Canaan Is Raising $30M to Expand Bitcoin Mining in Texas

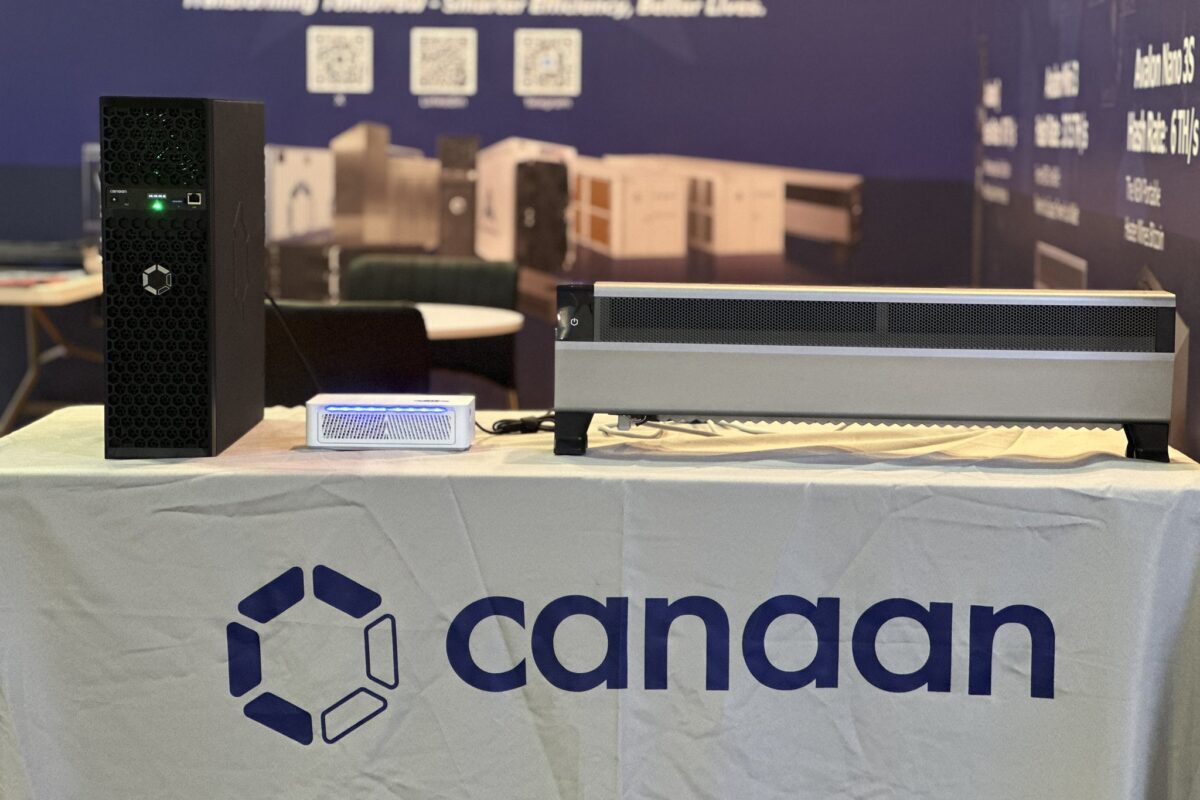

Bitcoin ASIC chip designer and mining hardware manufacturer Canaan is set to raise $30 million to expand its proprietary Bitcoin mining operations in the U.S.

The company announced on Wednesday that it has entered into a securities purchase agreement with an institutional investor to sell up to 30,000 Series A-1 Preferred Shares at $1,000 per share.

Canaan stated that the proceeds from the equity raise will be used to manufacture or invest in Bitcoin mining sites and equipment to be deployed or sold in North America.

In a separate announcement on Wednesday, Canaan revealed a joint mining agreement with Luna Squares Texas to energize 1.62 EH/s of computing power at a facility in Willow Wells, Texas, by the first quarter of 2025. This initiative is part of Canaan’s broader plan to reach 10 EH/s in North America by mid-2025.

Under the agreement, Canaan will deploy 3,480 Avalon A14 miners and 5,664 Avalon A15 miners. For the A14 miners, net Bitcoin mining profits will be shared evenly between the two partners. For the A15 miners, Canaan will retain 70% of net profits until it fully recovers its capital investment in the equipment, after which profits will be split equally.

Additionally, Canaan announced a follow-up order from HIVE Blockchain for 5,000 Avalon A15 miners, totaling 940 PH/s of capacity. This order, expected to be delivered in Q1 2025, follows HIVE’s earlier purchase of 1.2 EH/s of Avalon A1566 miners.

Canaan reported a Bitcoin production of 147 BTC during Q3, with proprietary holdings of 1,212 BTC as of September 30, indicating a Bitcoin liquidation of 49.2 BTC over the past three months.

The company also recorded $64.6 million in product revenue last quarter, selling 7.3 EH/s of computing power at an average price of $8.8/TH/s. This represents a 10% decrease from the $9.9/TH/s average in Q2, despite rising Bitcoin prices.