This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

The previous Miner Weekly issue highlighted how the U.S. accounts for more than 40% of global bitcoin production, with the largest bitcoin mining pool alone contributing 33%.

The Bitcoin network has grown significantly over the past decade, and most Bitcoin mining now takes place on known pools. This is not entirely news, though. As far back as 2020, the largest known pools already accounted for over 90% of global bitcoin production. However, at the time, the industry lacked clarity about the entities controlling the hashrate, apart from a handful of smaller-scale companies in North America. The majority of hashrate was owned by larger, often opaque operations in China.

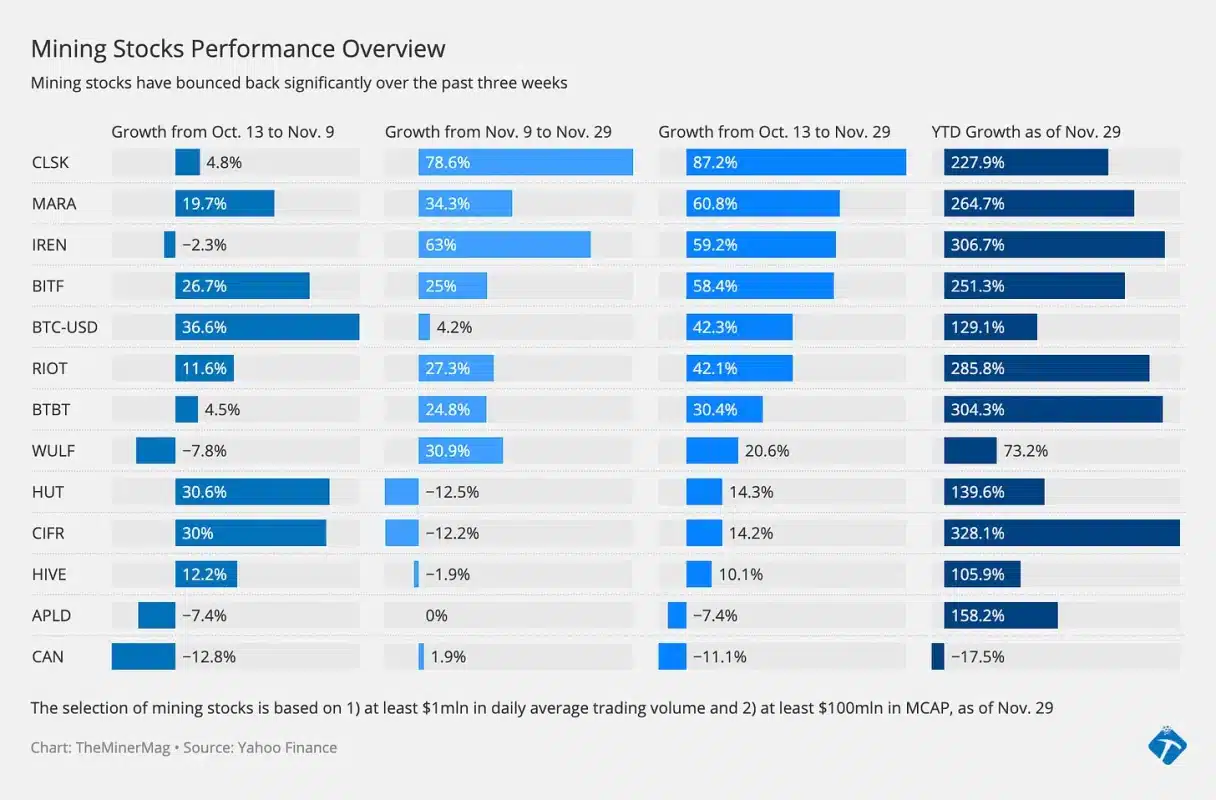

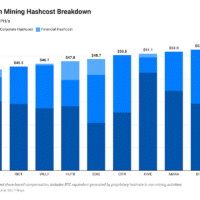

But the landscape has changed significantly since then. December 2024 data shows that about 31.6% of global bitcoin production can now be directly attributed to 19 publicly traded mining companies that disclose their proprietary mining performance monthly. They are: Argo Blockchain (ARBK), Bitfarms (BITF), Bit Digital (BTBT), Bitdeer Technologies (BTDR), BitFuFu (FUFU), Cango Inc. (CANG), Cipher Mining (CIFR), CleanSpark (CLSK), Core Scientific (CORZ), Digihost Technology (DGHI), DMG Blockchain (DMGGF), HIVE Digital (HIVE), Hut 8 Mining (HUT), Iris Energy (IREN), MARA Holdings (MARA), Mawson Infrastructure Group (MIGI), Riot Platforms (RIOT), Soluna Holdings (SLNH) and Terawulf (WULF).

Notably, the list above excludes companies that report only quarterly, such as Greenidge Generation (GREE), Canaan Inc. (CAN), Galaxy Digital (TSX: GLXY), Northern Data (FRA: NB2), Phoenix Technology (ADX: PHX), Cormint Data Systems (private), and Stronghold Digital Mining (SDIG). When including these quarterly results, the total hashrate attributable to the 27 aforementioned companies mined over 34% of global bitcoin production in December, representing more than one-third of the bitcoin network’s total hashrate. Below is the realized hashrate breakdown by most of these companies.

This level of transparency in bitcoin’s hashrate distribution is unprecedented. In January 2022, only about 16.7% of the total hashrate was attributable to known entities, according to TheMinerMag's archive data. This figure has doubled in just three years, showcasing the growing share of bitcoin mining owned by publicly traded companies and the increased transparency.

Imagine if China had not banned bitcoin mining. How might today’s landscape look?

Regulation News

- Beaver County bitcoin mining permit upheld by land tribunal after noise concerns - CBC.ca

- Thailand Police Seize 996 Bitcoin Miners in Power Theft Raid - TheMinerMag

Hardware and Infrastructure News

- Canaan Secures 580 PH/s of A15XP Order from New US Customer - Link

- Phoenix Energizes 50MW Bitcoin Mine in North Dakota - TheMinerMag

- Canaan unveils Avalon Mini 3 at CES 2025: a Bitcoin miner that doubles as a home heater - The Block

- Italian Miner Alps Buys S21+ Hydro for 70MW Iowa Bitcoin Mine - TheMinerMag

Corporate News

- Hodl Resumes? Core Sold 27% of Mined Bitcoin in December - TheMinerMag

- Hut 8 Gets Approval for AI Data Center in Louisiana - TheMinerMag

Financial News

- Bitcoin Miner MARA Lends 16% of Its 44,893 BTC Reserves - TheMinerMag

Feature

- Trump Wants All Future Bitcoin Mined in US—Is That Even Possible? - Decrypt

- Bitcoin miners stockpile coins to ride out profit squeeze - FT

- The Truth About the Russia Bitcoin Mining Ban - The Mining Pod

- 2024 Bitcoin Mining Year in Review w/ Nico Smid - The Mining Pod

- Bitcoin miner's claim to recover £600m in Newport tip thrown out - BBC

Share This Post: