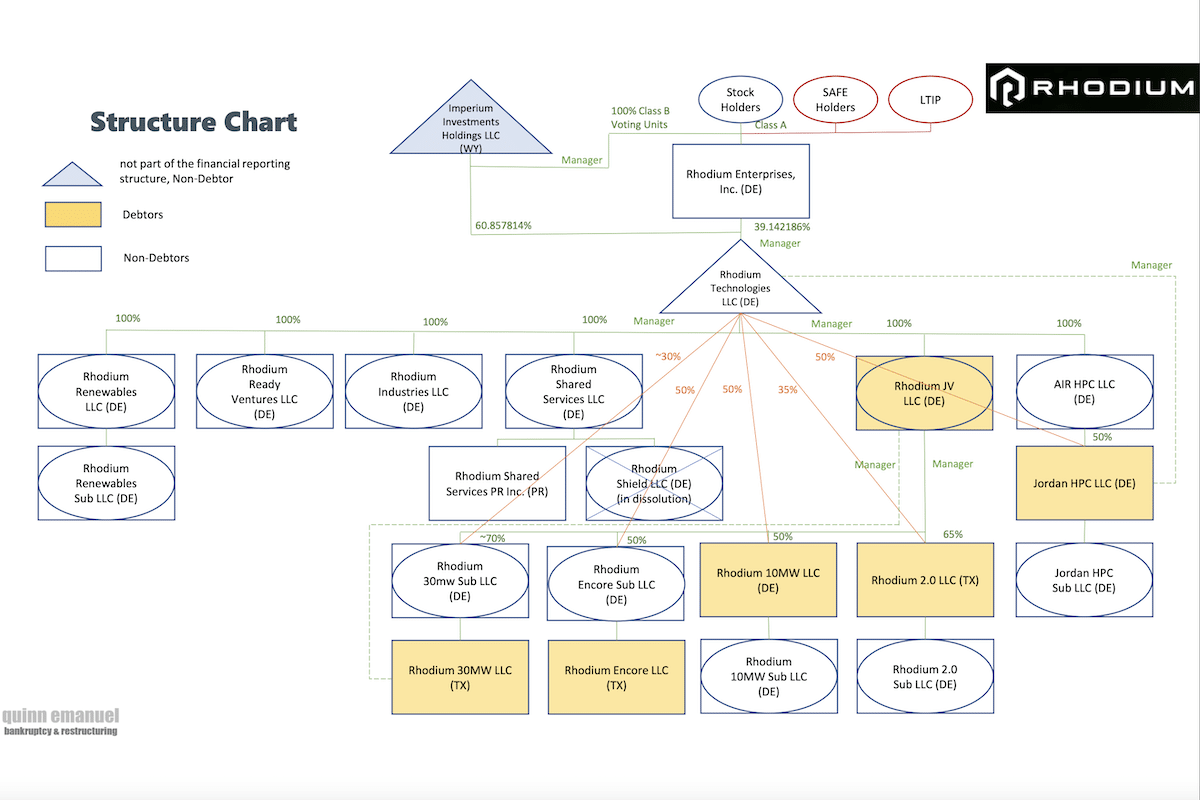

Rhodium Enterprises, previously reported to be facing financial difficulties, has filed for voluntary bankruptcy protection for several of its bitcoin mining subsidiaries.

The company submitted filings to the U.S. Bankruptcy Court in the Southern District of Texas on Saturday for entities including Rhodium Encore, Jordan HPC, Rhodium JV, Rhodium 2.0, Rhodium 10MW, and Rhodium 30MW.

The lead filing, which has been consolidated under Rhodium Encore, indicates that Rhodium’s total liabilities range from $50 million to $100 million, while its total assets are between $100 million and $500 million.

Earlier this month, TheMinerMag reported that Rhodium Enterprises failed to repay a total of $54 million in loans due to the lenders of Rhodium Encore and Rhodium 2.0, which were set to mature on July 30, 2024. Rhodium raised $78 million in loans for the two subsidiaries in 2021.

The company did not respond to TheMinerMag’s previous inquiries regarding the potential sale of its proprietary Temple site in Texas, which creditors suggested as a means to repay the loans.

Additionally, Rhodium has filed a motion to the bankruptcy court to decide whether it could “assume certain executory contracts with Whinstone US,” the colocation subsidiary of Riot Platforms.

As of December 31, 2022, Rhodium hosted 2.7 EH/s of its hashrate at Riot’s Rockdale site operated by Whinstone US and energized 1.1 EH/s at its own Temple site, which has a capacity of approximately 50 megawatts.

However, Rhodium’s relationship with Winstone US began to deteriorate in 2023, leading to an arbitration case in which Rhodium is seeking at least $67 million in damages.

Share This Post: