Bitcoin mining stocks saw notable gains during Monday’s pre-market trading session, following a sharp recovery in Bitcoin’s price, which surged by $10,000 to retake the $95,000 mark.

The rebound in Bitcoin’s price comes after U.S. President Donald Trump announced a new crypto reserves plan on Sunday, which appears to have renewed optimism in the crypto market. Bitcoin fell sharply last week to a local low of $79,000.

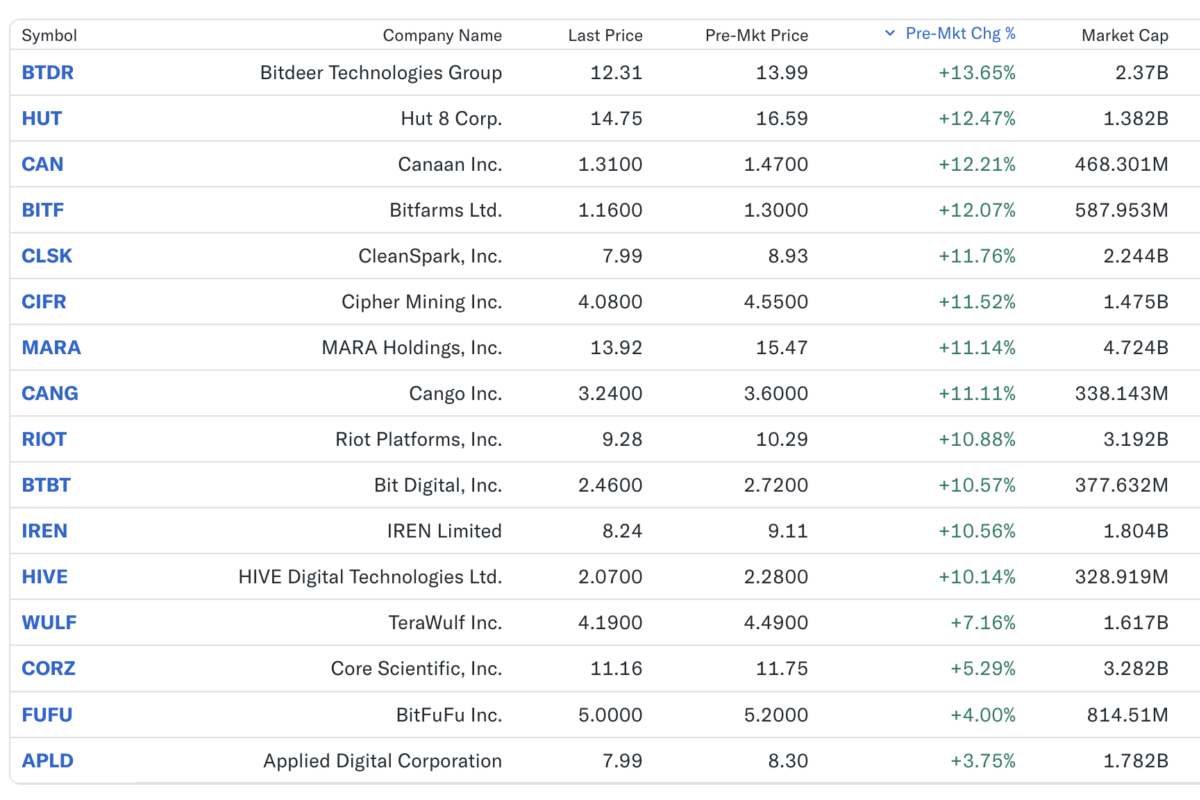

Among major Bitcoin mining companies, Bitdeer (BTDR) led the charge with a 13.65% increase at the time of writing. Hut 8 (HUT) also saw a notable jump of 12.47%, trading at $14.75 in pre-market hours. Other significant gainers included Canaan (CAN), which rose 12.21% to $1.31, and Bitfarms (BITF), which climbed 12.07% to $1.16.

CleanSpark (CLSK) posted an 11.76% increase to $7.99, while Cipher Mining (CIFR) gained 11.52%, reaching $4.08. Riot Platforms (RIOT) saw a 10.88% rise, trading at $9.28, and Bit Digital (BTBT) surged 10.57% to $2.46.

The overall market capitalization of these companies also reflected the positive sentiment, with many stocks posting gains in the low double digits. Hive Digital (HIVE) and Core Scientific (CORZ) gained 10.14% and 5.29%, respectively.

The Bitcoin price rebound, driven by Trump’s crypto reserve policy announcement, has provided a boost to the market, sending BTC prices soaring and lifting Bitcoin’s hashprice back to $50/PH/s.

Data reveals that Bitcoin’s hashprice is now at $53/PH/s, up from $45/PH/s last Thursday, offering a much-needed relief to mining companies. The network’s difficulty is projected to increase by a modest 1.1% in the coming week.

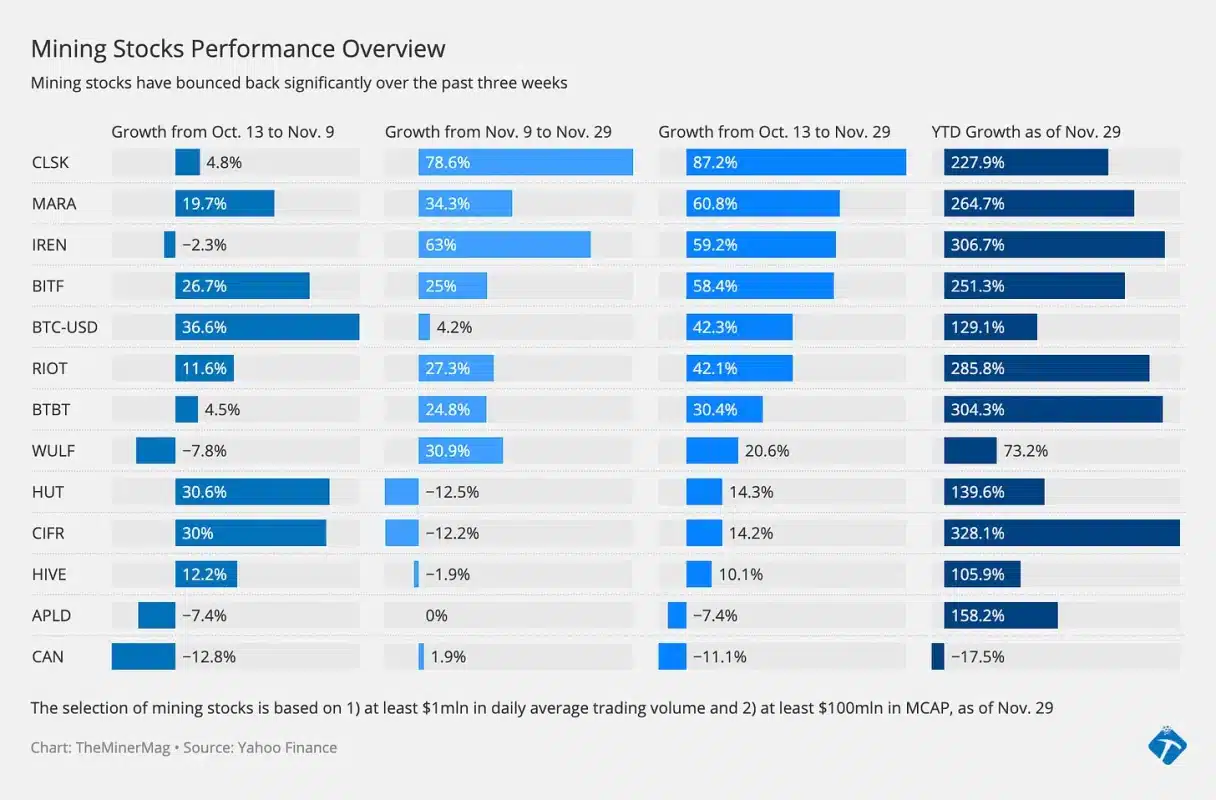

As reported last week, major mining stocks experienced a loss of $13 billion in aggregate market capitalization during the February sell-off.

Share This Post: