Bitcoin’s mining difficulty decreased by 2.12% on Monday, marking its first drop in four months and slightly raising the hashprice to $59/PH/s.

The adjustment occurred at block height 880,992, bringing the network difficulty level down to 108.11 trillion from its previous record high of 110.45 trillion, public data shows.

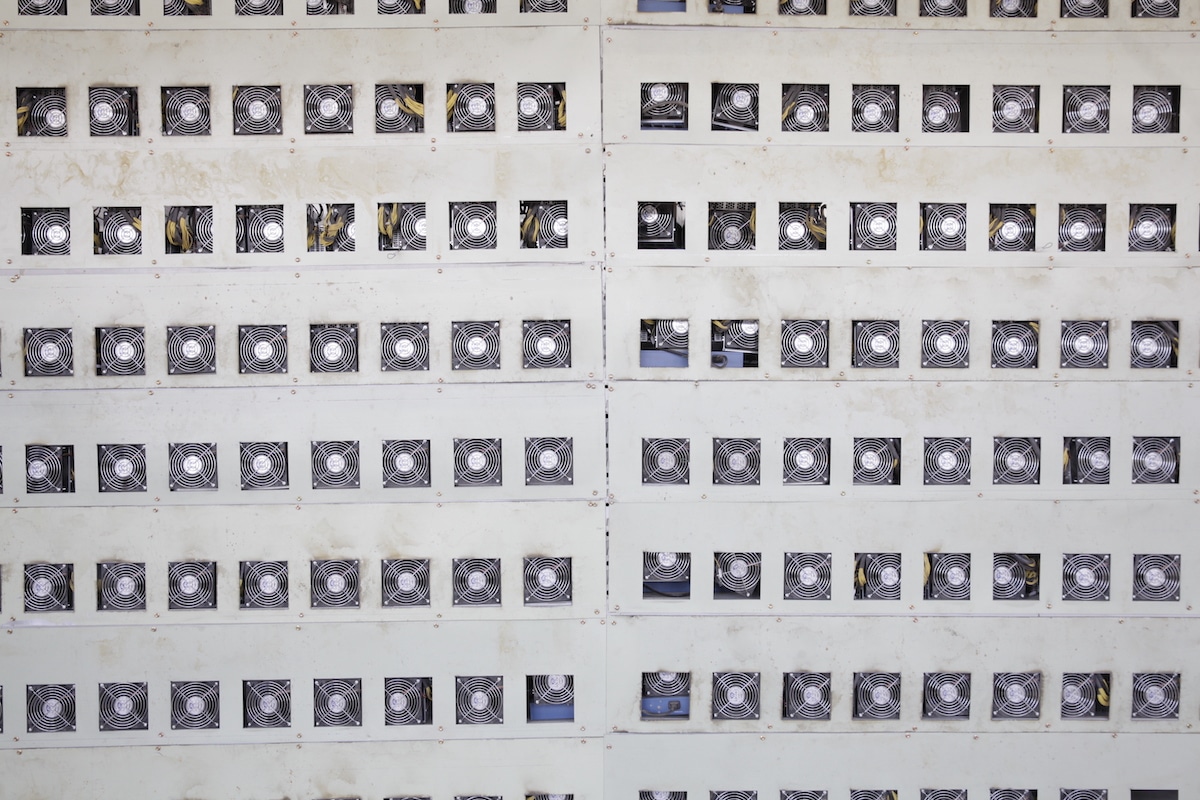

Mining difficulty, which adjusts roughly every two weeks, measures the computational challenge miners face to solve the SHA-256 hashing output required to validate Bitcoin transactions and earn rewards.

This decline reflects a slight reduction in network competition or overall computational power. Prior to this adjustment, Bitcoin’s difficulty had risen eight consecutive times since late September. Over that period, the network’s 14-day average hashrate climbed from 659 EH/s to 791 EH/s, equivalent to energizing around half a million Antminer S21 Pro units.

However, the recent difficulty drop suggests institutional mining companies have begun slowing the pace of their hashrate expansions since the New Year.

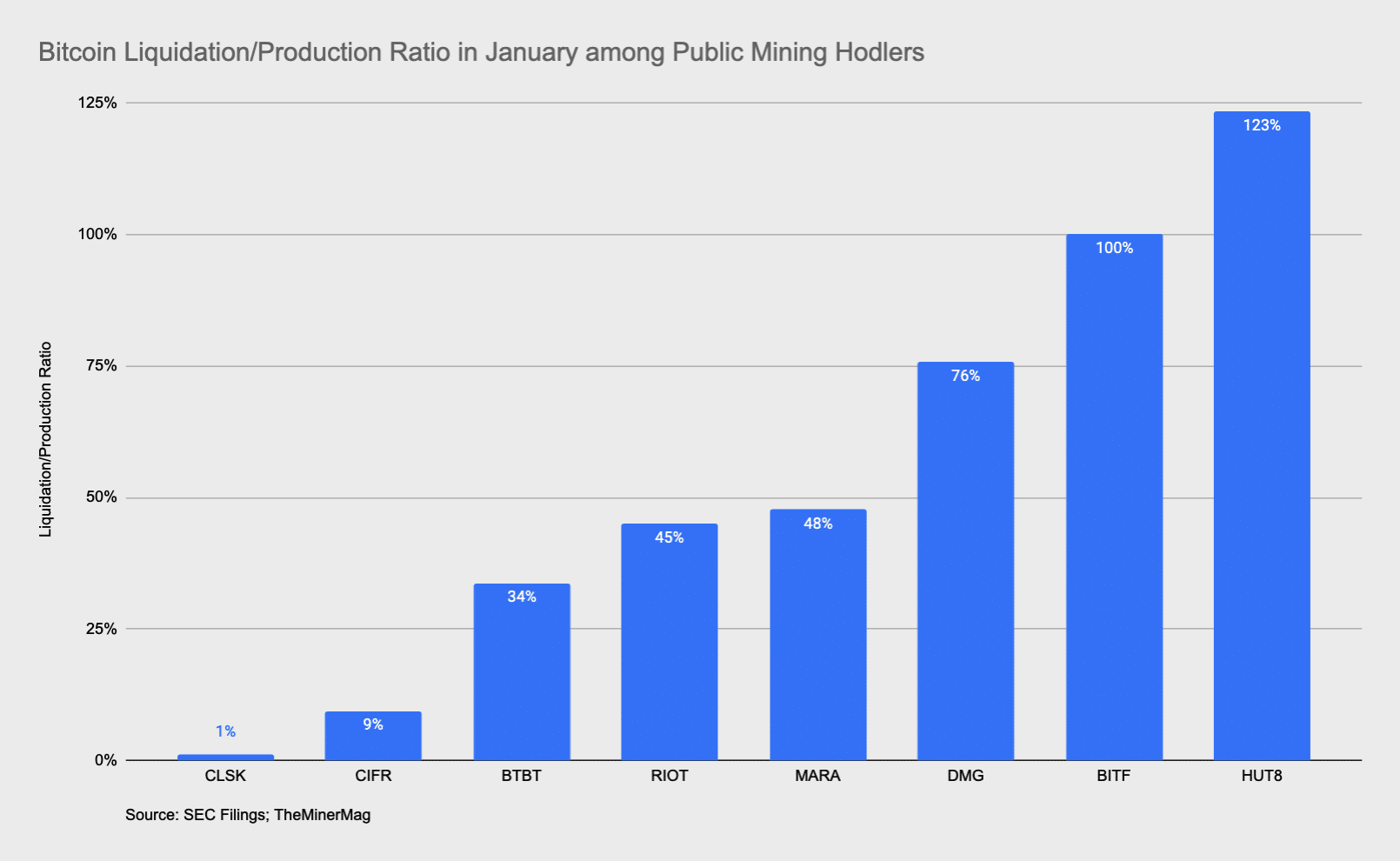

Public mining companies significantly increased their share of Bitcoin production over the last quarter, accounting for 35% of total Bitcoin rewards in December. However, Bitcoin’s declining hashprice appears to have pressured less efficient operators to capitulate and unplug from the network.

Bitcoin’s price briefly surged to new highs near $109,000 last week but dipped to $100,000 on Monday, driving the hashprice down to $58/PH/s. The difficulty adjustment slightly boosted the hashprice to $59/PH/s as of writing.

Despite the easing difficulty, mining profitability remains tight. For instance, Bitmain’s Antminer S19 Pro—a model estimated to account for a significant portion of the network hashrate—generates revenue of $0.082 per kilowatt-hour at a network hashprice of $59/PH/s. This means that miners paying more than $0.08 per kilowatt-hour for electricity risk operating at a loss.

Share This Post: