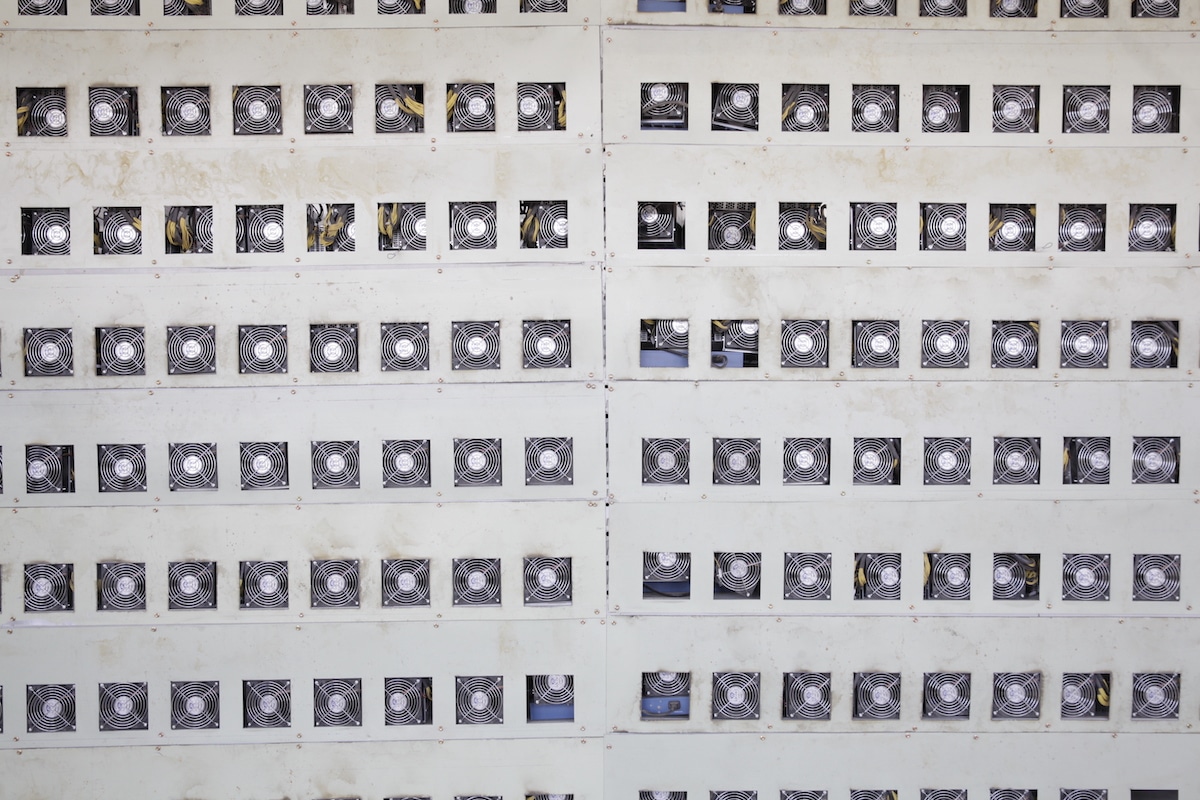

From at-home mining more than a decade ago to industrial-scale activities powered by gigawatts of capacities, bitcoin mining has come a long way since its inception.

An unprecedented level of capital drawn to the industry over the past year has helped form about 20 publicly listed mining companies with various business models.

Over a decade after Bitcoin’s genesis block, one clear thing is that bitcoin mining has become more vertically integrated than ever.

In the past, miners ran operations at home or in small-scale abandoned factories. Gradually, there came more properly built facilities that lured mining customers.

Some of those facility owners later realized the lucrative side of self-mining and embarked on the journey themselves. Power generators then started to notice how self-mining could bolster their balance sheet and decided to have an extra business stream.

This explainer breaks down mining companies by five business models: Asset-light Mining, Co-location Only, Self-Mining Only, Hybrid Mining, and Vertical Integration.

If you are new to bitcoin mining, we recommend this piece that provides an overview of the bitcoin mining ecosystem.

Asset-Light Mining is a model where a company owns mining equipment but does not fully own mining data centers. They rely on third-party co-location providers to host their equipment and pay hosting fees.

Sometimes, asset-light mining operators may set up a joint venture with a co-location partner or share a portion of their mined bitcoin based on the exact agreements. But the main idea is that they let their hosting partners do the heavy lifting on power sourcing, construction, and maintenance.

Co-location Only refers to a model where a mining data center owner only hosts for customers but does not engage in self-mining. They are responsible for sourcing energy to power their infrastructure and profit from selling such energy capacity to mining customers with markup and charging management fees.

Self-Mining Only, on the other hand, means a mining data center owner completely mines bitcoin for itself and does not allocate any energy capacity to third-party customers. Hence, it solely profits from the production of bitcoin with self-owned mining equipment.

Hybrid Mining is the combination of co-location and self-mining. In such a model, a company typically owns facilities with large power capacities in hundreds of megawatts. To fulfill these capacities with completely proprietary equipment would be extremely expensive. As such, they allocate some energy capacities to host third-party customers while using the remaining capacity for self-mining.

Companies have to rely on credible third-party power producers in any of the four models explained above. But what if a power producer integrates power, infrastructure, and mining equipment? That is what Vertical Integration means in bitcoin mining.

A vertically integrated power producer can be flexible in terms of the utilization of their generated power. They can sell parts of the energy to the grid while self-mining bitcoin with the remaining capacity or provide hosting capacity for customers, or both.

Each business model has unique pros and cons and there are prominent examples in the public market. The table below provides a high-level summary.

|

Business Model |

Pros |

Cons |

Examples |

|

Asset-Light Mining |

Less CapEx on infrastructure |

Highly dependent on hosting partners |

Marathon, Bit Digital, BitNile, The9 |

|

Co-location Only | Less sensitive to bitcoin hashprice | High CapEx upfront; Low profit margin |

Applied Blockchain, Compute North |

|

Self-Mining Only | Full potential on market upside |

High CapEx, bitcoin hashprice sensitive |

CleanSpark, Bitfarms, Iris Energy |

|

Hybrid Mining |

Revenue hedge during bear market |

High CapEx, Partial loss of bull upside |

Riot, Core Scientific, Argo Blockchain |

|

Vertical Integration |

Low power costs; Energy revenue hedge |

High CapEx, Asset-heavy, |

Stronghold Digital, Terawulf, Greenidge |