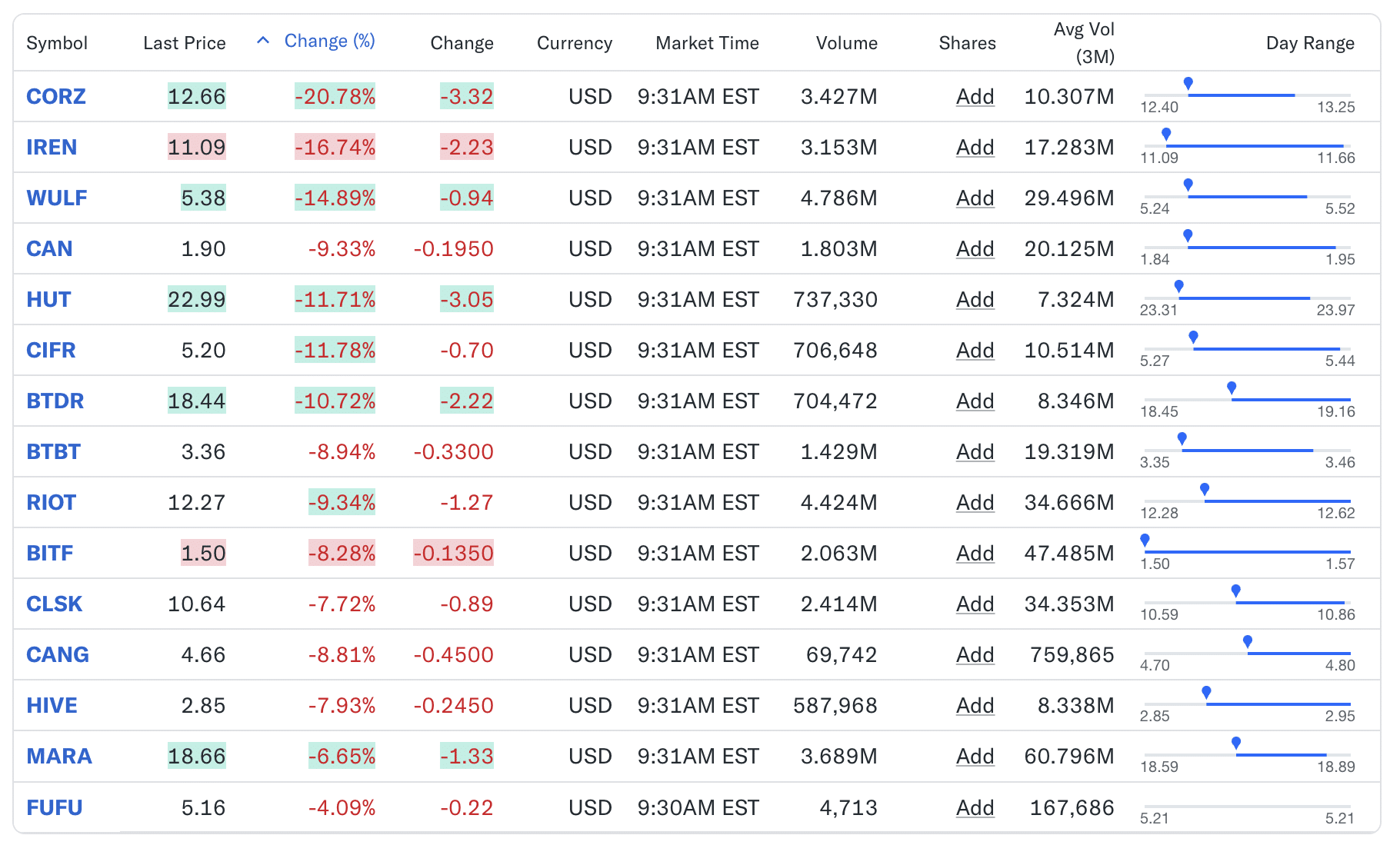

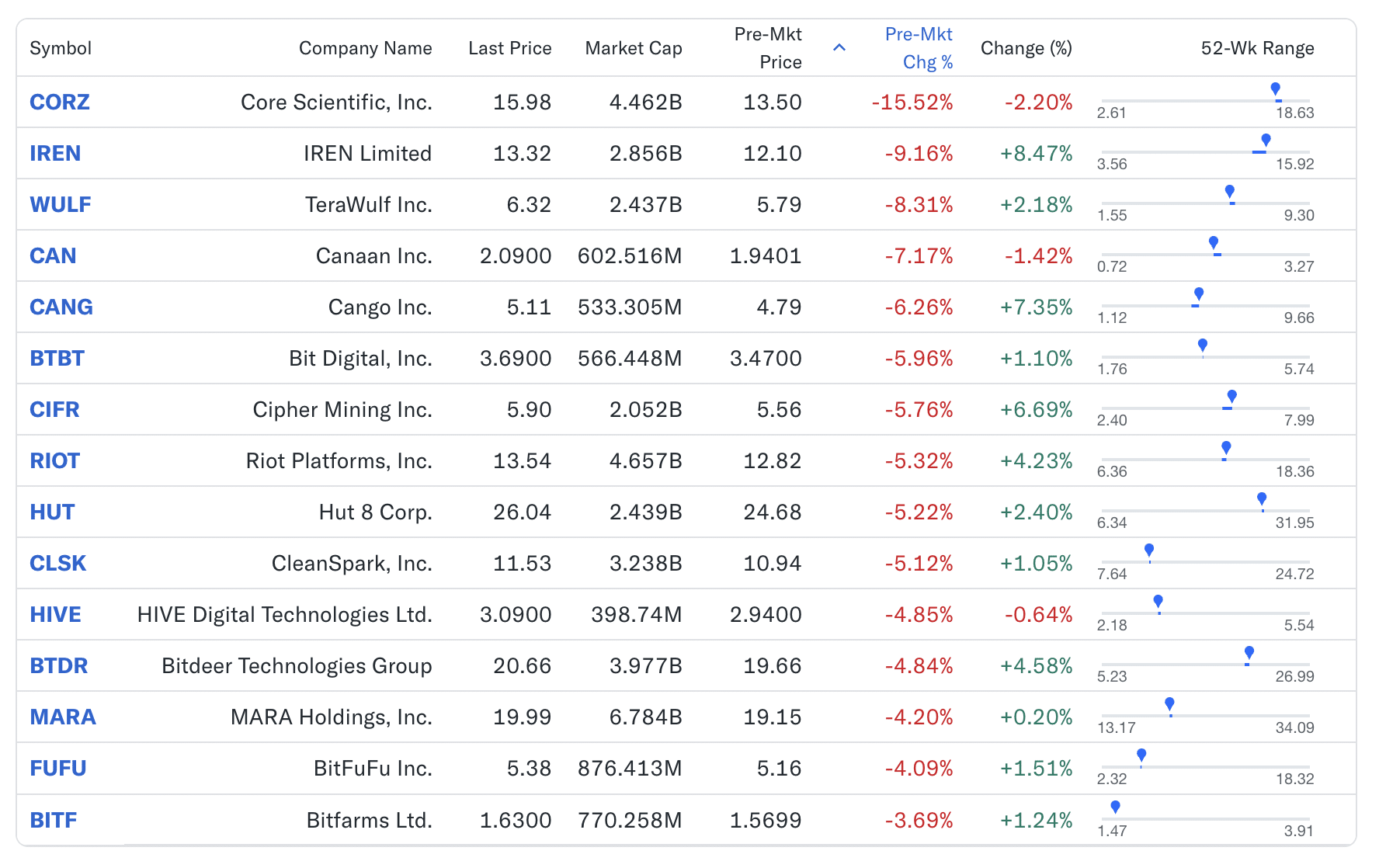

UPDATE: Core Scientific is down 20% after the market opens on Monday. Iris Energy and Terawulf followed with a 15-17% slump.

Bitcoin mining stocks saw sharp declines during pre-market trading hours on Monday, as fears over the said breakthrough AI model from Chinese company DeepSeek weighed heavily on U.S. tech stocks.

Shares of major Bitcoin mining companies, including Core Scientific, MARA, Riot Platforms, and Hut 8 Mining dropped between 3% and 15% in early trading.

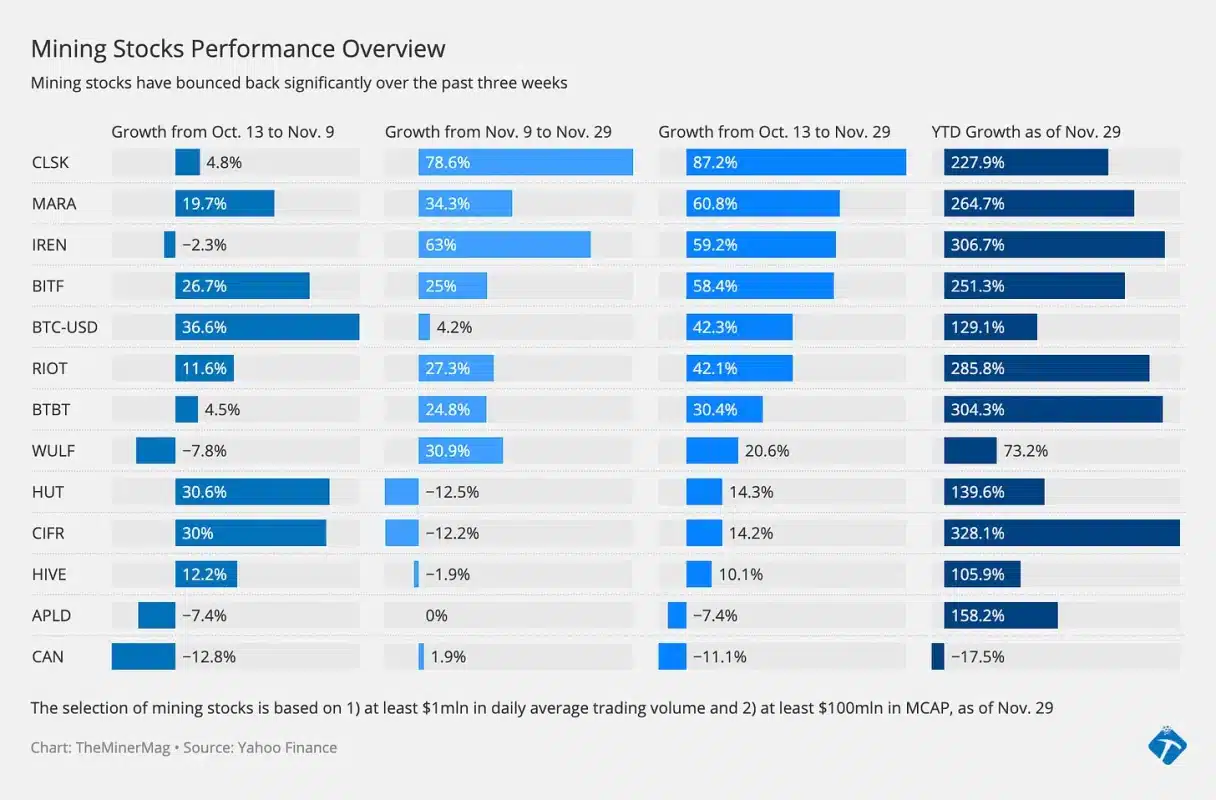

The decline comes as mining stocks often follow the movement of Bitcoin, which is correlated to the broader tech sector on the Nasdaq. Core Scientific, Iris Energy, and Terawulf are leading the decline likely due to their expansion in AI and high-performance computing hosting infrastructure.

DeepSeek, an AI model reportedly developed with a tight financial budget and limited hardware resources to rival OpenAI’s ChatGPT, has sparked concerns about its ability to outpace U.S. artificial intelligence models in both speed and efficiency.

The Nasdaq 100 Futures fell nearly 4% on Monday during pre-market trading hours, reflecting broader concerns about the ripple effects of this perceived technological leap. Tech giants such as Nvidia and Microsoft also experienced significant pre-market declines, underscoring the widespread unease.

As of Jan 24, the largest 13 public mining companies had a total market capitalization of $35 billion.

Share This Post: