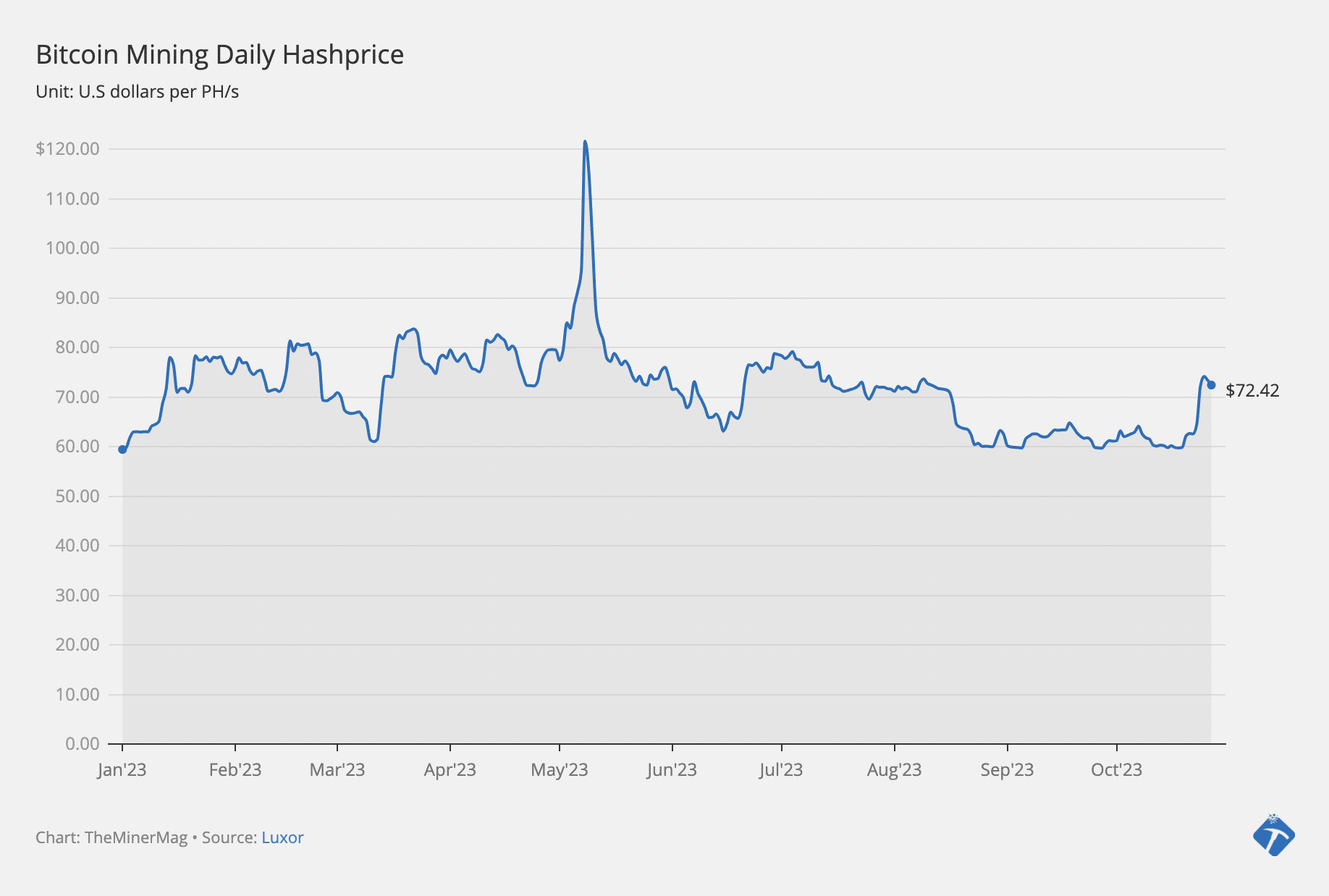

Bitcoin’s hashprice, which measures daily mining revenue in dollar terms, has reached three-month highs as the network’s hashrate and competition stabilize.

Public data shows Bitcoin’s hashprice reached $74.2 per PH/s earlier this week, a level not seen since early August, though it has since pulled back to $72.5 per PH/s as of the time of writing.

It remains to be seen how long the current Bitcoin price rally will sustain, fueled by news and rumors surrounding the approval of BlackRock’s ETF. However, the rebound in hashprice has, at least for now, alleviated the existential crisis for many less efficient operators.

With an average energy rate of $0.07/kWh, the daily hashcost of Bitmain’s S19Pro (30J/TH) and MicroBT’s WhatsMiner M30S+ (34J/TH) is $50.4 and $57.1 per PH/s. This means that such equipment, or those with equivalent efficiency, could be mining at a gross loss if Bitcoin’s hashprice drops well below $60/PH/s.

Although bitcoin’s hashprice largely remained at $60/PH/s over the summer, the hashrate rally starting from mid-September could soon set new hashprice lows had bitcoin’s price rally not arrived in mid-October.

Over the past two weeks, bitcoin’s prices have recorded as much as a 30% jump while bitcoin’s hashrate growth has stabilized, which is good news for existing mining operations before others rush to plug in more miners.

Indeed, data shows that bitcoin’s 7-day moving average hashrate set all-time highs first on Sept. 18 at 430 EH/s and then at 450 EH/s on Oct 12. It has since remained steady at around 445 EH/s. As a result, bitcoin’s mining difficulty is set to increase by less than 1% in about three days.