Editor’s note on January 25: This story has been updated with clarification on Bitfarms’ hashrate and power capacity plan in the last three paragraphs.

Canadian bitcoin mining firm Bitfarms said it has purchased land in Yguazu, Paraguay, eyeing a 100 megawatts (MW) of capacity expansion in Latin America.

Bitfarms said on Wednesday that the purchased land is located near the Itaipu Dam, potentially tapping into renewable energy in one of the world’s largest hydropower sites. The company did not disclose the transaction value but said it anticipates completing the buildout in the second half of 2024.

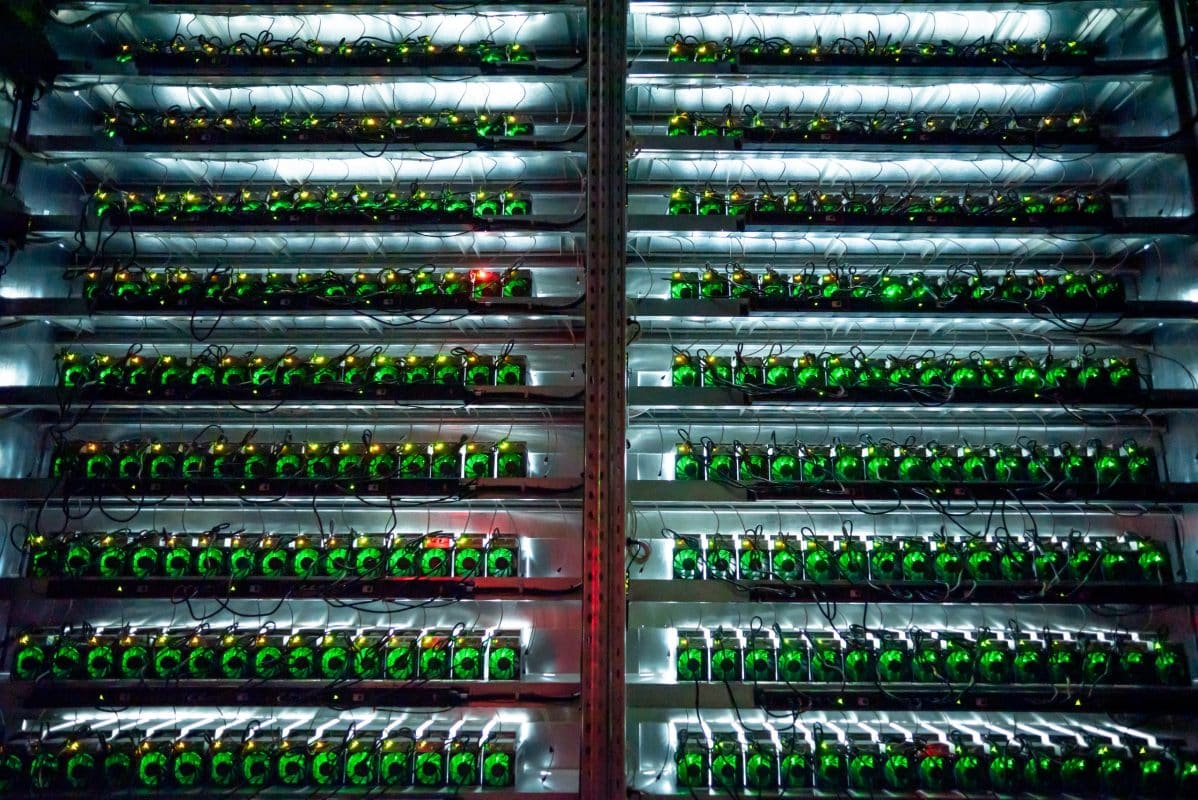

Bitfarms previously announced a preorder of 35,888 units of Bitmain’s Antminer T21 while securing an option to buy another 28,000 T21s. With the land purchase in Yguazu for a 100 MW buildout, Bitfarms appears to be advancing plans to ensure sufficient power capacities to exercise the T21 option.

“In conjunction with our miner redeployment strategy, the Yguazu project will be designed to help provide sufficient infrastructure to achieve a corporate hashrate of 21 EH/s by year-end 2024 should we exercise our recently announced miner purchase order option for additional Bitmain T21 miners,” said Bitfarms’ president and CEO Geoff Morphy.

Bitmain’s T21 model has a built-in feature to overclock the equipment. In a high voltage mode, its hashrate is said to be able to increase from a standard 190 TH/s to 233 TH/s.

If Bitfarms exercises the option, its total hashrate on order, in high voltage mode, would be as much as 14.9 EH/s. That is on top of Bitfarms’ existing 6.5 EH/s that is operational.

However, the maximum 14.9 EH/s expansion to reach a target of 21 EH/s will need to draw significantly more power capacities than what has been announced so far.

According to Bitmain’s specification for the T21 model, the high voltage mode will reduce the efficiency from 19 J/TH to 22 J/TH. Theoretically, Bitfarms will need an additional 327 MW to provide enough energy for operating all the preordered and optional T21s in a high-voltage mode.

In November while announcing the T21 purchases, Bitfarms outlined how it plans to add as much as 14.9 EH/s of T21s within 2024 while unracking older and less efficient models like the WhatsMiner M30S/M31S totaling 4.3 EH/s. In essence, it will replace all the old WhatsMiners with Antminers first.

In that way, Bitfarms projects to reach 17 EH/s while expanding power capacities by 151 MW within 2024. Yet, it still needs another 180 MW to redeploy the 4.3 EH/s of M30S and M31S that will be unplugged this year. It remains to be seen when and how the redeployment will take place given the uncertainties of bitcoin’s hashprice after halving.