This article first appeared in Miner Weekly, BlocksBridge Consulting’s weekly newsletter curating the latest news in bitcoin mining and data analysis from TheMinerMag. Subscribe to receive in your inbox once a week.

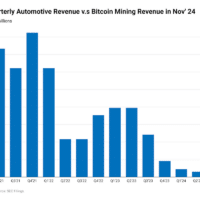

Bitcoin’s price surpassed $68,000 this week for the first time since July, signaling that “Uptober” might be in full swing after all. Alongside the renewed market exuberance, Bitcoin-backed loans are increasingly making waves in the mining sector.

Most notably, MARA announced this week that it secured a $200 million line of credit, backed by Bitcoin collateral. This follows CleanSpark’s $50 million revolving line of credit with Coinbase, revealed in August, and Canaan’s $22.3 million loan secured by 530 BTC, reported last month.

Earlier in January, Hut 8 expanded its credit facility with Coinbase, raising the outstanding principal to $65 million. A month later, DMG Blockchain secured a smaller $9 million credit facility from Swiss crypto-friendly Sygnum Bank.

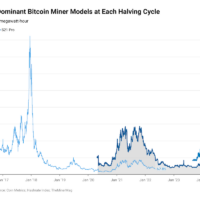

Bitcoin-backed loans, it seems, are following the cycles of Bitcoin’s bull runs, though market dynamics have shifted since the 2020 crypto bull run. Many lenders who were actively offering loans to miners during the 2020 boom—such as Genesis Capital, BlockFi, and Celsius—have since gone under. Meanwhile, those that survived, like Galaxy Digital and NYDIG, ended up taking over the mining hardware and infrastructure assets of struggling Bitcoin miners.

This time around, both lenders and borrowers appear to be more cautious, at least based on the publicly disclosed deals so far. While MARA has not yet revealed specific terms of its new credit line, previous agreements, such as those of CleanSpark and Hut 8, provide insight into the current landscape.

For example, Hut 8’s loan agreement with Coinbase set an initial Loan-to-Value (LTV) ratio at 50%. The LTV measures the loan amount relative to the market value of the collateral. In secured loans, a lower LTV indicates less risk for the lender, as the loan is better protected by the collateral.

In Hut 8’s case, a $100 loan would require $200 in bitcoins as collateral. If Bitcoin’s value falls, the LTV ratio increases, reflecting the reduced value of the collateral. If the LTV exceeds the Top Up LTV threshold, set at 60% in Hut 8’s case, the borrower must add more bitcoins to the collateral to restore the LTV to a safer level. For context, Bitfarms’ loan with Galaxy Digital in December 2021 had a minimum LTV of 60% and a Top Up LTV threshold of 70%.

As for CleanSpark, it’s unclear how much of its $50 million revolving credit line has been drawn. However, Coinbase has stringent collateral requirements. For bitcoin-backed loans, Coinbase mandates that the collateral must be 140% of the loan amount, and an 80% “haircut” is applied to the collateralized bitcoins. This means that not only does the borrower need to pledge bitcoins worth 140% of the loan amount, but the lender values each bitcoin at only 80% of its current market price.

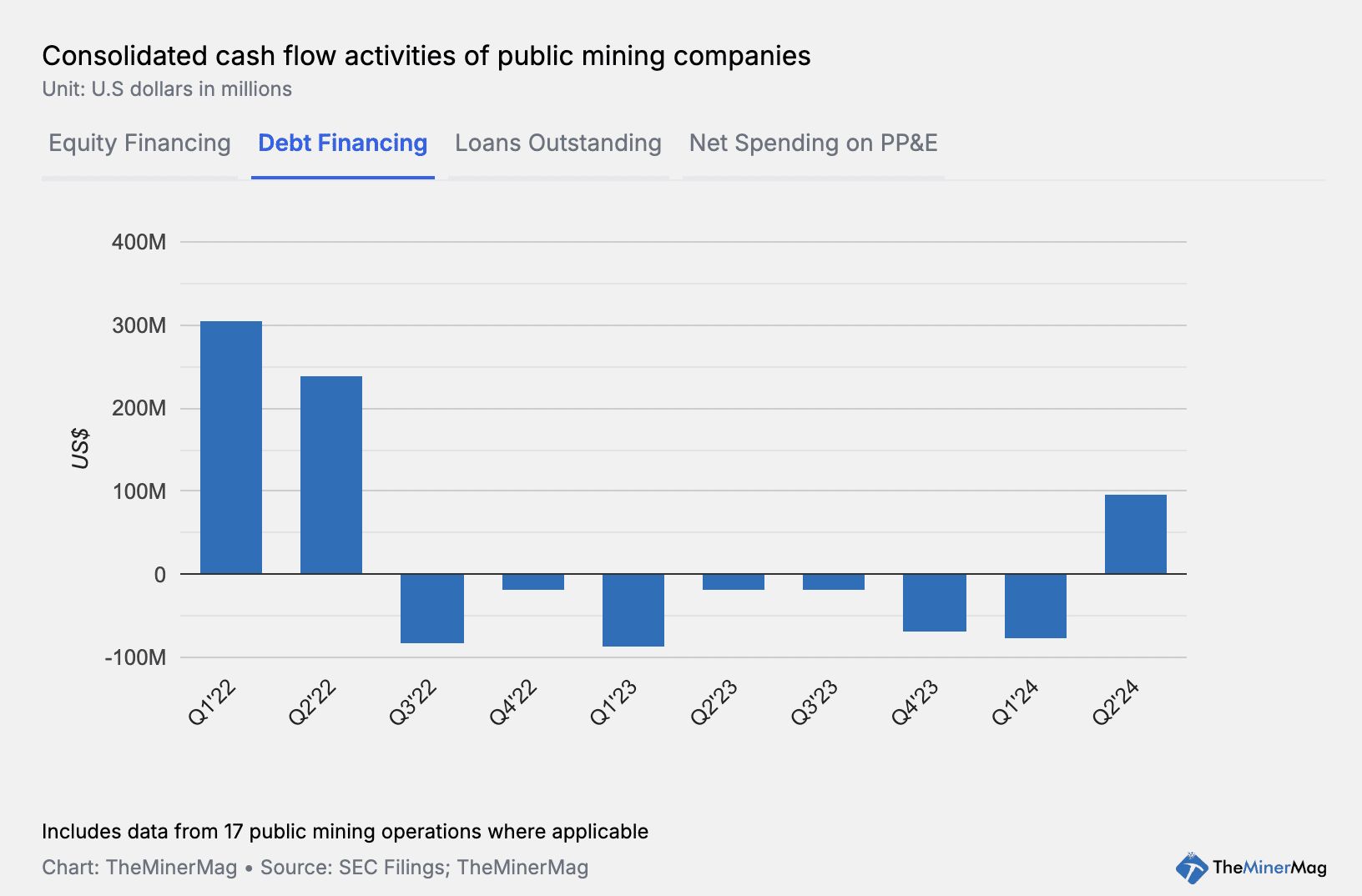

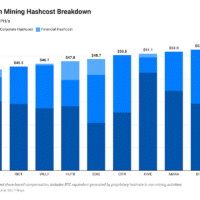

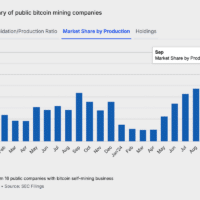

Beyond Bitcoin-backed loans, financial leverage has generally been on the rise for bitcoin mining companies in the last quarter. According to data compiled by TheMinerMag, 17 major public mining companies have posted multiple quarters of negative cash flow from debt financing activities, indicating deleveraging efforts. However, this trend reversed in Q2 of this year, with the combined debt financing activities of these companies turning positive, contributing nearly $100 million.

Regulation News

- Another Texas City Is Protesting Against Bitcoin Mining – TheMinerMag

Hardware and Infrastructure News

- Bit Digital Acquires HPC Data Center for $46 Million – TheMinerMag

- Cipher Eyes 1.5 GW of Bitcoin Mining, HPC Capacities – TheMinerMag

- Blue Owl Backs Crusoe in $3.4B JV for 200MW AI Datacenter – TheMinerMag

- Bitcoin Miners Catch Breath as Hashprice Regains $50/PH/s – TheMinerMag

Corporate News

- TeraWulf Appoints John Larkin as Director of Investor Relations – Link

- TeraWulf Enters Into Long-Term Ground Lease at Lake Mariner Facility – Link

- Greenidge Announces Preliminary Operating Results for the Q3’ 2024 – Link

Financial News

- Blockstream Raises $210M in Convertible Note Financing Round – CoinDesk

- MARA Secures $200M Credit Line with Bitcoin Collateral – TheMinerMag

Feature

- Home Bitcoin Mining For The Masses With Bitaxe – The Mining Pod

- Miner Sues Local Council to Retrieve 8k BTC Buried in Landfill – TheMinerMag

- Bitdeer’s SEALMINER ASIC and AI/HPC Business With Jeff LeBerge – The Mining Pod

- Energy-hungry cryptocurrency mining is growing in Iowa. Will it help or hurt the state? – Des Moines Register

Share This Post: