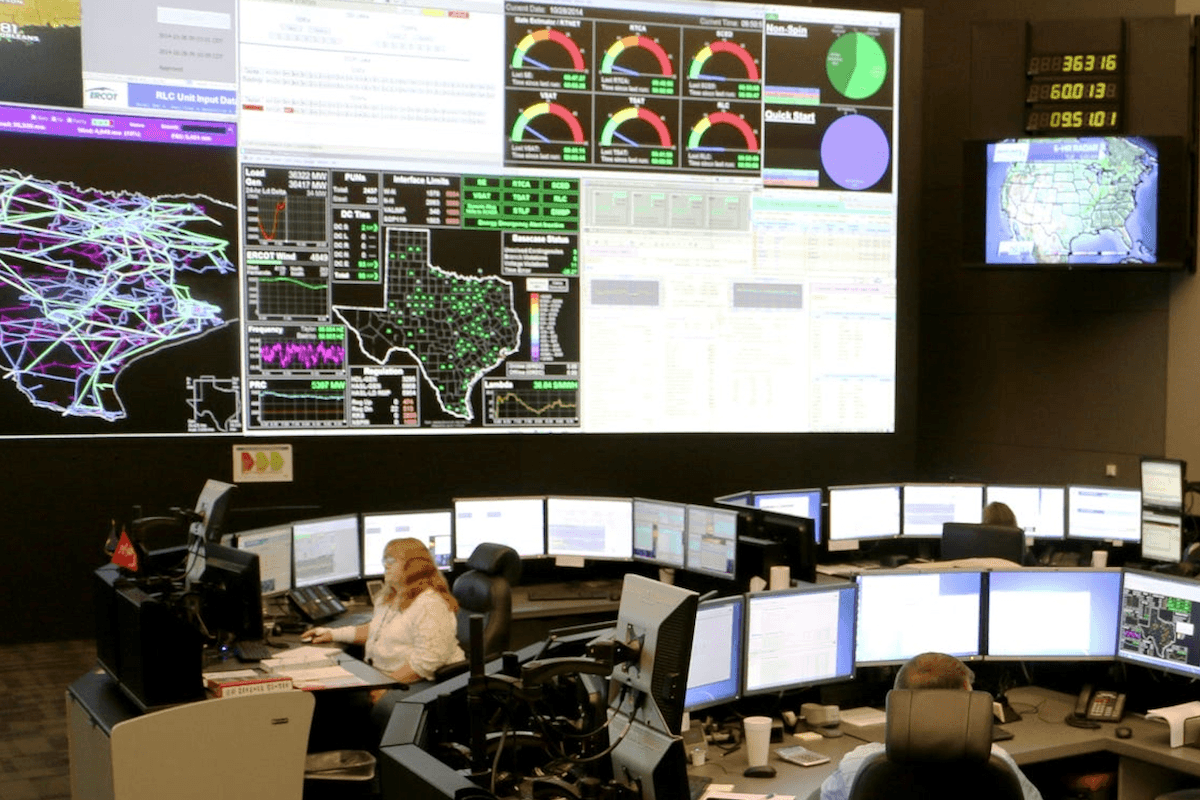

Bitcoin Miners Unplug 110+ EH/s to Ease Grid Strain During Arctic Blast

Bitcoin mining pools serving North American operators have seen a sharp drop in hashrate as an Arctic blast sweeps across the U.S., prompting power curtailment aimed at easing strain on regional grids.

Network Pulse

Live DataBitcoin Price

Network Hashrate

Network Difficulty

Latest News

View All

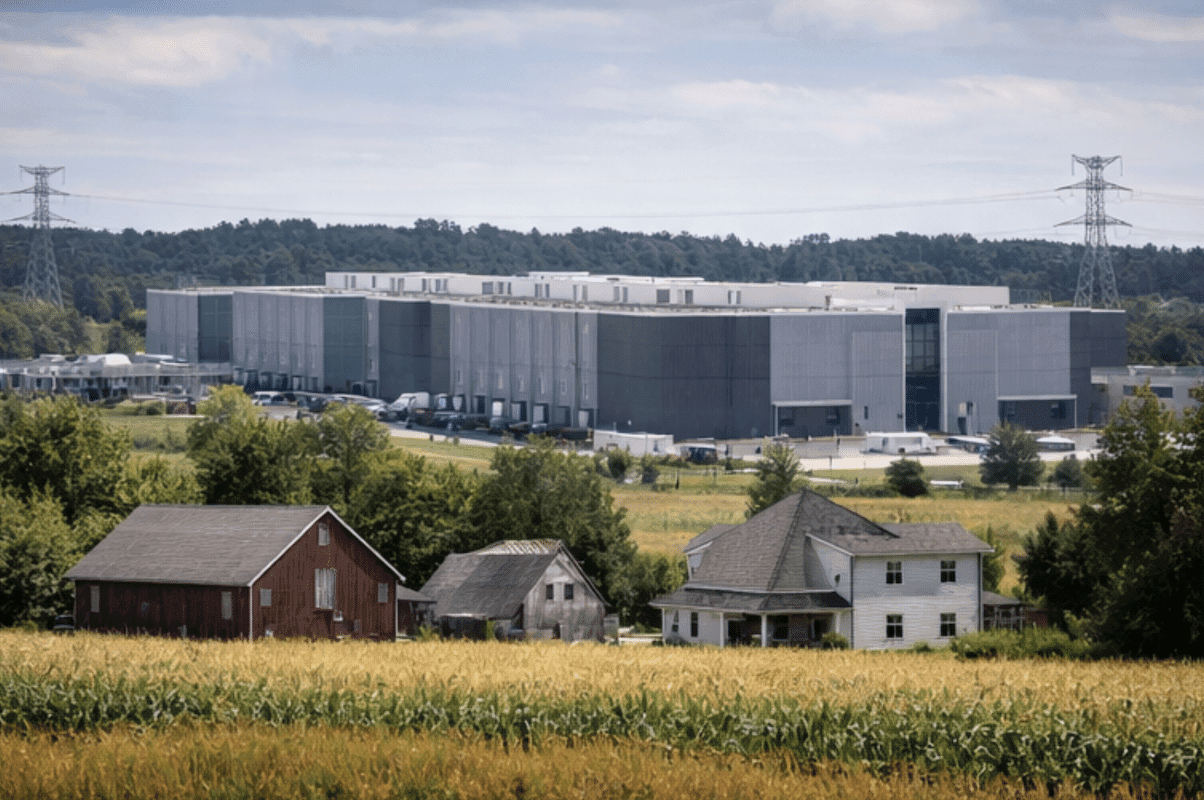

Miner Weekly: AI Inherits Bitcoin Mining’s Hard Lesson – Locals Matter

As the U.S. AI data center boom accelerates, local communities are pushing back over power, water and grid costs—echoing the resistance bitcoin miners faced after 2021.

OpenAI Joins Microsoft in Pledging Data Centers Will Not Shift Energy Costs to Residents

OpenAI said it will fully cover the energy costs associated with its rapidly expanding AI data center footprint as concerns mount over the impact of large-scale data centers on regional power grids.

Bitcoin Hashrate Slides 14% From October Peak as Difficulty Set for Moderate Pullback

Bitcoin’s seven-day average network hashrate has slipped to about 992 EH/s, down roughly 13.7% from the all-time high of above 1.15 ZH/s reached in October.

Learn & Explore

Bitcoin Mining 101

Master the basics of Bitcoin mining, from blockchain fundamentals to proof-of-work consensus mechanisms.

Mining Research

Deep dive into hardware efficiency, profitability analysis, and choose the right equipment.

North America Map

Interactive map displaying operational Bitcoin mining power capacity distribution across the continent.