Hashrate-shipment Coefficient Report: November 2023

In October, bitcoin’s average hashrate experienced a 9.6% increase compared to September, pushing the daily production benchmark to an all-time low of 2.17 BTC per exahash per second (BTC/EH/s).

This sharp increase was not entirely unexpected, with several factors contributing to it.

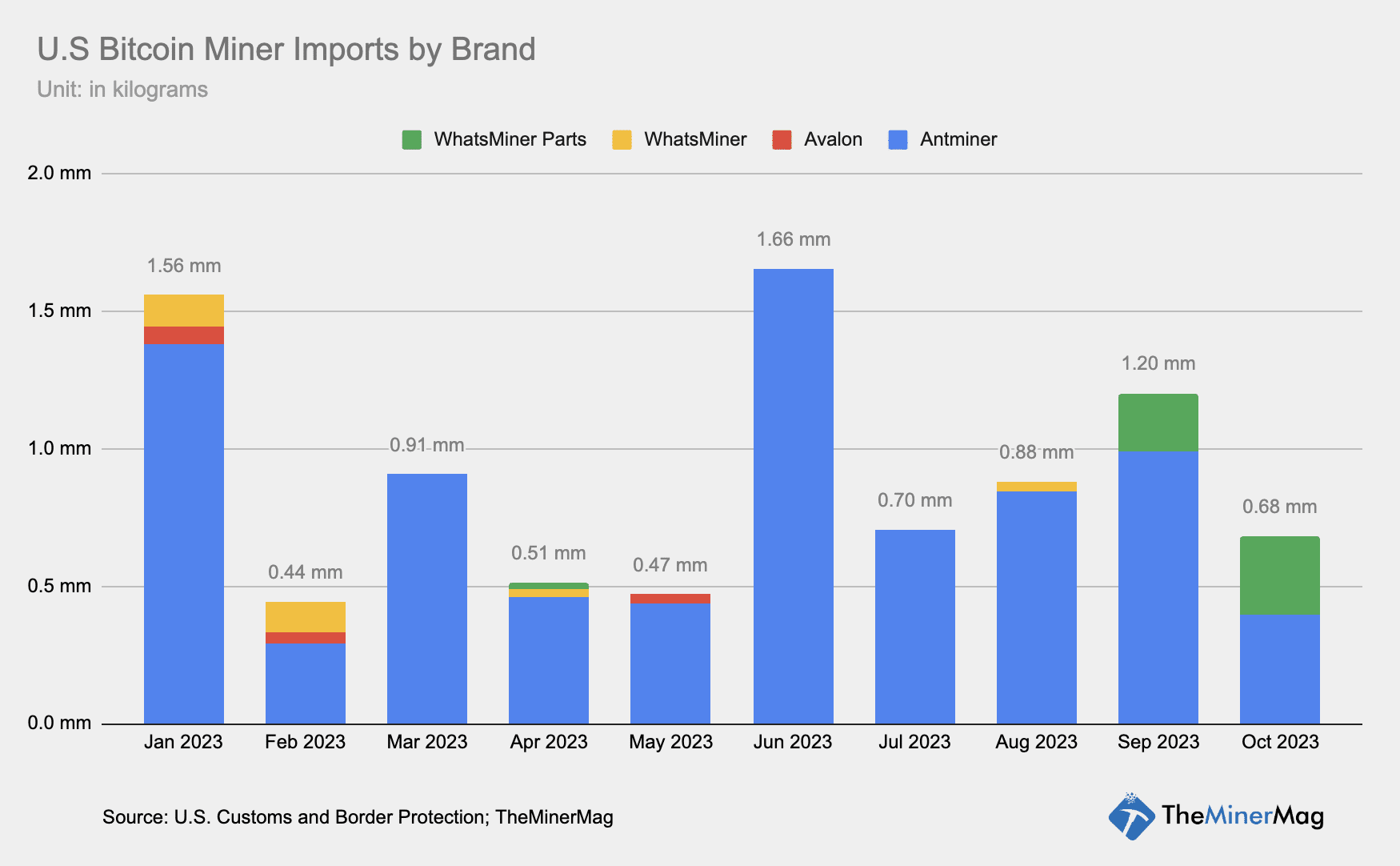

Firstly, the reduction in mining activity during the summer months is winding down, and mining operations are expected to reactivate their proprietary miners. Secondly, U.S. companies imported at least 2.57 million kilograms of bitcoin miners in the third quarter. The majority of the identified imports were Bitmain’s Antminer S19XPs, which had an estimated total hashrate capacity of more than 20 exahashes per second (EH/s).

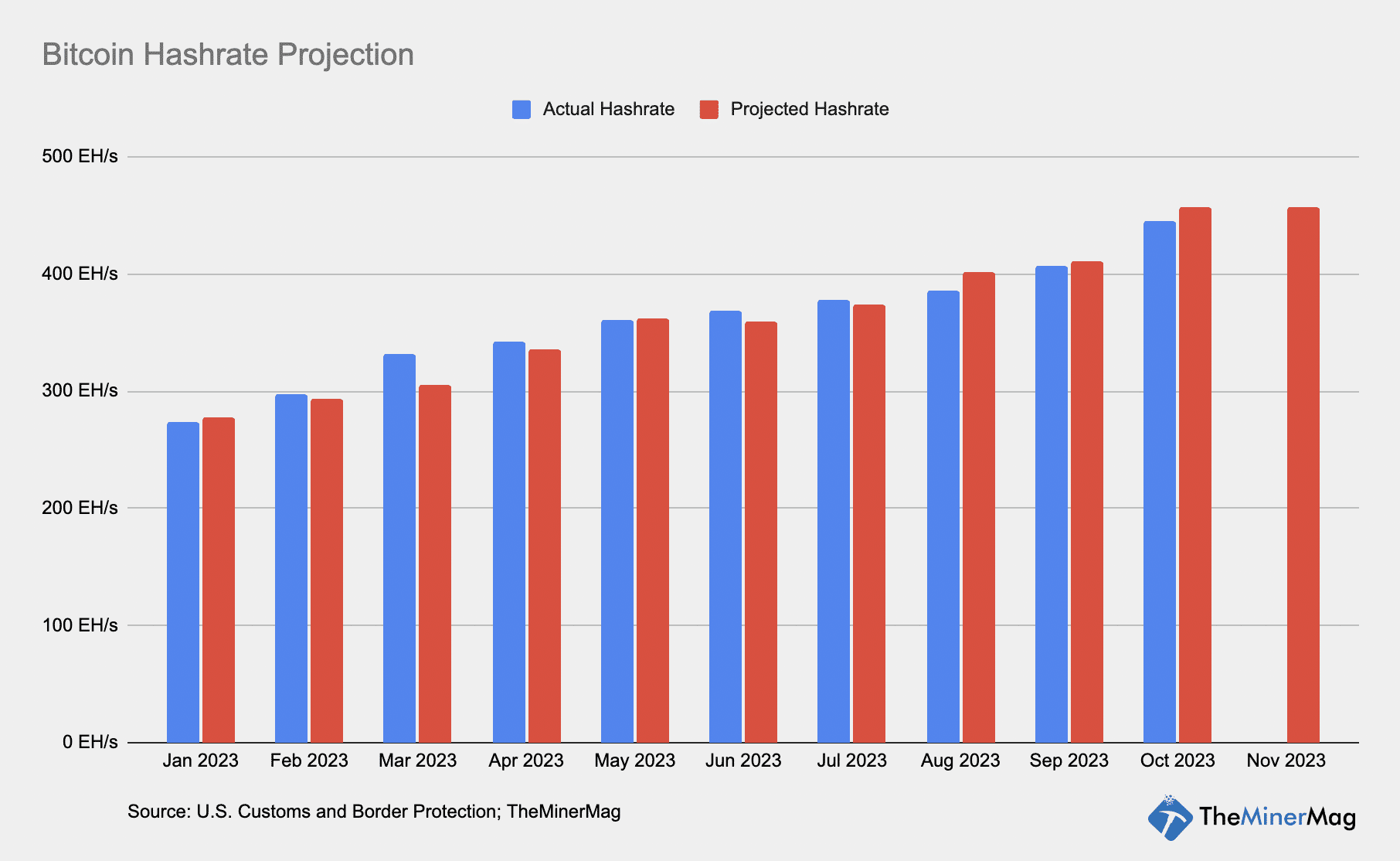

By the end of September, our hashrate-shipment coefficient model demonstrated a strong correlation of 0.919 between the gross weight of miner imports to the U.S. and the growth of Bitcoin’s network hashrate. At that time, the model projected that the average hashrate for October would be 459 EH/s, representing a 12.3% increase. While the actual increase was 9.6%, it still marked significant growth.

Taking into account shipment records for October, the model continues to maintain a strong coefficient of 0.914. However, due to a relatively low volume of imports in October, the model projects that the average hashrate in November will remain steady at around 460 EH/s.

As the chart below illustrates, miner imports decreased in October compared to the monthly volumes in Q3. Nonetheless, it is noteworthy that the volume of WhatsMiner parts increased in both September and October.

The total gross weight of WhatsMiner parts imported to the U.S. reached 500,000 kilograms. All of these parts were imported by Synos Corp, the U.S. manufacturing partner of MicroBT, responsible for assembling and delivering the WhatsMiner equipment.

Estimating the eventual number of WhatsMiners that can be produced with these imported parts is challenging. However, it is known that the gross weight of a WhatsMiner M56S+ is approximately 17 kilograms. Therefore, 30,000 units of these would amount to about half a million kilograms.

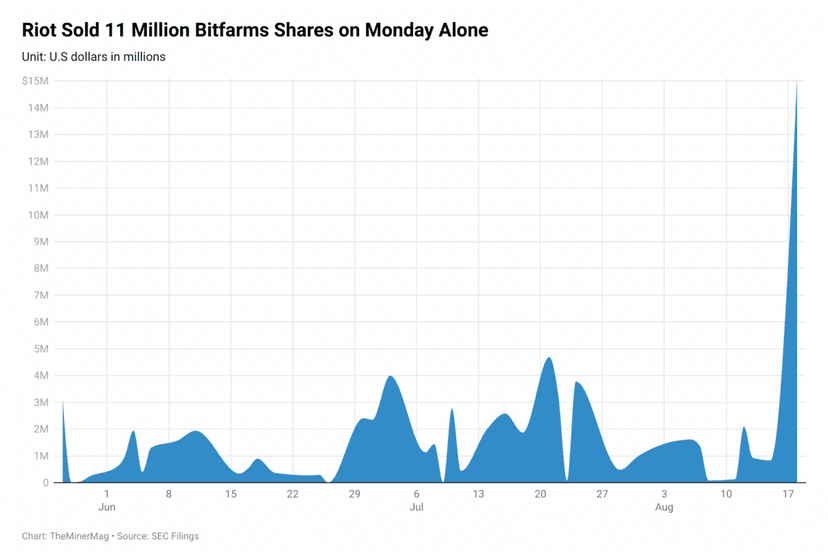

For context, Riot signed a pre-order for 33,280 units of M56S+ and 56S++ in June, with deliveries expected to commence in December. According to the announcement at that time, the WhatsMiners will be produced in the U.S., contributing 7 EH/s in hashrate capacity for Riot.

In summary, the shipment activity of Synos Corp suggests that Riot can anticipate receiving the pre-ordered WhatsMiner units on time for subsequent energization ahead of the halving event in April. The records for November and December will be interesting to watch.

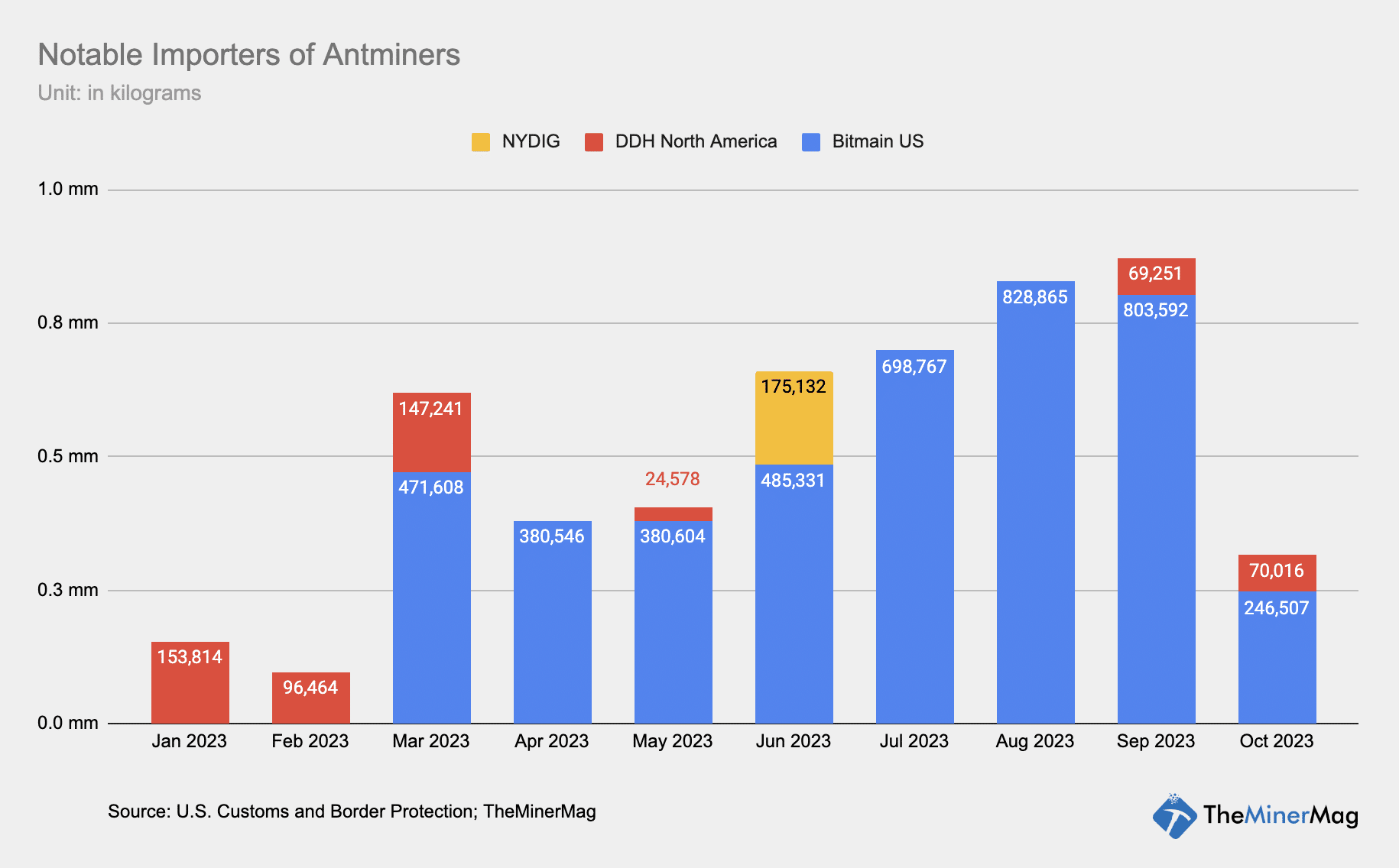

Regarding Antminer units, Bitmain significantly saturated the U.S. market with S19XPs this year, although the volume sharply decreased in October. The chart below outlines notable Antminer importers for this year, which included Bitmain’s U.S. subsidiary in Georgia, NYDIG, and DDH North America, the U.S. subsidiary of Genesis Digital Assets.

Since March 2023, Bitmain Georgia has imported over 4.3 million kilograms of miners, all of which were S19XPs, translating to a capacity of as much as 35 EH/s.

On the other hand, DDH appears to have diversified its mining fleet composition this year. In 2022, DDH mainly imported the Avalon miners that GDA pre-ordered from Canaan during the 2021 bull run. Starting this year, DDH’s imports were exclusively Bitmain’s S19s until September and S19XPs in October. Based on the gross weight of the two types of machines, we estimate that GDA has imported at least 3.2 EH/s of Antminers this year.