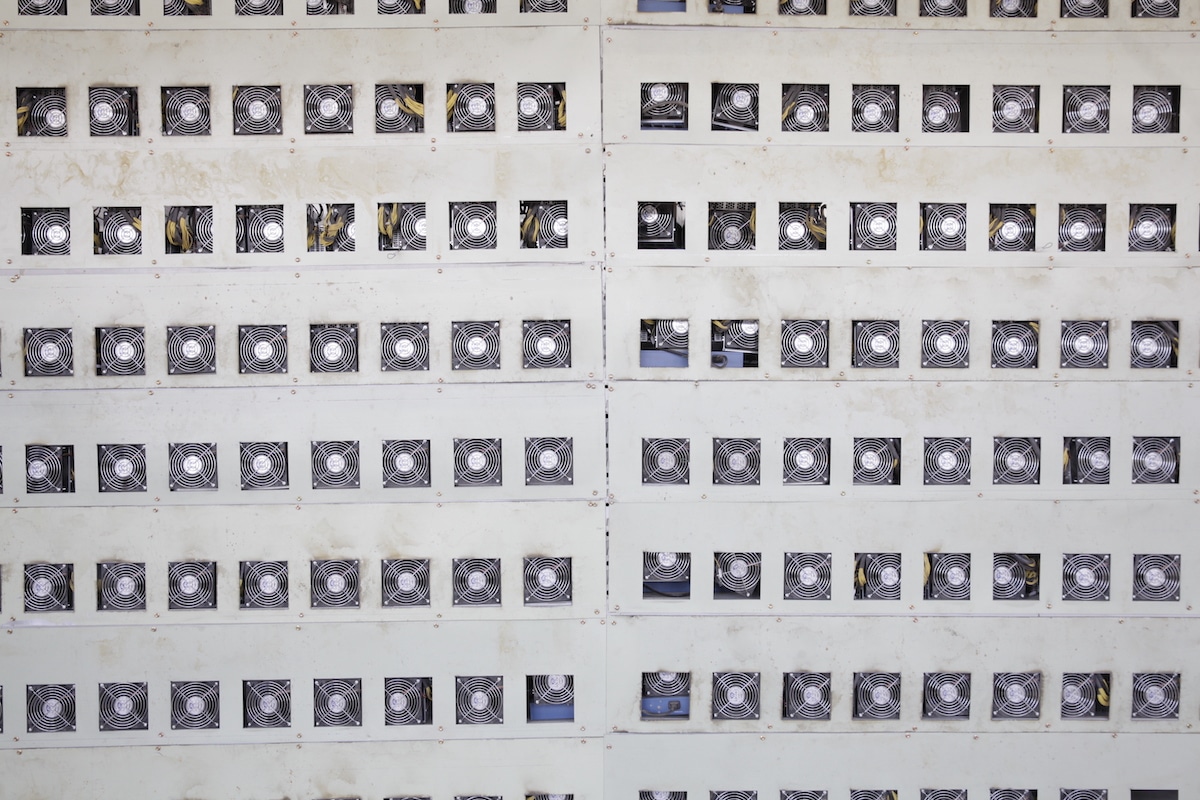

Bitcoin miners feel the squeeze as the network’s hashprice—a key profitability metric—nears its one-month low following a record-setting difficulty adjustment on Sunday.

Bitcoin’s network difficulty increased 5.61% over the weekend, setting a new all-time high at 114.17 trillion. The adjustment has intensified the competitive landscape for miners, further reducing their potential earnings.

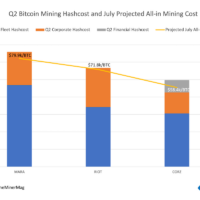

The difficulty adjustment, together with Bitcoin’s market price slump below $96,000 on Monday, sent the mining hashprice to $53/PH/s, which is close to its one-month low of $52.3/PH/s seen in mid-January.

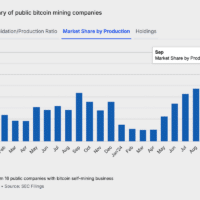

Bitcoin’s difficulty adjusts approximately every two weeks to ensure that blocks are mined at a consistent 10-minute interval. This latest adjustment reflects the growing competition among miners, with more computing power being added to the network despite a relatively stagnant Bitcoin price of around $100,000.

The surge in difficulty also comes on the heels of a recent decline driven by North American institutional miners curtailing operations during extreme cold weather. In January, several large mining facilities reduced their hashrate to help balance regional power grids and avoid overloading during peak demand.

Large public mining companies reported lower realized hashrate output for January, with MARA and Core Scientific realizing only about 80% of their energized capacity. With milder weather and grid conditions returning to normal, those miners have resumed operations at higher uptime levels, boosting the network’s hashrate.

Share This Post: