As TheMinerMag previously analyzed, over 6,000 tons of bitcoin mining machines have arrived in various U.S ports in the year prior to March 14. Over the past few weeks, more records have been identified, bringing the total number to about 7,400 tons as of the end of March.

The previous research looked at a breakdown of these shipments by product brands and how the arrival of large shipments in September and January correlated with bitcoin’s network hashrate surge. This article further examines these shipments by their recipients.

Out of the 7,400 tons of shipments, about 27% had various logistic companies as the shippers and consignees, which obscured the real companies behind those transactions. The chart below hence illustrates the top importers that can be actually identified. To be clear, these numbers do not represent the total mining machines that each company purchased because they could directly buy from U.S brokers or choose to self-pick at the respective warehouses of the U.S entities of Chinese manufacturers.

DDH North America

Most of the importers are well-known names in the industry, except perhaps DDH North America and Synos Corporation, the top two identified importers.

Synos is an authorized manufacturing partner of MicroBT. It assembles full-system WhatsMiner equipment in the U.S and mainly imported WhatsMiner parts from MicroBT’s Hong Kong subsidiary SuperAcme, which, through its factory in Thailand, has also shipped a considerable number of miners to Cipher Mining.

DDH North America, on the other hand, appears to be a subsidiary or the operating entity of Genesis Digital Assets (GDA) in the U.S. According to The Wall Street Journal, FTX’s Alameda invested $1 billion in GDA to buy stakes from two co-founders and to fund the mining operation.

Based on the compiled import records, more than 50% of the miners that were sent to DDH came directly from GDA and another firm called Danolio Limited. Records show that GDA and Danolio are incorporated in Cyprus with the same address. The remaining shipments came directly from various factories in Thailand and Malaysia as shown below. In 2021, GDA announced a series of bulk pre-orders from Canaan. The equipment that DDH imported from GDA and Canaan in the chart below were all Avalon miners.

Corporate records show that a person named Ankit Joshi remains a president of several U.S. branches of Delaware-incorporated DDH North America. GDA’s Head of North America is Ankit Joshi on LinkedIn. Another DDH employee on LinkedIn also stated that DDH North America is a GDA company.

Since GDA is a private entity, there is not much public record regarding the company’s operating capacity. The most recent update on its hashrate was 3.8EH/s as of October 2021. Most of DDH’s shipments in 2022 and 2023 so far were Bitmain’s AntMiner S19 series and Canaan’s A12 series, which average weighs about 17 kg. Based on that figure, the 957.8K kg of gross weight would equal about 56,000 units or about 5.5EH/s potential hashrate in addition to what was already online before 2022.

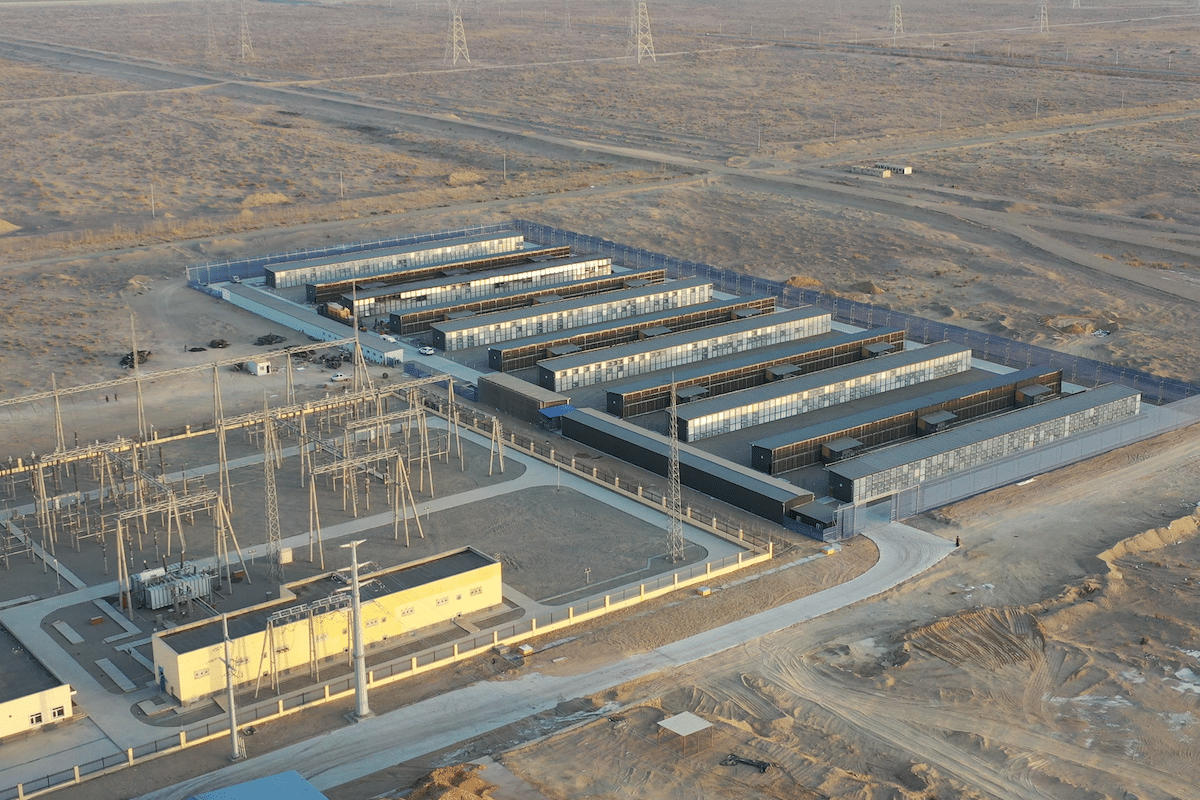

Apart from the actual miners, DDH also imported ancillary equipment such as switchboards and PSUs, as well as 12 Bitmain’s Antspace containers and corresponding cooling towers. Each Antspace container can house up to 210 hydro-cooling AntMiner units. What remains private is how much of the total received equipment has been plugged in and is now actively hashing.

Cipher Mining

Two of the top five importers –– Core Scientific and Celsius Mining –– are going through bankruptcy protections. Meanwhile, Cipher Mining is worth paying attention to given that it was one of the fastest-growing mining operations in 2022 among public peers. It kicked off a small-scale production only around Q1’22 and by the end of Q1’23, already reached 4.54 EH/s in realized hashrate, ranking the 6th largest by market share. The import records also attest to its growth and show Cipher’s fleet mainly consists of equipment from Bitmain and MicroBT.

Cipher’s business model is somewhat different from other major competitors. It splits up the mining fleet across a wholly-owned proprietary mining site and three joint ventures with all four facilities in Texas.

Cipher fully owns the Odessa facility, which commenced operation on November 22, 2022, and had about 4.7 EH/s in an operating capacity as of the end of Q1. The Odessa site produced 180 BTC for the final 39 days in 2022 at a cost of power of $748,000. That translates to a bitcoin production cost of only $4,155. But it also incurred $7.5 million in cash-based general expenses during Q4’22, which equals $17,793 per BTC mined pro rata for the 39 days. Cipher’s all-in mining cost at its proprietary site was about $21,000.

Each of Cipher’s other three sites (Alborz, Bear, and Chief) was jointly developed with a firm called WindHQ LLC. Cipher owns 49% of each venture. The three sites add up to 1.9 EH/s in total operating hashrate and Cipher owns about 0.93 EH/s. But for the bitcoins Cipher receives from the three equity investees, there appears to be no further operational data about the power and general expenses.

In total, the top five importers identified by TheMinerMag received 4,000 tons of miners, which accounted for 54% of the total shipment volume. Other companies with fewer identified imports include Foundry, Galaxy Digital, Greenidge, Bitnile, Sphere 3D, etc, as well as the U.S. entities of MicroBT, Bitmain, and Canaan.