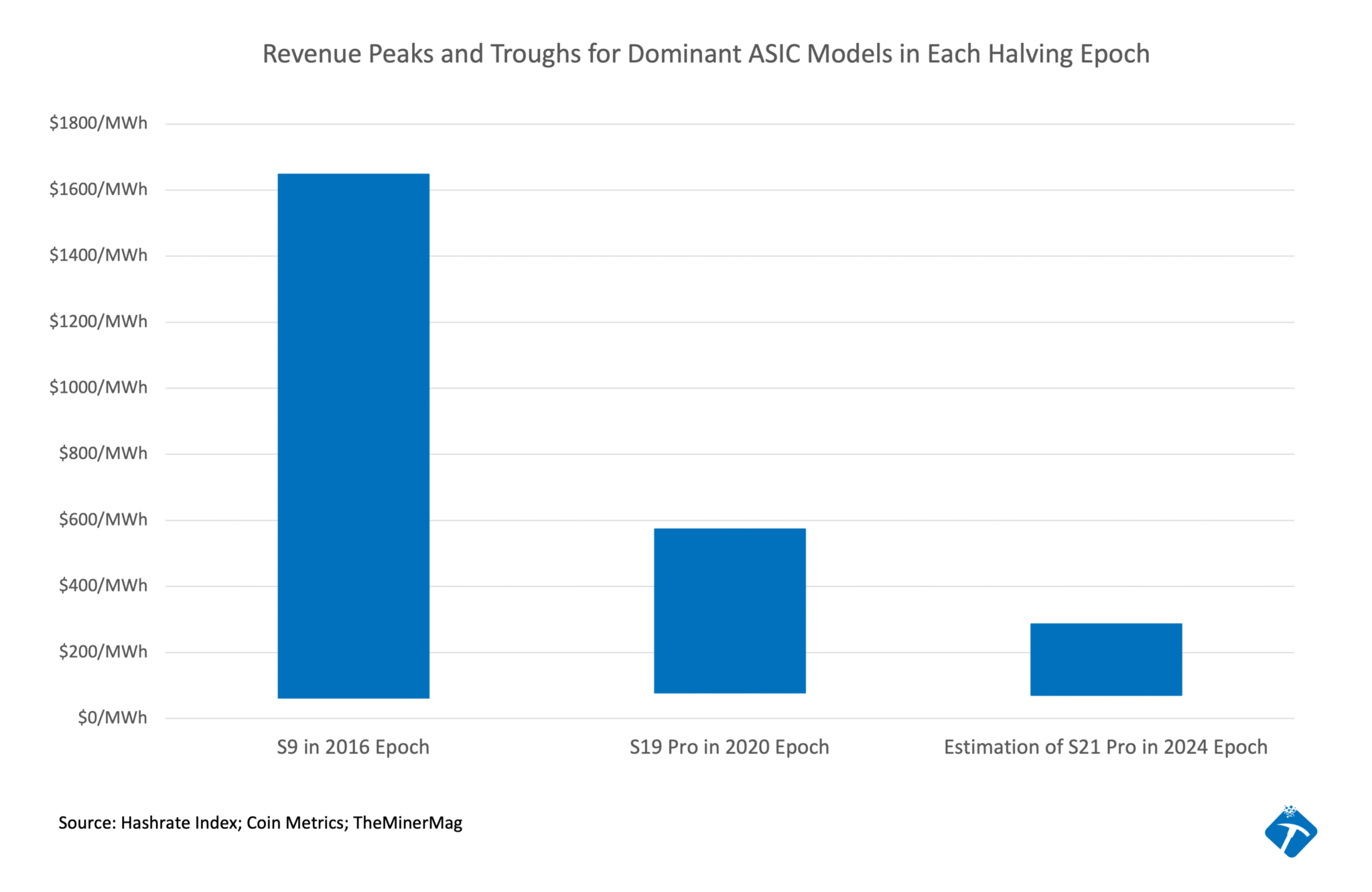

The historical relationship between Bitcoin halving cycles, miner efficiency, and miner revenue per MWh patterns highlights predictable trends. Revenue peaks and troughs for dominant ASIC models mirror Bitcoin’s cyclical price movements.

During the 2016 halving cycle, the Antminer S9’s revenue ranged from $62 to $1,648 per MWh. In comparison, the S19 Pro during the 2020 cycle demonstrated less volatility, with revenues falling between $78 and $573 per MWh. Notably, the S19 Pro’s peak revenue was approximately one-third of the S9’s peak, mirroring the S19 Pro’s efficiency, which is about one-third of the S9’s.

If this trend continues, the S21 Pro’s peak revenue during the 2024 halving cycle could reach $287 per MWh—half of the S19 Pro’s peak in 2021. This aligns with the S21 Pro’s efficiency, which is half that of the S19 Pro’s 30 J/TH.

The revenue bottoms of the S9 and S19 Pro during their respective cycles were notably similar, aligning closely with the average energy or hosting costs throughout those periods. By taking the simple average of these revenue bottoms, we estimate the revenue low for the S21 Pro at the market’s bottom during the 2024 halving cycle as shown below.

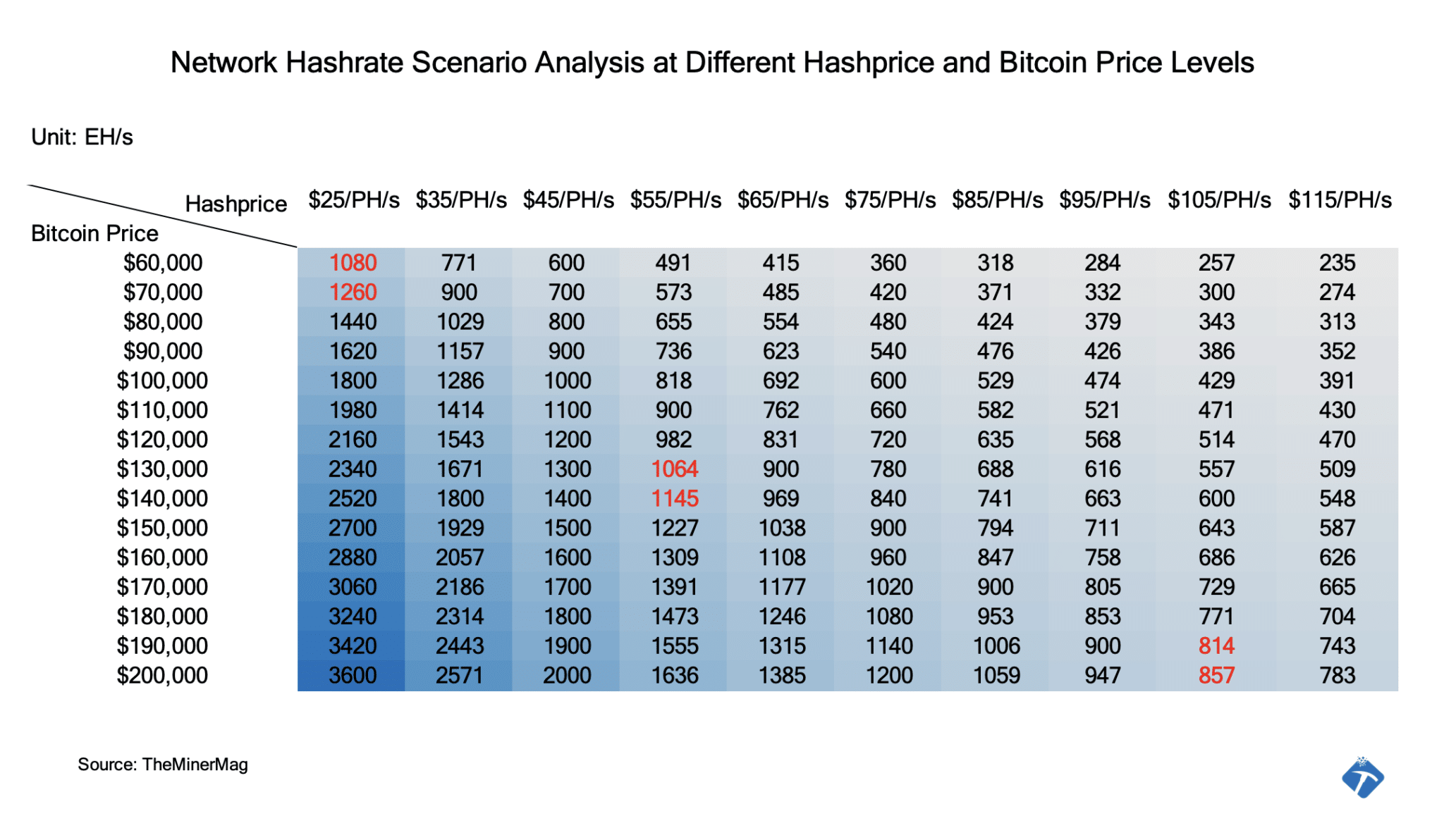

A peak revenue of $287/MWh for the S21 Pro translates to a Bitcoin hashprice of approximately $103/PH/s at the market’s top. Conversely, a bottom revenue of $69/MWh for the S21 Pro corresponds to a Bitcoin hashprice of about $25/PH/s at the market’s low point.

Bitcoin’s historical cyclical patterns suggest the market could reach its peak by late 2025, followed by a bearish phase lasting until the end of 2026. This mirrors the behavior observed during previous peaks in December 2017 and November 2021 and bottoms in December 2018 and November 2022. Additionally, the four-year cyclicality implies the next Bitcoin peak could be three times higher than the previous peak, with the next market bottom remaining close to the prior peak.

For example, the market peak of the 2020 halving cycle occurred at approximately $69,000 in November 2021—3.6 times higher than the 2017 peak of around $19,000. The market bottom during the same cycle came in November 2022 at $16,700, only 15% below the 2017 peak. If this trend continues, Bitcoin’s price could surge to $200,000 at the 2025 peak and subsequently drop to $60,000 at the 2026 bottom.

With these assumptions for Bitcoin’s hashprice and market price at their peaks and troughs over the next two years, the network’s average hashrate is projected to grow from its current 730 EH/s to 871 EH/s by late 2025, and reaching 1,072 EH/s by the end of 2026. The same methodology and historical patterns further anticipate Bitcoin’s hashprice to recover from the 2026 low of $25/PH/s to an average of $51/PH/s leading up to the next halving in 2028. This recovery suggests a steady network hashrate level of approximately 1,100 EH/s.

Such analysis of potential bull and bear cases over the coming years indicates a net increase of approximately 300 EH/s from new generations of miners within the next 26 months. A bull market would likely sustain profitability for older equipment, such as most of the S19 series, delaying their phase-out until hashprices reach their nadir at the end of 2026.

Following the hashprice bottom in late 2026, the industry is expected to witness the gradual retirement of older mining equipment with efficiencies of 30+ J/TH. This transition presents a significant market opportunity, with a replacement demand for another 600 EH/s based on the current network composition.

Market Potential

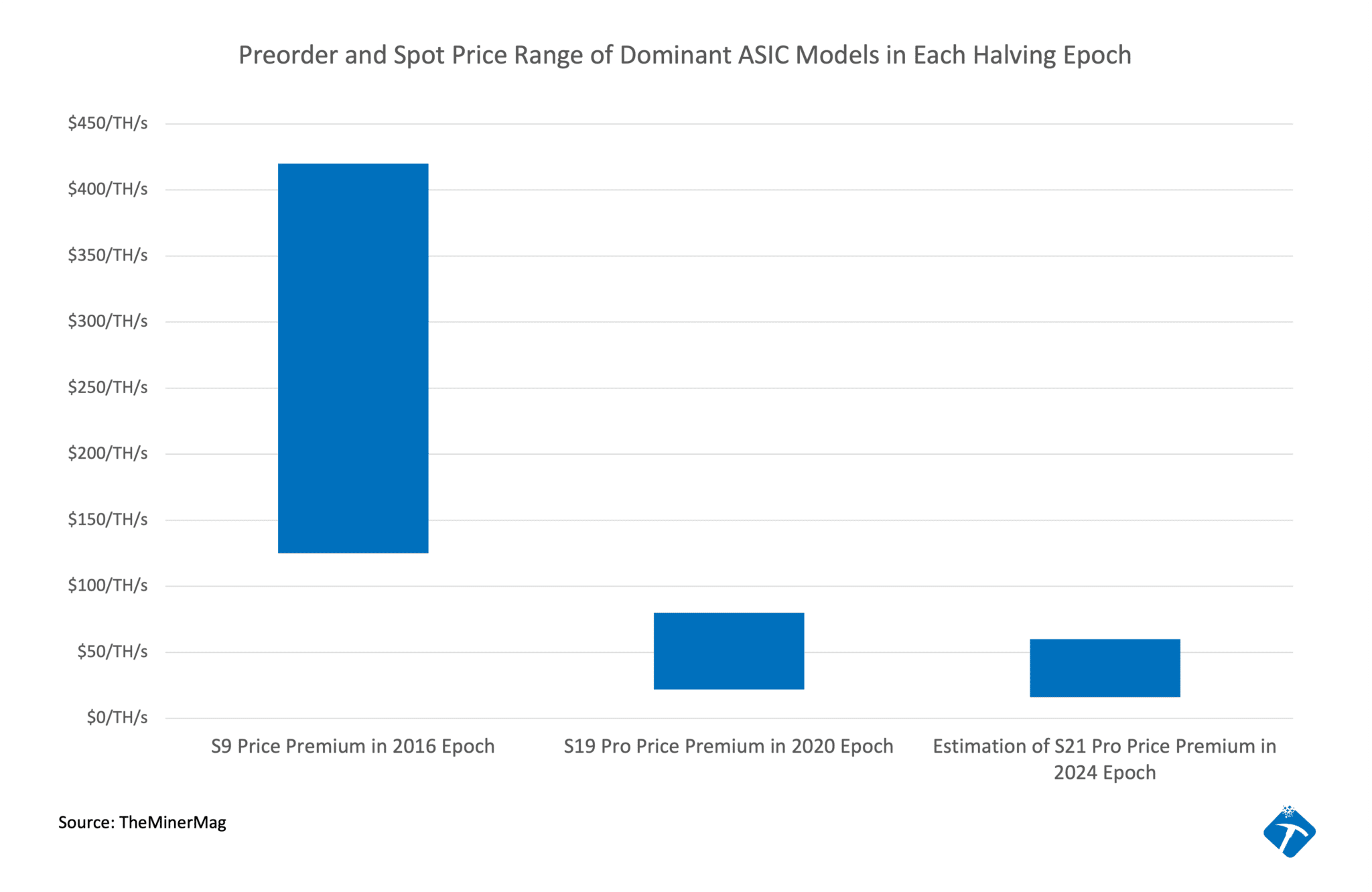

Historical data indicates that the capital cost—and the associated premiums during bull markets—for each TH/s of the dominant mining model in each halving cycle has been steadily declining.

For example, when Canaan introduced the first-ever ASIC miner, it was priced at $1,299 for a hashrate capacity of 60 GH/s, equating to a preorder price of $21,650/TH/s in early 2013. Anecdotal Chinese news reports suggested that during the bull run later that year, the premium for the first-generation Avalon machines skyrocketed to as much as $1 million per TH/s. It was a volatile time.

Similarly, during the 2017 bull run, Bitmain sold the S9 for approximately $125/TH/s, with premiums reaching as high as $420/TH/s among distributors, according to Chinese reports from the time. By the 2021 market rally, the price for the S19 Pro ranged from $22/TH/s to $62/TH/s, as documented by preorder prices tracked in TheMinerMag’s archives.

Currently, the preorder price for the latest generation of mining equipment, such as the Antminer S21 Pro, is around $18/TH/s. Given that the S21 Pro’s projected revenue peak in 2025 is estimated to be lower than the S19 Pro’s revenue peak in 2017, it is unlikely that the S21 Pro’s premium in 2025 will exceed the S19 Pro’s spot price of $62/TH/s recorded in 2021.

This projection, combined with an anticipated net increase of 300 EH/s over the next 26 months, suggests the hardware market could grow by as much as $18.6 billion. Furthermore, the estimated demand to replace 520 EH/s of older-generation equipment by the next halving could present an additional market opportunity of $10.8 billion.

Key challenges

With all above being said, the current halving cycle differs significantly from previous ones in two notable ways: the emergence of new entrants in the Bitcoin ASIC miner marketplace and the increasing demand for AI computing capacity.

The slowdown in chip processing advancements has provided new players like Auradine’s TeraFlux, Bitdeer’s SEALMiner, and Block’s Proton team with more time and resources to refine their chip designs and compete with established industry leaders. Meanwhile, incumbents like MicroBT and Canaan have continued to expand their hardware businesses, securing bulk preorders from large public mining companies in North America.

This heightened competition for the $30 billion hardware market growth is further complicated by uncertainties facing Bitmain.

In November, several mining industry companies experienced delays with their S21 or T21 Antminers being held at various U.S. ports. While some were eventually released, others remained stuck for over two months without any clear explanation. Importantly, miners from other brands were unaffected, fueling uncertainty and speculation about a possible connection between the Antminer delays and Huawei’s alleged sanction violation.

Amid this competitive landscape, mining companies worldwide face the challenge of scaling their combined power capacities by an additional 4.5 gigawatts over the next two years. This expansion is necessary to accommodate an estimated net increase of 300 EH/s, utilizing mining equipment with an efficiency of 15 J/TH. The pressing question is not only when but also whether the mining industry can build out such infrastructure, especially as it competes with AI data centers for access to power resources.

Share This Post: