Altcoin Miner’s IPO Reveals $144M Revenue, Faces US Customs Detention

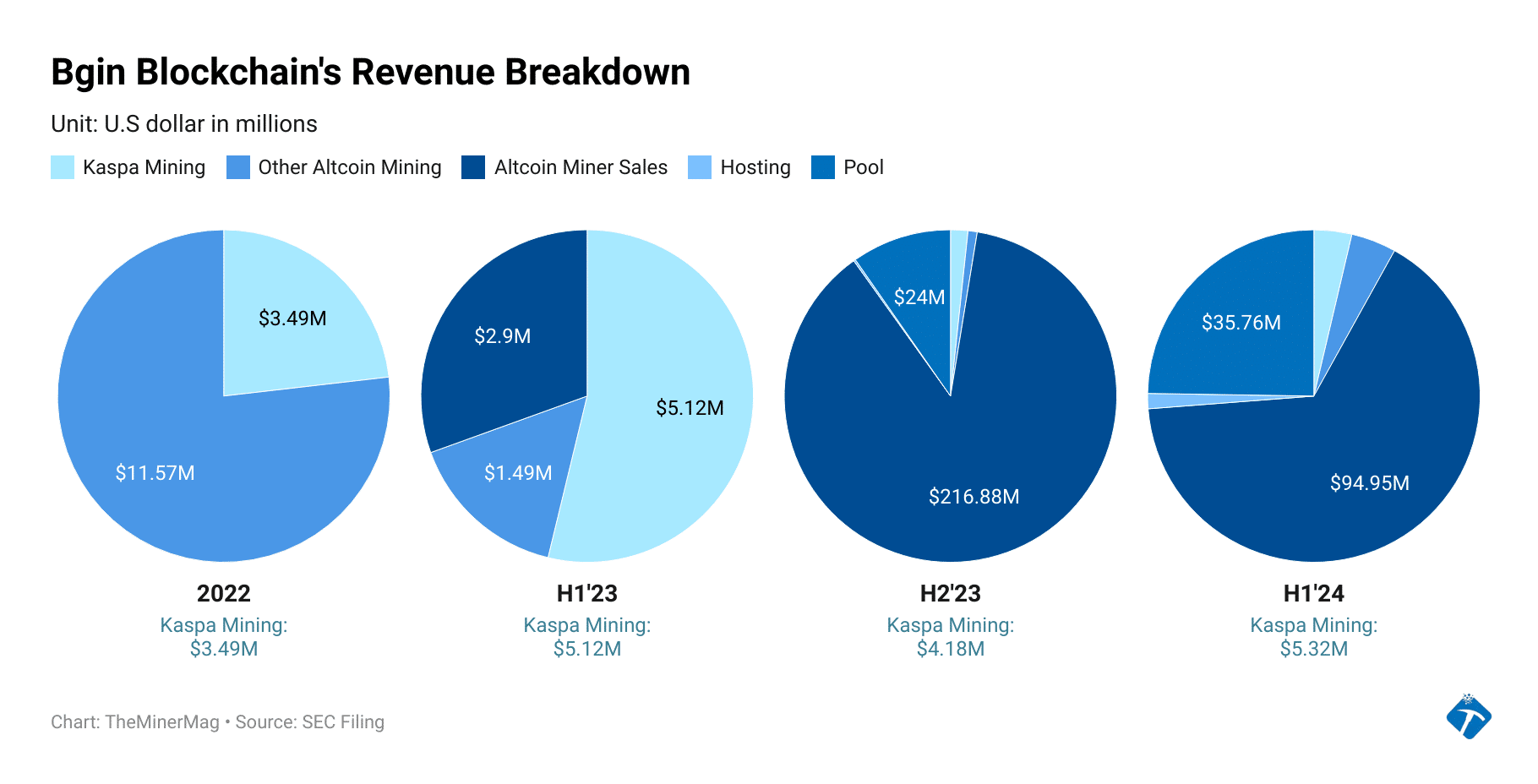

Bgin Blockchain, an altcoin mining firm behind the IceRiver hardware, has reported $257 million in revenue for 2023 and $144 million for the first half of 2024, as part of its filing to go public in the U.S.

Bgin, which mines several cryptocurrencies and sells self-designed IceRiver mining rigs with a strong focus on the Kaspa network, filed an F-1 registration prospectus with the U.S. SEC on Friday reportedly seeking to raise $50 million. The document offers a rare look at the financials of both an altcoin mining operation and an altcoin miner manufacturer.

According to the prospectus, Bgin originally focused solely on mining non-Bitcoin proof-of-work digital assets including KAS, reaching a peak hashrate capacity of 44.51% of the Kaspa network in August 2022. However, its Kaspa market share dropped to 1.56% by June 2024.

In 2023, the company expanded into selling proprietary ASIC mining rigs for various proof-of-work networks, with a key focus on KAS miners. This shift helped drive a significant increase in its revenue from the second half of 2023 onward.

Bgin reported selling 67,998 mining rigs in 2023 and 47,252 rigs in the first half of 2024, representing 85.43% and 65.71% of its total $257 million and $144 million revenues for each period, respectively.

Additionally, Bgin reported 35% and 57% gross margins for its altcoin mining business in 2023 and the first half of 2024, respectively. Its miner sales segment had even higher margins, at 88% in 2023 and 81% in 2024.

Bgin also operates crypto mining pools for various proof-of-work networks, which contributed $35.7 million to its total revenue in 2024. However, it is worth noting that the pool revenue accounts for all the cryptocurrencies Bgin received as coinbase rewards from respective networks before paying out to individual minining customers. The gross margin for the pool segment is hence negligible.

Excluding the pool segment, Bgin’s revenue for 2023 and the first half of 2024 was $233 million and $109 million, respectively. In comparison, Canaan’s Bitcoin miner sales and proprietary mining businesses generated $211 million in revenue in 2023 and $106 million in the first two quarters of 2024.

Founded in 2019 by a group of Chinese investors, Bgin initially operated altcoin mining farms in mainland China before relocating overseas following China’s 2021 mining ban. As of February, it has 106 employees with 31 of them based in mainland China and 59 of them based in the U.S.

In addition to selling IceRiver mining rigs, Bgin operates 33,862 machines for its own mining operations and 4,020 miners on behalf of customers, spread across its proprietary mining farms and colocation facilities in the U.S. The third-party facilities provides 105.6 megawatts (MW) of power capacity for Bgin’s total operating fleet while its own sites operate 18.85 MW as of February 2025.

U.S. Customs Detention and Seizure

Notably, Bgin disclosed that more than 2,400 units of its IceRiver equipment, imported for proprietary mining in the U.S., have been detained by U.S. Customs and Border Protection (CBP) since September 2024.

This development corroborates previous reports of the U.S. agency detaining Bitcoin ASIC miners from Chinese manufacturers Bitmain, MicroBT and Canaan. Bgin was informed that the machines are “subject to a compliance review with the applicable requirements set by the Federal Communications Commission (FCC).”

The company also received Notices of Seizure on January 23, issued by the Fines and Penalties Department of CBP. According to these notices, the IceRiver rigs did not comply with FCC import regulations. As a result, 828 rigs were seized and are now subject to forfeiture under the following legal provisions:

- 19 USC 1595a(c)(2)(A), 47 CFR 2.935, 47 CF19 USC 1595a(c)(2)(A), 47 USC 510, 47 USC 302a — Communication Interference Devices

- 19 USC 1595a(c)(2)(A), 47 CFR 2.935, 47 CFR 15.19, 47 CFR 2.1204 — Other FCC Violations

- 19 USC 1595a(c)(2)(B), 47 USC 302a — Failure to Have License, Permit or Authorization