Crypto asset management firm Grayscale has launched a new exchange-traded fund (ETF) aimed at offering investors exposure to the Bitcoin mining industry.

Grayscale announced on Thursday the Grayscale Bitcoin Miners ETF (Ticker: MNRS), which is based on the Indxx Bitcoin Miners Index and includes companies generating a significant portion of their revenue from Bitcoin mining or related activities such as hardware, software, and infrastructure services.

Unlike direct Bitcoin investments, MNRS gives investors exposure to the broader Bitcoin mining sector, which is often considered a leveraged play on Bitcoin’s price movements. The fund’s website currently lists holdings in 23 companies engaged in proprietary Bitcoin mining or hosting businesses, along with chip giants Intel and Nvidia.

“Grayscale Bitcoin Miners ETF offers investors targeted exposure to Bitcoin miners and the global Bitcoin mining industry in a passively managed, rules-based, and index-tracked fund designed to evolve with the industry,” said David LaValle, Global Head of ETFs at Grayscale.

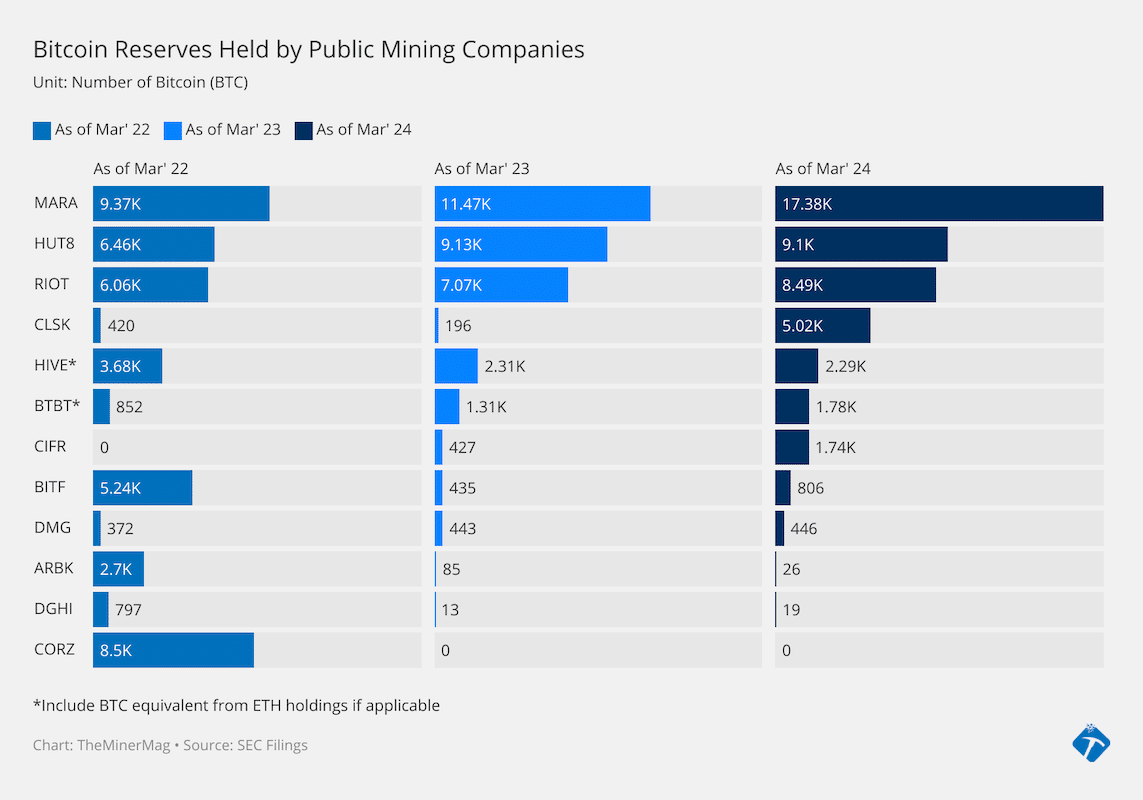

According to the fund’s description, Marathon Digital (MARA), Riot Platforms (RIOT), Core Scientific (CORZ), CleanSpark (CLSK), Iris Energy (IREN), and Hut 8 (HUT) make up nearly half of its allocation, with 16.66%, 11.92%, 9.2%, 4.79%, and 4.37%, respectively.

Publicly traded Bitcoin mining companies have gained significant traction since 2023, with a combined market capitalization exceeding $30 billion as of January 2024. In December 2023, these firms collectively accounted for 35% of Bitcoin rewards, reflecting their growing dominance in the sector.

The launch of the Bitcoin Miners ETF comes at a time of regulatory shifts in U.S. Bitcoin investments. The approval of spot Bitcoin ETFs in early 2024 marked a major milestone for institutional adoption—one that Grayscale played a pivotal role in shaping through its legal battle with the SEC.

Share This Post: