Bitcoin’s mining difficulty posted a 3.2% decline on Sunday, slightly elevating the network’s hashprice to $56/PH/s.

Network data shows that the difficulty adjusted to 110 trillion at Bitcoin block height 885,024, marking a 3.2% decrease from the previous record high of 114 trillion.

Bitcoin mining difficulty is adjusted approximately every two weeks to maintain a consistent block creation rate. The adjustment ensures that the average time to mine a block stays around 10 minutes, regardless of the total computational power on the network. When miners leave the network, the difficulty decreases, making it easier for the remaining miners to find blocks.

As previously reported, Bitcoin’s network hashrate growth is expected to slow down after eight consecutive upward difficulty adjustments in the fourth quarter of 2024. The latest competition eases means the difficulty has returned to the same level seen at the beginning of 2025.

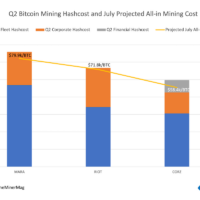

Bitcoin’s average hashrate increased by about 140 EH/s between October and December of last year, which significantly offset Bitcoin’s market price momentum for miners. This has caused Bitcoin’s hashprice to stagnate in the $50/PH/s range over the past three months, still about 50% below the pre-halving level, despite Bitcoin staying above $90,000.

The Antminer S19 Pro—the last-generation but still dominant hardware on the Bitcoin network—is facing a gradual phase-out due to the harsh hashprice environment. However, the latest difficulty decrease gives operators with older-generation equipment a much-needed relief.

With a $56/PH/s hashprice, the S19 Pro can generate $0.079 per kilowatt-hour, which still leaves little room for margin but is about 5% higher than what it could generate at the $53/PH/s hashprice seen a week ago.

Share This Post: