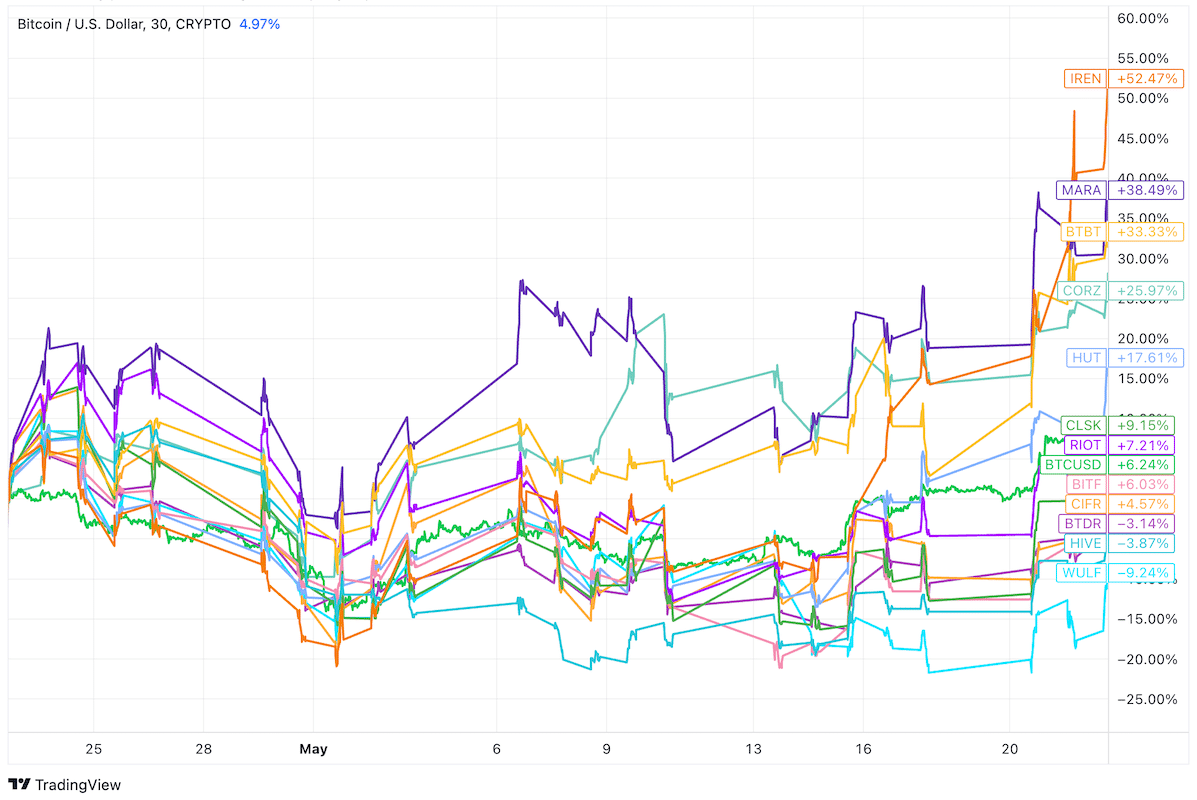

Iris Energy (IREN) has announced plans to raise up to $1 billion through an at-the-market equity offering to support its Bitcoin hashrate expansion, as well as data center upgrades and development projects.

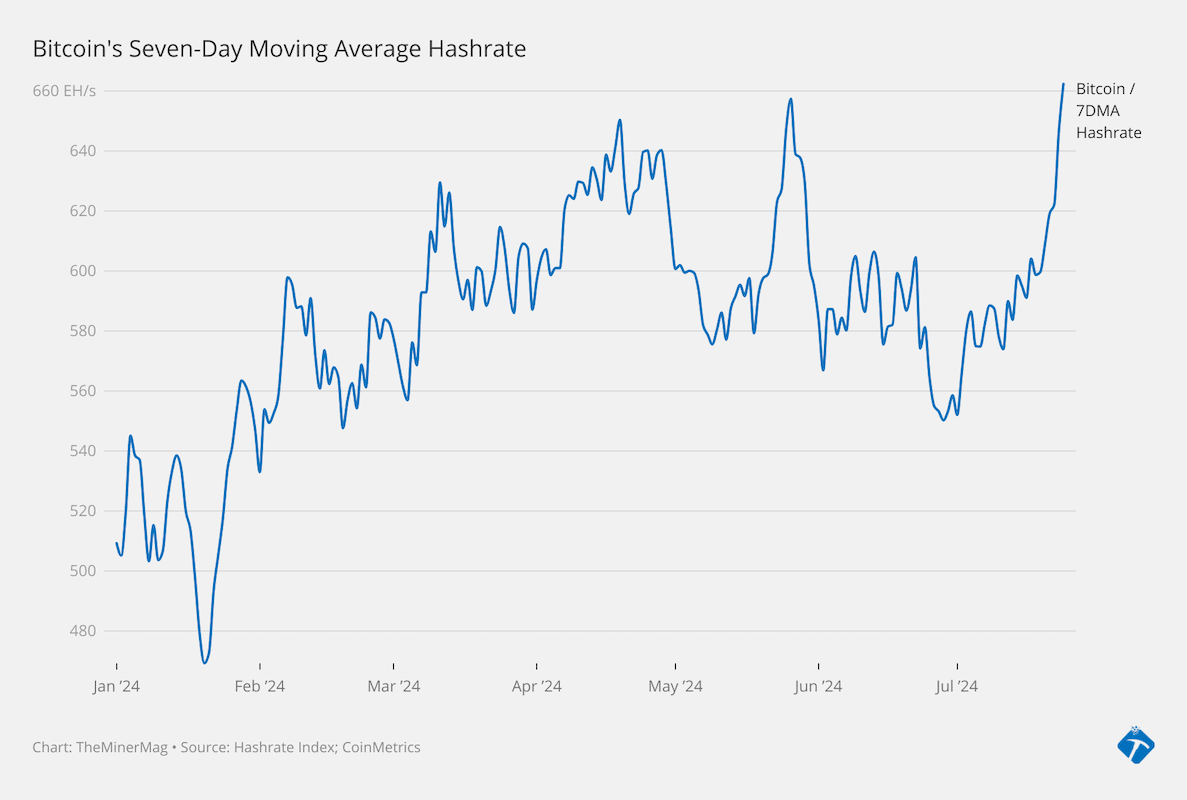

In a business update released on Tuesday, IREN set a target to expand its Bitcoin mining capacity to 57 EH/s by the second half of 2025, with 50 EH/s on track for the first half of 2025. This growth will be driven by the anticipated completion of the final 100 MW of IREN’s 750 MW Bitcoin mine in Childress, Texas, by the end of 2025.

IREN previously reported a 39% increase in its monthly Bitcoin production for December, which implied a 45% increase in realized hashrate.

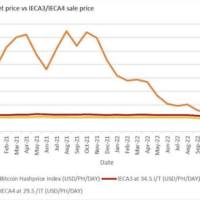

The Childress site boasts an electricity cost of $0.028 per kilowatt-hour (kWh). IREN said it is expected to improve fleet efficiency to below 15 J/TH once fully operational. The company’s monthly electricity cost per Bitcoin mined was reported to have remained stable at approximately $22,000 in recent months.

However, IREN’s stock price fell 10% on Wednesday following the announcement.

IREN stated that part of the planned $1 billion equity financing will be allocated to deploy direct-to-chip liquid-cooling systems across its data centers. This initiative aims to meet the growing demand for scalable, high-performance computing infrastructure. While Bitcoin mining remains the company’s core focus, IREN is exploring the potential to replace Bitcoin ASICs with liquid-cooled GPUs, such as NVIDIA’s upcoming Blackwell GPUs.

IREN also noted that the construction for its Sweetwater project is underway and is scheduled for energization in April 2026. The site will feature 1,400 MW of grid-connected power, though IREN is still evaluating commercial plans to monetize the power assets, including potential Bitcoin mining and other opportunities.

Share This Post: