MARA has increased the upper limit of its latest convertible notes offering to $1 billion after the initial $700 million proposal was oversubscribed, the company said.

Initially proposed on Monday, the offering included $700 million in convertible notes with an option for initial purchasers to add $105 million. In a follow-up release, MARA stated it had upsized the offering to $850 million, with a revised option allowing initial purchasers to contribute an additional $150 million.

This adjustment means MARA could raise up to $1 billion from the zero-interest convertible notes, which are due in 2030. By contrast, the company’s previous convertible notes due in 2026 and 2031 carried interest rates of 1% and 2.125%, respectively.

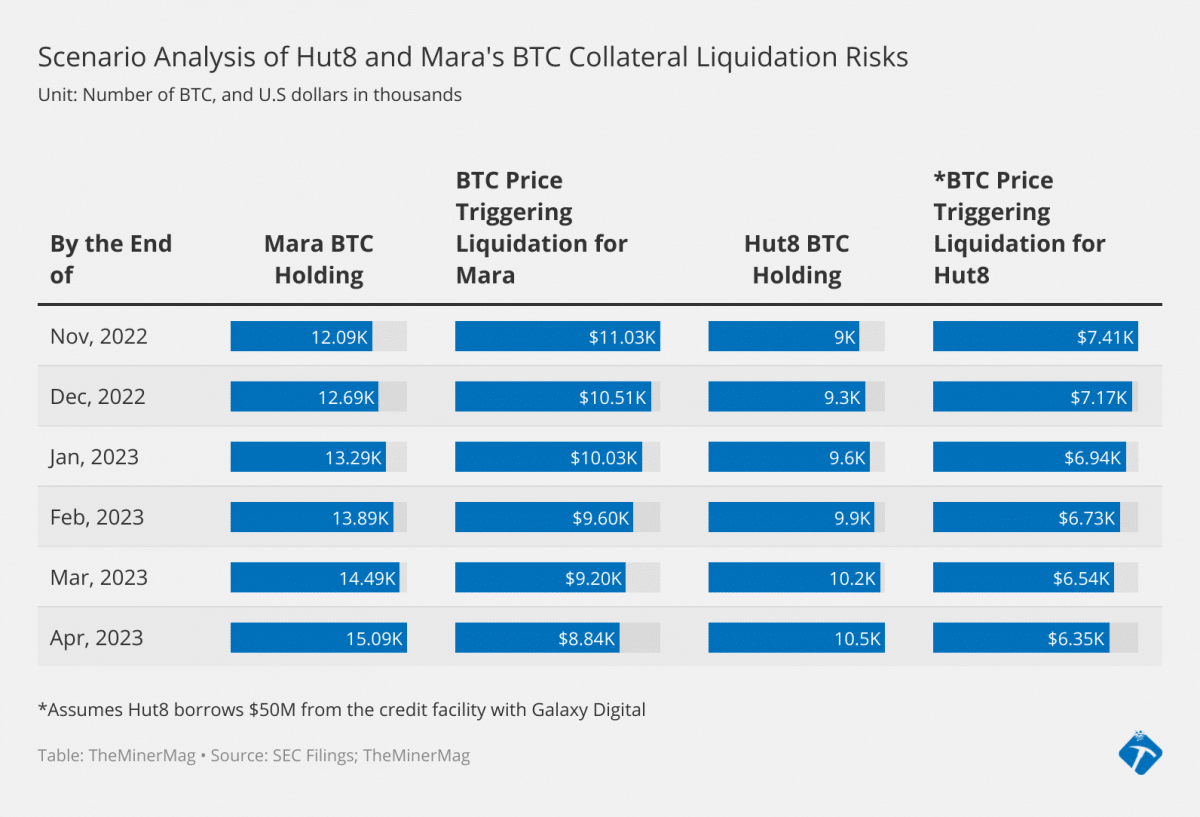

MARA plans to allocate $200 million from the proceeds to repurchase $212 million in aggregate principal of its 2026 convertible notes. The remaining funds will be used to acquire additional Bitcoin and support general corporate expenses.

The move aligns with MARA’s strategy of leveraging convertible notes to accumulate Bitcoin, mirroring MicroStrategy’s playbook. MicroStrategy also announced on Monday a convertible notes offering due in 2029 with an upper limit of $2 billion, carrying a zero-coupon rate. Like MARA, MicroStrategy intends to use the proceeds to purchase Bitcoin and for corporate purposes.

MicroStrategy recently made its largest single Bitcoin purchase, investing $4.6 billion to acquire 51,780 BTC, pushing its total holdings to 331,200 BTC.

MARA’s stock price was down 11.72% during the pre-market trading hours on Tuesday.

Share This Post: