Core Scientific, the largest public bitcoin mining company in the world by production, made headlines in October in a filing with the Securities and Exchange Commission, where it stated recent operational pains as well as a warning of a potential bankruptcy filing.

The news, while somewhat expected, nonetheless caused ripple effects on the market as Core’s stock price tumbled by more than 70% in a day. After all, it accounted for over four percent of the entire bitcoin network block rewards in November. 2022 year-to-date, Core mined more than 11,000 BTC.

While every mining company is facing the same mounting pressure of the declining gross margin in self-mining, how did the world’s largest public mining company end up in such a stressful situation?

In short, the fast growth of Core’s mining operation this year has been highly dependent on a leveraged hodl strategy.

Core Scientific started in 2017 initially as a bitcoin mining colocation provider. Following bitcoin’s bull run in 2020, the firm acquired one of its major hosting customers BlockCap to enter the self-mining business and went public in the US through a merger deal completed in early 2022.

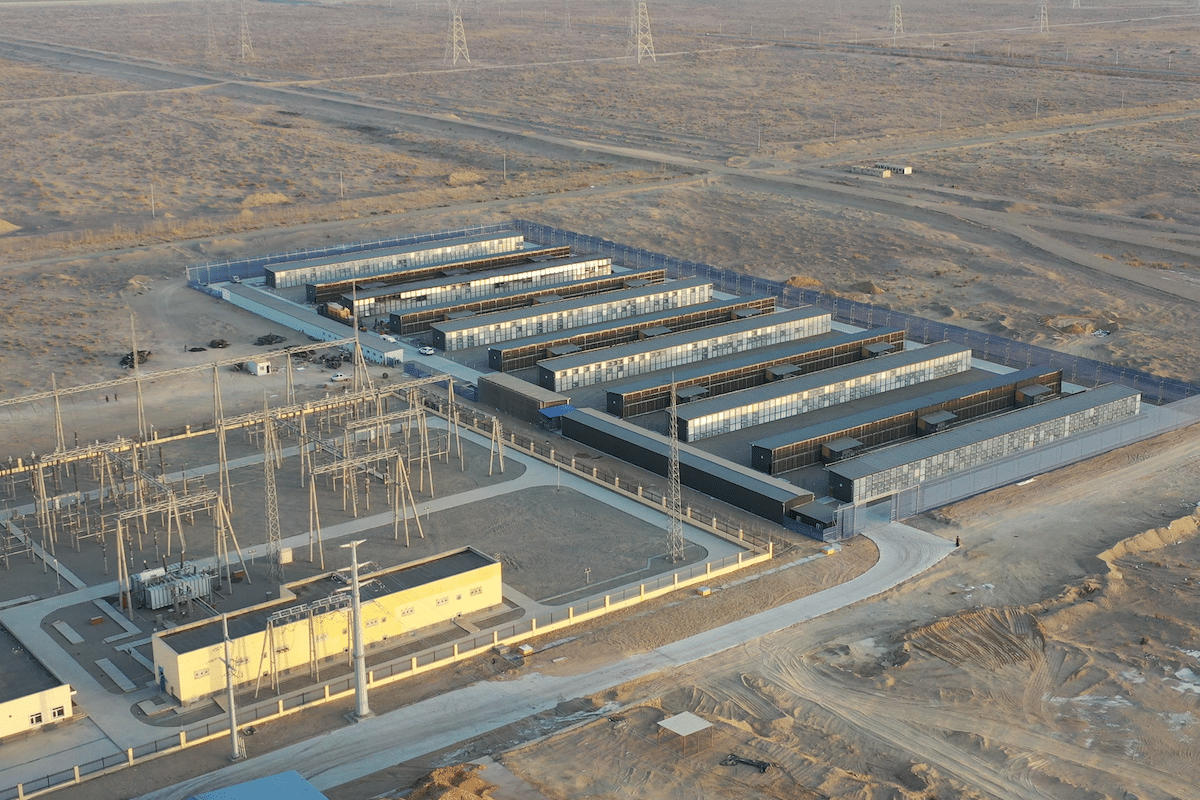

To public investors, Core had advantages. It was well positioned to start self-mining given its well-established infrastructure in five states with over 500 MW of capacity: North Dakota, Kentucky, North Carolina, Georgia, and Texas.

In addition, it was able to gain access to competitive energy rates. But it appears the situation changed rather rapidly in Q3. Core’s cost of bitcoin production spiked to $14.1K per BTC in Q3 – up 53.8% from $9.1K in Q2.

Leveraged Hodl

Bitcoin mining has a high demand for CapEx and OpEx and there are only limited ways to raise money: 1) Sell mined BTC, 2) Offer stocks, and 3) Borrow loans.

To a large extent, Core’s distress stemmed from its conviction that BTC is going to be up only even in a short-term cycle. Apart from selling stocks, it also chose to borrow money to fund its expenses so that it could hold on to its BTC reserves – as if the hodl strategy itself is not risky already.

With enough debt financing, Core increased its production, and effectively its Realized Hashrate, by 65% year-to-date. To fund this growth, its debt-to-equity ratio spiked from 140% in Q1 to 355% in Q3.

Core’s net debt increased from $735 million as of March 31, to $1 billion as of September 30. The majority of its debts came from the convertible notes it issued in early 2021 while the remaining amounts were borrowed from lenders in the TradFi and crypto space.

The increasing debts meant increasing net interest expenses, which were $21 million, $27 million, and $26 million in the first three quarters this year, respectively. Because a lot of the interest expenses were paid to fund its self-mining segment, Core’s all-in cost of mining has been inevitably high if we factor in both general expenses and interest expenses.

In retrospect, Core should have changed its treasury strategy as soon as BTC declined below $60,000. Its biggest mistake was perhaps that it waited until the bear market pain was strongly felt in May.

The chart below outlines how many BTC Core Scientific mined, sold, and held every month this year.

It finished off 2021 with 5,296 BTC on its balance sheet when bitcoin’s price stayed well above $50,000. None of those, in addition to the 4,322 BTC it mined from January to April this year, was liquidated until a month later, when bitcoin’s price tanked to below $30,000 and then further below $20,000.

Based on public records, Core received about $400 million in total proceeds from the sale of 16,863 BTC between May and October. That translates to an average price point of $22,000. But even with such a sale, its cash and cash equivalents as of the end of October were down to $30 million.

Holding everything else equal, what would it be like if Core adopted different treasury strategies?

For example, what if the 16,863 BTC that it mined and accumulated from 2021 to October 2022 was sold on a regular basis in the same way it credited its self-mining revenue for 2021 and the first three quarters of 2022? What if it only sold half of its mined BTC on a regular basis?

If Core adopted a 50/50 hybrid strategy, it would have received about $100 million less in cash proceeds than it did in reality. But that could reduce its demand for leverage in the first place while still keeping the upside of BTC’s future appreciation.

There are mining companies that to this date still stick to a hodl strategy, such as Marathon and Hut8. But their D/E ratio is nowhere near that of Core Scientific.

There are also mining companies that have higher D/E ratios, like Greenidge and Stronghold, but they have been consistent in selling mined BTC to fund day-to-day operations.

Whether Core Scientific can get through the current stress, the one lesson worth taking from the situation is that "leveraged hodl" is not a viable treasury strategy in bitcoin mining to survive bitcoin's bull and bear cycles.