This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

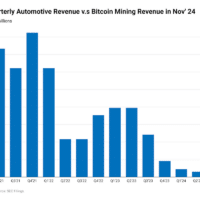

Bitcoin mining has entered another challenging period. Despite a recent decline in Bitcoin’s mining difficulty, which lifted the hashprice—a measure of mining profitability—to $56/PH/s, broader market turbulence since the past weekend has once again pushed the hashprice down below $50/PH/s. This marks the lowest point since mid-November.

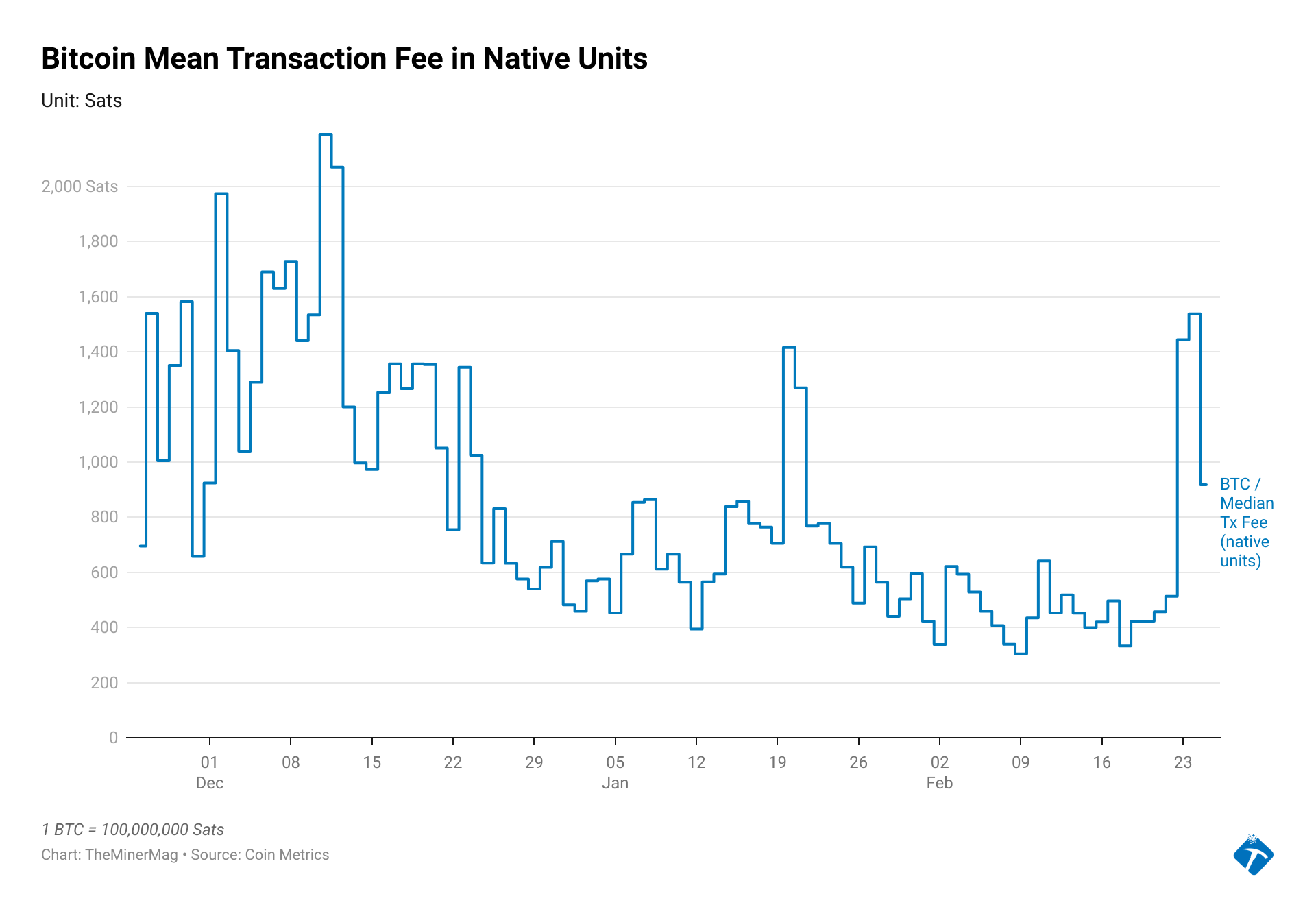

What’s also concerning is that bitcoin’s transaction fees, which complement the usual block subsidies miners earn from the Bitcoin network, are not providing much relief. Data compiled by TheMinerMag shows that bitcoin’s transaction fees totaled only about 163 BTC for the first 26.5 days of February (UTC), representing just 1.33% of the total block rewards (fees + block subsidies) so far this month.

This percentage will likely remain flat unless there’s a significant fee spike in the remaining one and a half days. On a monthly basis, this is the lowest figure since the bottom of the last bear market in October 2022 (1.26%).

Be reminded that was before bitcoin’s last halving—where the block rewards for miners are automatically reduced by half every four years. Transaction fees are expected to play a larger role in bitcoin’s total block rewards after each halving, as block subsidies are reduced by 50%.

Bitcoin miners did see a brief fee spike after the 2024 halving, driven by a surge in on-chain activity. However, this fee increase gradually subsided in the months that followed, dropping below 2% in September 2024 and below 1.5% by January 2025. In fact, on-chain transactions became so scarce that bitcoin’s mempool—a backlog of unprocessed bitcoin transactions—was cleared in early February.

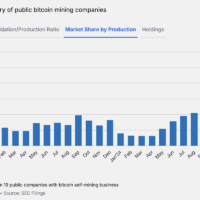

The weak transaction fees and Bitcoin’s price slump mean that miner operators with high energy costs or inefficient fleets could face another wave of capitulation. The network’s seven-day moving average hashrate already dropped to 753 EH/s, down from the record high of 850 EH/s seen earlier this month.

With all being said, a potential silver lining emerged over the weekend with a seeming return of BRC-20 token-minting activity on bitcoin’s blockchain, signaling a potential increase in transaction fees.

As of last Friday, February 21, bitcoin’s transaction fees only accounted for 1.07% of total block rewards this month. However, the fees spiked to 2.3% starting Saturday, largely due to speculative investors in China minting a single BRC-20 token called MASK, according to Blockspace’s latest newsletter.

On-chain data confirms this fee bump, though it seems to have subsided again. With bitcoin’s price now tumbling below $90,000, it remains uncertain whether or when transaction fees can come to miners’ rescue.

Hardware and Infrastructure News

- Bitcoin Mining Difficulty Drops 3.2% Boosting Hashprice to $56/PH/s – TheMinerMag

- Argo Moves More Bitcoin Miners to Merkle Despite S19j Pro Woes – TheMinerMag

- Crusoe, Kalina partner to develop natural gas powered AI data centers in Alberta, Canada – DCD

- Compass Energizes 5.5 MW in North Dakota Amid Bitcoin Hashrate Drop – TheMinerMag

- Cipher Secures 8.7 EH/s of S21XP Bitcoin Hashrate with Q2 Delivery – TheMinerMag

- Core Scientific Prepays $21.3M for Block’s Bitcoin Miners with Q3 Delivery – TheMinerMag

Corporate News

- Bitdeer Targets 40 EH/s in 2025, Pays $240M to TSMC for SEALMINER – TheMinerMag

- Bitcoin Miners Drawing Power From Grids Will Face ‘Reckoning’ Post Next Halving, MARA Says – CoinDesk

- Tether fails to halt dispute in UK court with former bitcoin mining partner – FT

- Core Scientific Stock Surges After $1.2B Expansion of Data Center With CoreWeave – CoinDesk

Financial News

- Altcoin Miner’s IPO Reveals $144M Revenue, Faces US Customs Detention – TheMinerMag

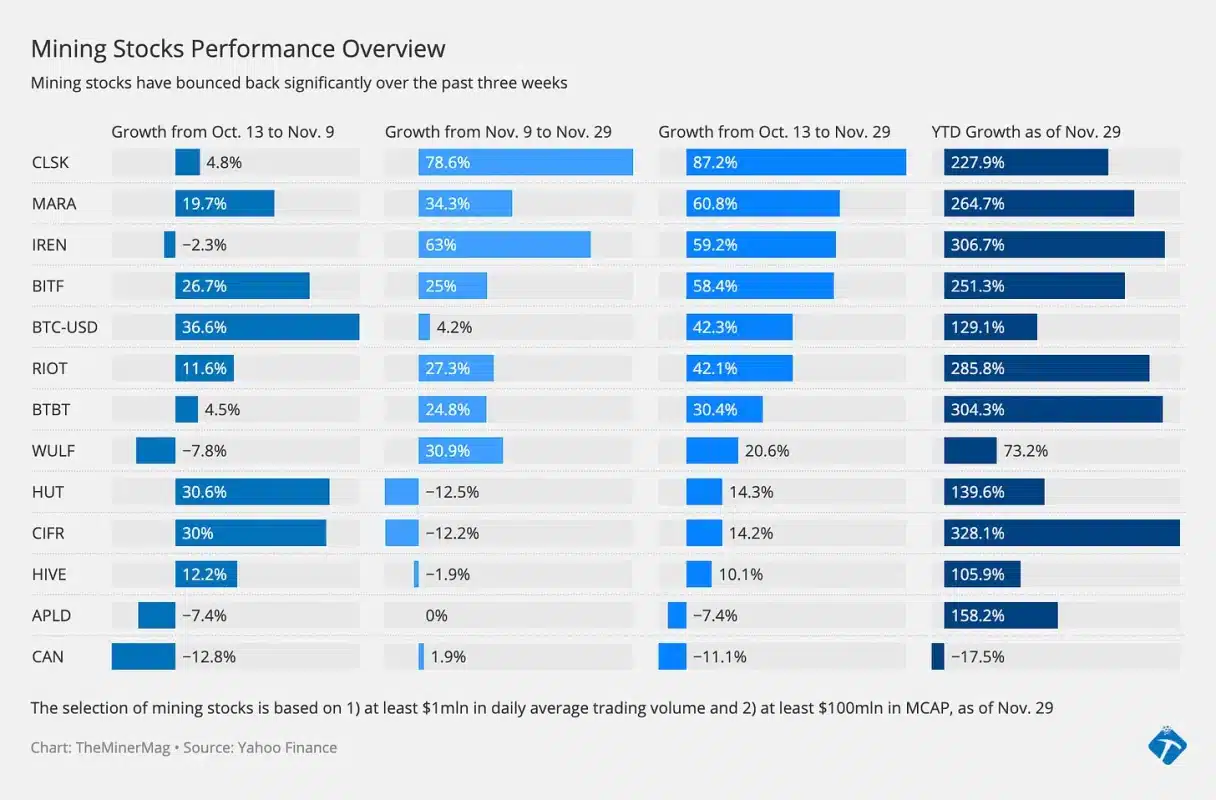

- Bitcoin Mining Stocks Lose $13B Amid February Market Selloff – TheMinerMag

Feature

- Bitcoin Hashrate Growth Slows Amid Tough Market Conditions for Smaller Miners – Coindesk

- Crisis Over? U.S. CBP & Bitcoin ASIC Importation – The Mining Pod

Share This Post: