Bitcoin mining stocks experienced significant declines on Monday amid a broader sell-off in the Nasdaq, following U.S. President Donald Trump’s announcement of new tariffs over the weekend.

The Trump administration imposed 25% tariffs on imports from Canada and Mexico and 10% on goods from China, effective Tuesday, heightening fears of a global trade war and leading to widespread market volatility.

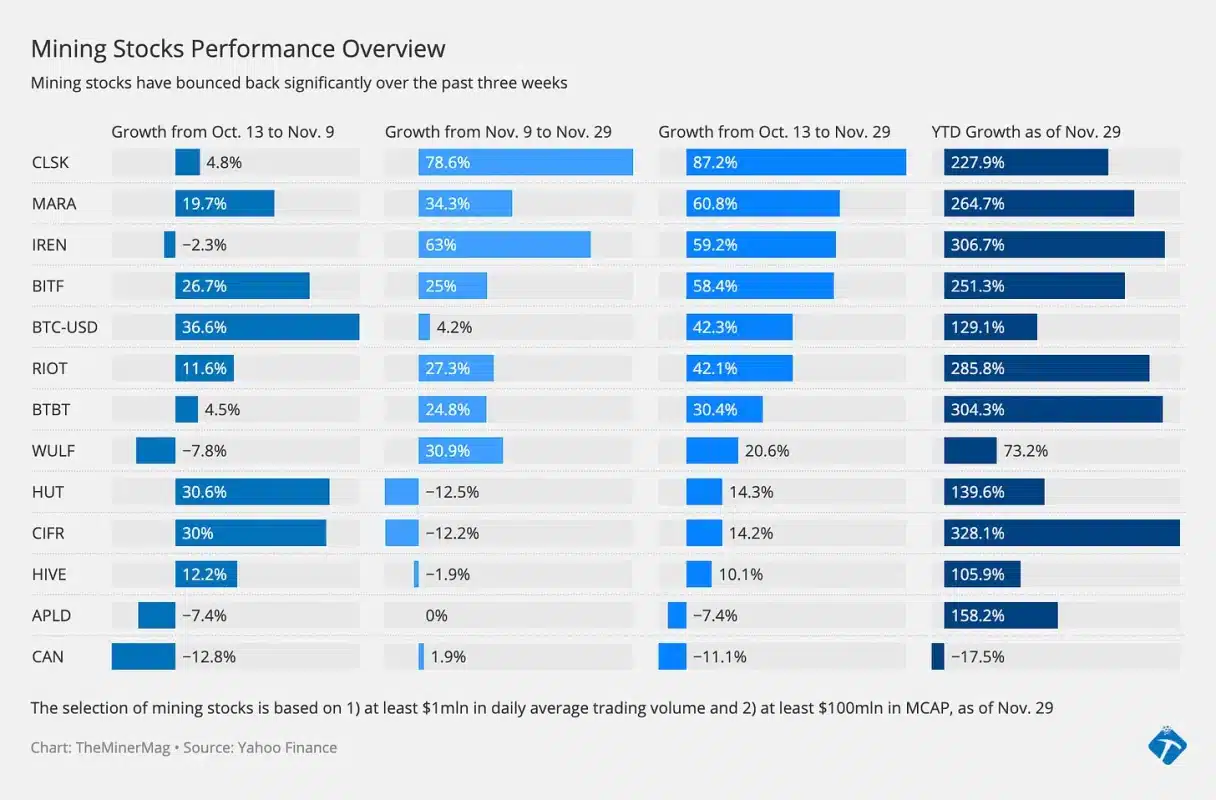

Major Bitcoin mining-related stocks were notably affected. Shares of Marathon (MARA) dropped approximately 7%, while Riot Platforms (RIOT) saw a decline of about 8%. Core Scientific, Bitdeer, CleanSpark, Iris Energy, and Cipher Mining also faced downturns, with their stocks decreasing between five to eight percent.

The broader cryptocurrency market mirrored these declines. Bitcoin’s price fell to approximately $95,000, marking a 4% decrease over the past 24 hours, while Ethereum saw a sharper decline of about 17%, trading around $2,577. The overall market capitalization of cryptocurrencies shrank by $500 billion, dropping from over $3.6 trillion to about $3.1 trillion.

Analysts attribute these downturns to investor concerns that the newly imposed tariffs could exacerbate inflation and disrupt global supply chains. Such economic uncertainties often lead investors to retreat from riskier assets, including cryptocurrencies and tech stocks.

The tariffs have also prompted retaliatory measures from Canada and Mexico, with China announcing plans to challenge the U.S. actions at the World Trade Organization.

Share This Post: